Contents

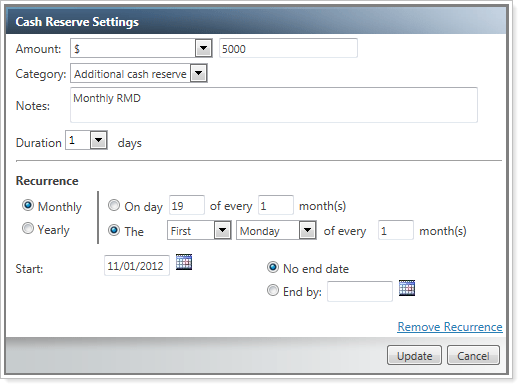

Schedule Recurring Cash Reserves

With this release, we're pleased to announce that you can schedule recurring cash reserves. Recurring cash reserves repeat on a regular basis - for example, every month. You can specify an end date for the cash reserves or have them occur indefinitely.

Example

Let's say you have a client that is 75 years of age. This client is required to withdraw required minimum distributions (RMD) from his or her account each year. Some clients prefer to distribute these amounts monthly. With the recurring cash reserves functionality, you can automatically schedule cash reserves each month.

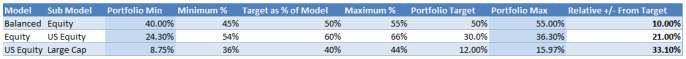

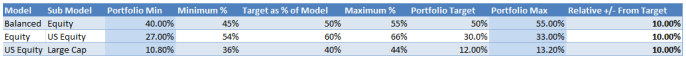

Min/Max Model Logic Update for N-Tier Models

When using a min/max range with N-Tier Models, Advisor Rebalancing will now calculate the min/max range as MIN or MAX multiplied by the target/goal.

Before the release, Advisor Rebalancing calculated minimums and maximums in models as MIN * MIN or MAX * MAX for each tier in your model. As the number of tiers in a model increased, this method of calculation would create an increasingly wider acceptable range to hold.

With the enhancement, minimums and maximums are calculated as min or max multiplied by the target of the parent model or the model where you've set the min/max range.

This new method of calculation eliminates the increasingly wider acceptable range to hold as the number of tiers in your model increase and allows you to keep the same relative min and max tolerance bands at any level of the model. In addition, because the previous calculation was MIN * MIN, if a min of zero was used at any level of the model, the min for every tier below was set to zero. Because the calculation is now MIN * TARGET, a min of zero can be used at any level of the model.

EXAMPLE

In the example below, we can see the difference between the previous calculation and the new calculation in the relative deviation allowed in each submodel.

With the previous calculation, the effective portfolio min for Large Cap would be 8.75 percent or a relative min of 33.10 percent. With the new calculation, the portfolio min for Large Cap is 10.8 percent, which allows a relative deviation of 10 percent and reflects the way the min is expressed in the model.

Previous Calculation

New Calculation

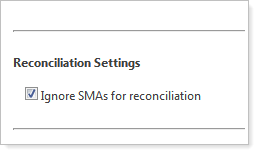

Ignore Separately Managed Accounts During Trade Reconciliation

For those of you that use Reconciler, Advisor Rebalancing can now ignore separately managed accounts during the trade reconciliation process. If you enable this new option, trades for separately managed accounts will not appear on any trade reconciliation pages or reports.

To enable this new feature, follow these steps:

-

On the Setup menu, click System Settings.

-

Under Reconciliation Settings, select the Ignore SMAs for reconciliation check box.

-

Click Save.

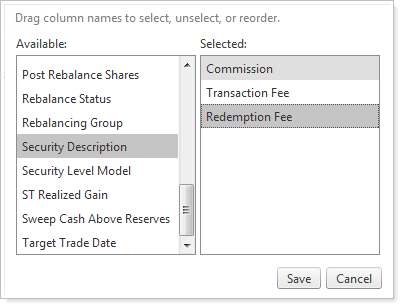

New Columns on the Trade Review Page

In the previous release of Advisor Rebalancing, we delivered the Trade Review page that makes it quick and efficient to create and review trades in bulk across multiple accounts. After we released the new page, some of you asked us to add the Rebalance Review shortcut icon and fee-related columns to the page.

We've listened to your feedback and have added the following columns to the Trade Review page:

-

Rebalance Summary Icon

-

Redemption Fee

-

Transaction Fee

-

Commission

To add these columns to the page, follow these steps:

-

On the Trade Review page, click

.

. -

On the Choose Columns dialog, click and drag the appropriate column to the Selected box. The Rebalance Summary icon column will be added to the page by default.

-

When finished adding columns, click Save.

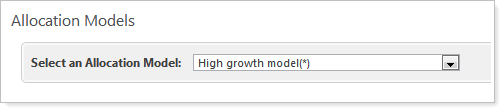

Differentiation of Prospect/Test Models in Lists

When you view your models in lists, it's sometimes helpful to tell which models are test/prospect models. With this in mind, Advisor Rebalancing now adds an asterisk (*) next to any model that has been marked as a prospect/test model.

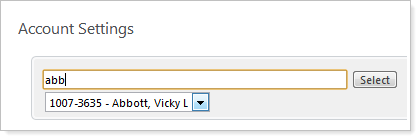

Increased Flexibility for Short-Term Gain Tolerances

Over the years, we've heard that many of you want increased flexibility for short-term gains. The two primary suggestions we've heard are:

-

Allow a short-term gain if within a specified tolerance

-

Prevent a short-term gain if the transition to a long-term gain is within a specified number of days

We've listened to your requests and have added these features to Advisor Rebalancing.

To take advantage of these new features, follow these steps:

-

On the Accounts menu, click Account Settings.

-

In the Type account name or number box, start typing the name or number of the account where you want to set short-term gain tolerances. When you see the account in the list, click it and then click Select.

-

On the Rebalance & Trade Settings tab, complete any of the following settings:

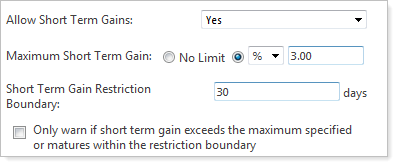

| This Setting... | Does This... |

|---|---|

| Allow Short-Term Gains |

Choose Yes if you want Advisor Rebalancing to allow short-term gains.

If you do not want Advisor Rebalancing to allow short-term gains, choose No. |

| Maximum Short-Term Gain | Specify the maximum short-term gain amount as a dollar amount or percentage. If you don't want to restrict the maximum short-term gain amount, click No Limit. |

| Short-Term Gain Restriction Boundary |

Advisor Rebalancing will prevent a short-term gain if the proposed sell is maturing from a short-term gain to a long-term gain within the number of days specified here. |

| Only warn if short-term gain exceeds the maximum specified days or matures within the restriction boundary |

Advisor Rebalancing will warn you if a proposed sell is maturing from a short-term gain to a long-term gain within the specified number of days entered in the Short-Term Gain Restriction Boundary box or if the short-term gain will be greater than the maximum short-term gain amount you've specified.

If you do not select this check box, Advisor Rebalancing will prevent the short-term gain from occurring. |

-

When finished, click Save.

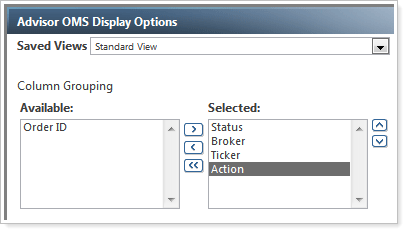

Advisor OMS Updates

For those of you using Advisor OMS, we've made some changes that you will be excited about:

-

Work orders over multiple days.If an order is only partially filled, the unfilled order will now remain on the page overnight. Any unfilled orders that remain in the page at the end of the day will be set to the New (un-submitted) status overnight.

-

Group By Action.You now have the option to group by buys and sells in addition to broker ID, status, and ticker.