Contents

|

New Setting: Trading Security Type |

New Setting: Trading Security Type

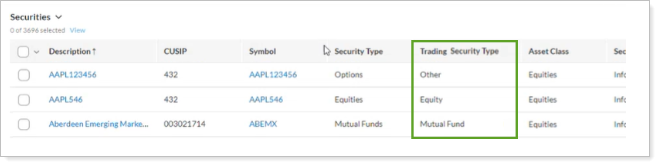

To route orders on trading files with the appropriate trade order details, Tamarac Trading assigns a Trading Security Type setting to each security on the platform. Before, you couldn’t see or configure the Trading Security Type setting. With this release, we’re exposing the Trading Security Type setting on new and existing securities to increase transparency and give you the opportunity to confirm that the security configuration aligns with your expectations.

IMPORTANT

The Trading Security Type setting is an important part of trading and trade routing. In your new security setup workflows, your firm should incorporate a process to check that it’s correctly configured.

Tamarac Trading automatically assigns each security a default Trading Security Type based on its Reporting Security Type. The available Trading Security Types are:

- Equity

- Exchange Traded fund

- Mutual Fund

- Other (examples: Fixed Income, Options)

- Cash

- Envestnet Managed

With this release, you’ll see the following changes:

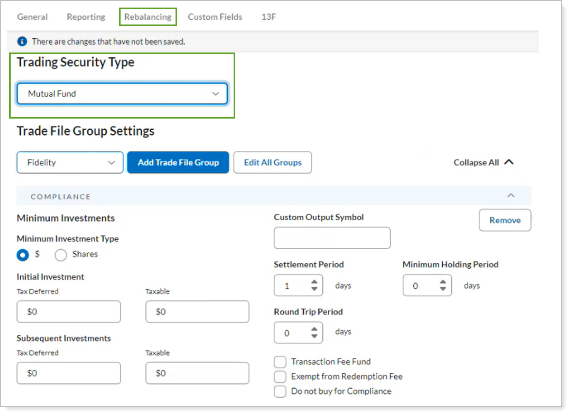

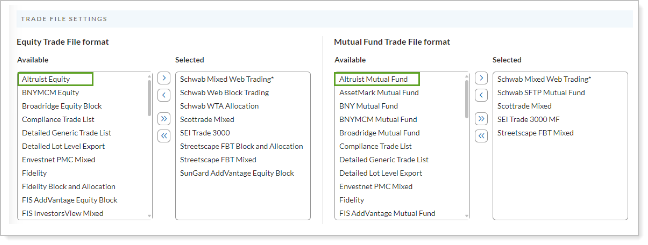

For trade routing, a security’s available Trade File Group Settings display according to its Trading Security Type. For more information about how to configure Trade File Group Settings, see Trade File Group Settings.

Example: Trade File Group Settings for a mutual fund.

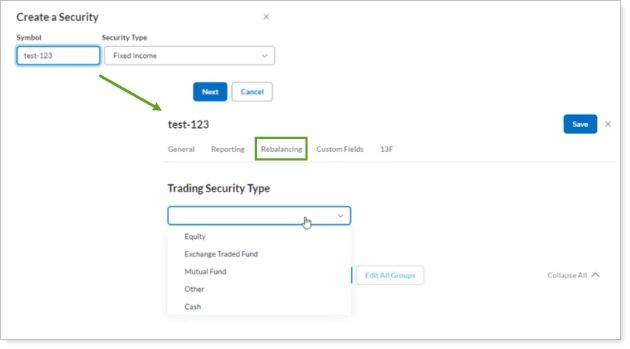

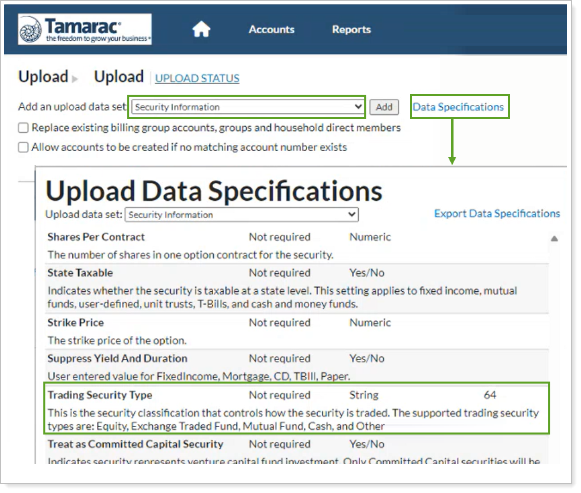

- Optionally, you can specify Trading Security Type when you create new securities in your Tamarac site manually or by bulk upload. When adding a security with the Security Information bulk upload, include the Trading Security Type data point.

- If you don’t, Tamarac automatically assigns a default value based on the security’s Reporting Security Type.

Example 1: You manually add a security.

Example 2: You bulk upload security information

Enhanced Trader Note Capabilities in the Order Blotter

We’re excited to announce improvements to the Order Blotter page that will help you manage fixed income orders even more efficiently and effectively.

Here’s what you can expect from our latest release:

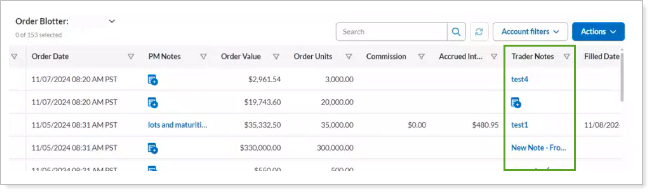

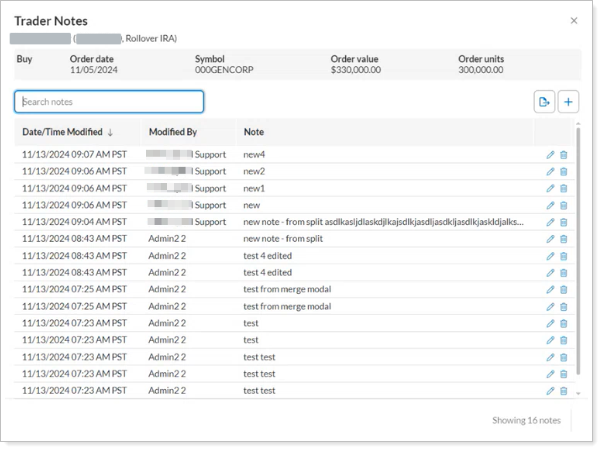

Enhanced trader notes

Fixed income traders use trader notes to track their progress as they work through a bond order. Before, each order only stored the latest note that the trader entered. Now fixed income traders can create and manage multiple notes per order to better support their iterative process as they work bond orders.

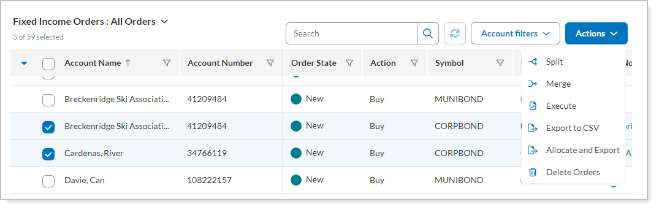

In Order Blotter, a trader adds a new trader note to a bond order as before and the order’s most recent note displays in the Trader Note column. When a trader selects a note’s link, they can now:

- Enter additional notes.

- Use the search function to filter by text in the notes.

- Make changes to or delete existing notes.

- Export the bond order and all of its trader notes to CSV.

Automated Equity and Mutual Fund Trading with Altruist

Trading is a foundational service you provide for your clients. You send many trades a day as part of your regular client account rebalancing and maintenance. To increase efficiency and handle fewer trade orders manually, for those of you with holdings at Altruist, we offer the ability to send CSV files to Altruist.

We've added two new trade files, Altruist Equity and Altruist Mutual Fund.

You can enable this trade file on the Rebalancing System Settings page under Trade File Settings.

Once enabled, you can choose this new trade file in the account settings for each account.