Contents

|

Make Changes to Cash in Client Accounts Cash Management and Dollar Cost Averaging |

Introduction

With Tamarac Trading, you have many different ways to manage cash within your clients' accounts, as well as different approaches to keeping cash in your clients' accounts. Below are the basic strategies you can use for cash management in your accounts.

Model Cash vs. Cash Reserves

You can maintain cash in client accounts by using cash reserves or adding cash to a model. Here is a comparison of these two methods:

-

Cash in the model.With this method, you can add cash—either using the $$$ symbol or a security you've set as a cash substitute—to a model with a goal and a rank. During a rebalance, Tamarac Trading will recommend buys or sells to maintain this position. Adding cash to a model is best for when your investment philosophy requires holding cash.

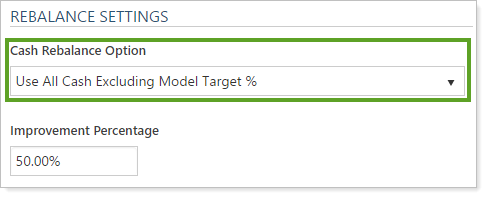

The Cash rebalance option, available on the Rebalancing System Settings page, determines how model cash is treated during a rebalance. The Use All Cash Excluding Model Target % option tracks cash for the group and prevents cash from being overspent based on your model allocations. For more details about each available option, see Rebalance Settings.

-

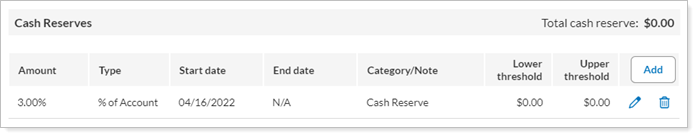

Cash reserves.With this method, you keep sweep cash in a client's account and use cash reserves to set cash reserve goal amounts for existing or ongoing cash needs. Tamarac Trading then uses these goal amounts and recommends trades during rebalance after the cash reserve needs have been met.

If you use groups, place cash reserves in individual accounts rather than placing cash in client models. Placing cash in models will include cash in asset location preferences and may not allocate the target cash to the desired account. By adding cash reserves to individual accounts, Tamarac Trading will always rebalance with each account's cash needs in mind.

Cash in a Rebalance

Cash is treated differently in some rebalance types. Here is a summary of how cash is treated:

| Rebalance Type or Setting | How Cash is Treated in the Rebalance |

|---|---|

| Buy Only to Invest Cash Rebalance | During a Rebalance, cash in the account, in excess of cash reserves, is invested in the portfolio to minimize overall deviation. |

| Full Rebalance | During a rebalance, each position is traded back to model target, and cash reserves are respected. |

| Invest or Raise Cash Only Rebalance | Tamarac Trading will determine the correct cash rebalance type based on each account's cash situation. If the account has excess cash—that is, there is a Cash for Trading amount on the Cash Management Settings tab—the account is rebalanced using Buy Only to Invest Cash logic. If the account has cash to raise—that is, there is a Cash to Raise amount on the Cash Management Settings tab—the account is rebalanced using Sell Only to Raise Cash logic. This rebalance type will not sell to raise cash. |

| Min/Max Rebalance | During a rebalance, each position is traded back into its min/max tolerance bands, and cash reserves are respected. |

| Sell Only to Raise Cash Rebalance |

This rebalance is used to raise cash to meet cash reserves by selling overweight securities; sells are recommended to raise the required cash—while minimizing deviation—using the fewest number of trades in a tax efficient manner (for taxable accounts). |

| Tactical Rebalance | This rebalance is used for individual models or submodels, rather than the account as a whole. Cash reserves are respected. |

| Tax Loss Harvesting & Rebalance | A buy and sell rebalance where securities in the account that meet each account's tax loss harvesting thresholds are sold. The proceeds are then reinvested back into the account's model and cash reserves are respected. |

| Tax Loss Harvesting Rebalance | A sell only rebalance where securities in accounts that meet each account's tax loss harvesting thresholds for loss are sold, and cash reserves are respected. |

Make Changes to Cash in Client Accounts

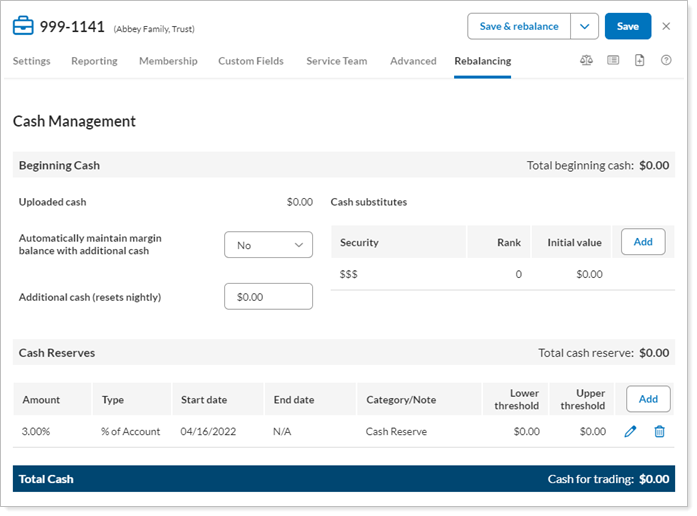

Cash management starts at the individual account level. Cash Management on the Account Settings page allows you to add intraday cash, set up cash substitutes at the individual account level, and set cash reserves in the account. You can also see, at a glance, if the account has cash to raise or excess cash to invest.

On this page, you can complete the following actions:

- Add intraday cash

- Create and remove cash substitutes

- Create and change cash reserves

- View, at a glance, cash available for trading or cash to raise amounts

Add Cash Reserves

Cash reserves in Tamarac Trading allow you to set aside specific amounts of cash for any cash needs for the client. Cash reserves can be a one-time cash need—like a vacation or cash to purchase a car—or a recurring cash need for management fees, taxes, or Required Minimum Distributions (RMDs).

For more information on setting cash reserves, see Cash Reserves.

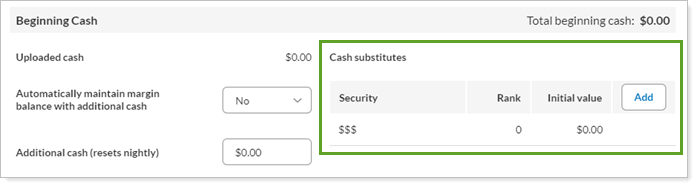

Add Cash Substitutes

Cash substitutes are securities that you want to treat as cash for monitoring and allocation purposes. However, unlike sweep cash, these securities require that a trade is entered at the custodian. An example of a cash substitute is a client who holds money in a money market fund. You can then add that fund as a cash substitute in the client's account so that the value of that fund is treated like cash.

For more information on cash substitutes, see Cash Substitutes.

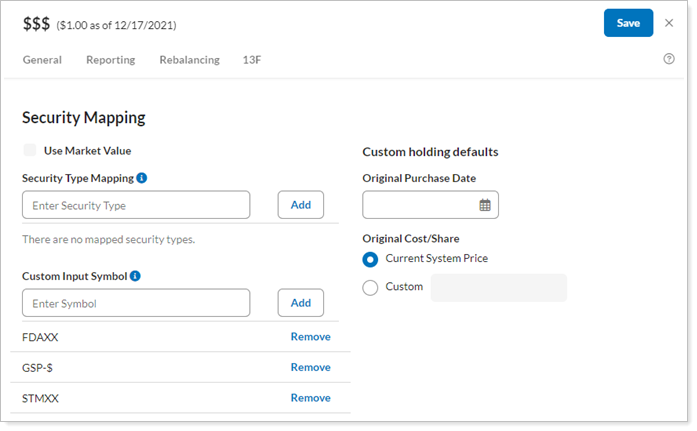

Map a Security to Cash

In some cases, you may want to map certain securities to cash to ensure that these liquid funds are treated like sweep cash—$$$—in Tamarac Trading. It is common to have more than one sweep cash security in your portfolio accounting system (PAS).

If you need to have a trade generated for a cash security, set it up as a cash substitute.

For more information on mapping securities, see Security Mapping.

Add Cash to an Account

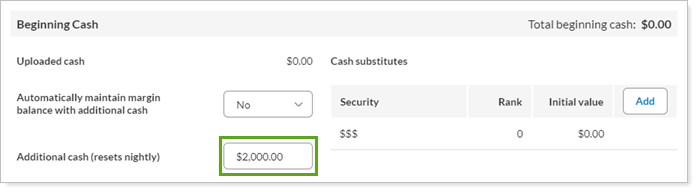

The amount of cash available in a client's account is updated with your daily upload. However, in some cases, you may want to deposit and use cash on the same day rather than waiting for the next daily upload to update the cash in the client's account. For these scenarios, you can use the Additional Cash setting to add and use cash on a same-day basis.

important

Proceed with caution when using this feature to avoid inadvertently pushing accounts into margin.

To add intraday cash to an account, follow these steps:

-

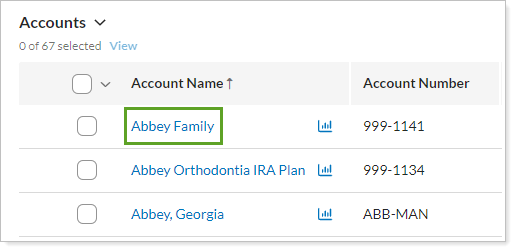

On the Accounts menu, select Accounts.

-

Select the name of the account where you want to add cash.

-

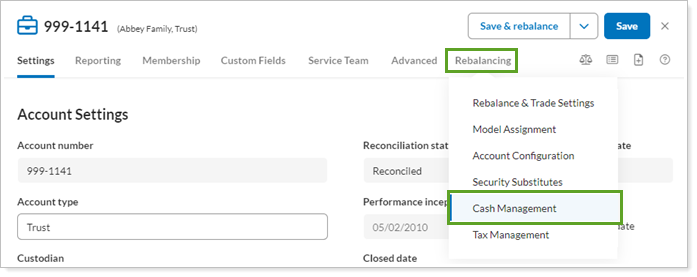

In the Rebalancing tab, select Cash Management.

-

Type the amount of added cash in Additional cash.

-

Select Save.

Cash Management and Dollar Cost Averaging

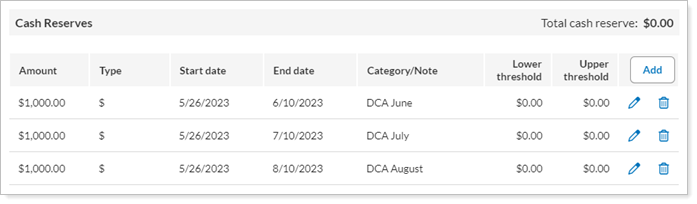

If you want to implement a dollar cost averaging (DCA) strategy in a client's account, you can use the cash reserves feature to do this. You can create a series of expiring cash reserves without start dates to release cash into the account on the dates you've determined.

Upon expiration, you can use the reserved cash to invest into the market or security of your choice.

Using Saved Searches for Cash Management

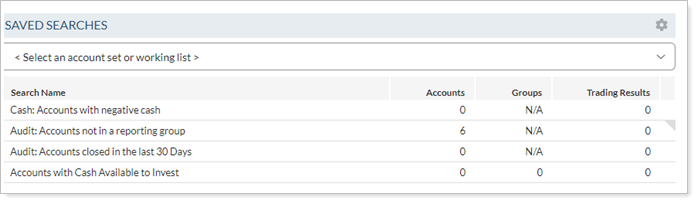

Saved searches allow you to find accounts that meet specific criteria for cash needs, like accounts that need to raise cash or accounts with excess cash. Once you've created these saved search, you can monitor them from your dashboard for easy access. You can also use these saved searches to filter pages and take account on the accounts that meet your criteria.

Check your saved searches daily to find accounts with cash needs. You can do this easily by adding saved searches to your dashboard.

Suggested Saved Searches

You can create the following saved searches to monitor your cash needs.

-

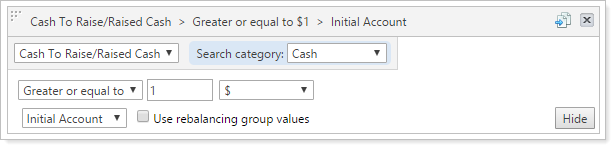

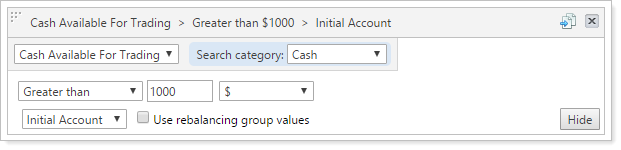

Cash to RaiseFinds accounts that have cash to raise. This filter ignores model cash targets. Add additional filters as needed, like account type, account status, and so on.

It's best practice to leave the Use rebalancing group values check box unchecked.

-

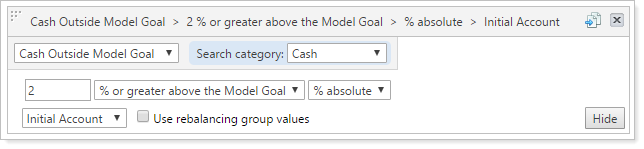

Cash Outside Model GoalFinds accounts with cash greater than its goal in the model. This filter ignores cash in reserves and looks at deviation from model cash targets. If you don't have cash in your models, this filter will still find cash reserves.

To find what you're looking for, begin with a 2% deviation and adjust as needed. Add additional filters as needed, like account type, account status, and so on.

To search for aggregate cash values at the group level, select the Use rebalancing group values check box.

-

Cash Available for TradingFind accounts with available cash for trading. This filter looks at cash above reserves and ignores model cash targets. You can add additional filters as needed, like account type, account status, and so on.

-

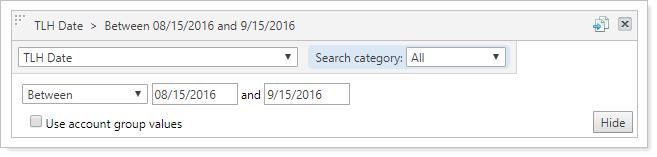

Custom FieldsFind accounts by the custom fields you've associated with the account. For example, you can add a custom field to indicate an account has taken an RMD or when it's been harvested for losses, as well the dates those occurred.

For more information on creating saved searches, see Create, Edit, and Delete Saved Searches.

Use a Saved Search to Rebalance for Cash Needs

After examining your saved searches, you can take action and rebalance the underlying accounts in the saved search. You can use the rebalance to raise cash in accounts that need cash, invest excess cash, or rebalance account or models which need to raise or invest excess cash. In particular, the Invest or Raise Cash rebalance type allows you to address each account's cash needs, whether they need to raise cash or invest excess cash.

To rebalance using a saved search, follow these steps:

-

On the Rebalance & Trade menu, select Rebalance.

-

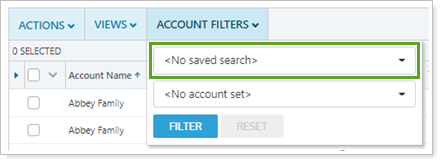

Add the saved search filter.

-

On the Rebalance page, select the saved search in the Account Filters list. Click <No saved search> and select the saved search you created.

-

-

Select one or more account in the list in which you want to perform a rebalance for cash management.

-

Adjust the rebalance setting.

-

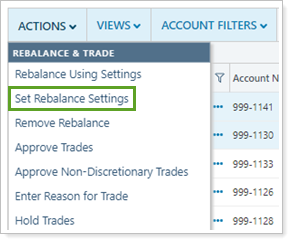

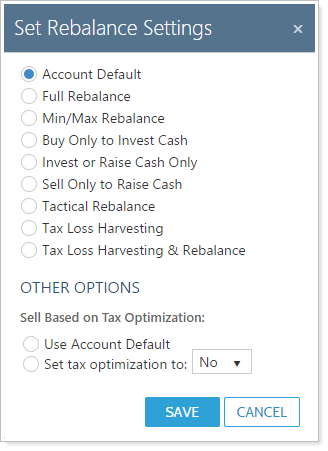

On the Rebalance page, from Actions select Set rebalance settings.

-

-

Select the appropriate cash management rebalance in the Set Current Rebalance Settings dialog box. For more information on cash in the available settings, see Cash in a Rebalance.

-

Select Save.

Next, you can review trades and approve trades. For more information, see Learn More About Reviewing Rebalances and Trades.