Contents

|

See the Min/Max Rebalance in Action Example of When to Use a Min/Max Rebalance Example of When NOT to Use the Min/Max Rebalance |

Introduction

The Min/Max Rebalance allows you to bring accounts' models back into their tolerance bands but with fewer recommended trades than would be recommended if you completed a Full Rebalance on the accounts. This rebalance type allows you to sell down overweight models and assets and buy underweight models and assets to bring models back to tolerance by only trading where the account is outside the min and max ranges you have set for your models.

For more information on tolerance bands and min/max values for your models, see Min/Max Logic in Models .

Notes

The Min/Max Rebalance works if you have min and max tolerances set on your models. Be sure to apply this rebalance only to accounts containing models with min and max values set.

Rebalance Logic

The Min/Max Rebalance attempts to bring an account back to tolerance by selling securities in overweight models and buying securities in underweight models. When a particular tier of a model is out of tolerance, Tamarac Trading will start at the top of that tier and then recommend trades to all tiers below it to address the deviation.

The rebalance starts first with models over their max and sells those positions, then moves to models which are under their min tolerance and uses the proceeds from the sells to purchase those positions. The order of the buys and sells are based on default buy and sell order settings.

Unassigned positions are not automatically liquidated in a Min/Max Rebalance unless you choose that option. These positions are sold if an account needs to generate cash to purchase securities which haven't yet met their minimum. Unassigned positions are sold first before any positions in the model are sold.

If a portfolio isn't able to trade back into the min/max range, you'll get a warning or warnings under Rebalance Status Messages on the Rebalance Summary telling you why. Common reasons for this include security restrictions and minimum trade size restrictions.

In some cases, overweight securities below their max tolerance are sold if there is another security below its minimum and cash needs to be generated to buy that underweight security to bring it within tolerance.

If a group contains an account with negative cash, the minimums and maximums of the models in that account are disregarded, resulting in a Full Rebalance. The other accounts in the rebalance group will adhere to the Min/Max Rebalance.

For more information on system and account-level settings that affect this rebalance, see Applicable Settings.

See the Min/Max Rebalance in Action

Example of When to Use a Min/Max Rebalance

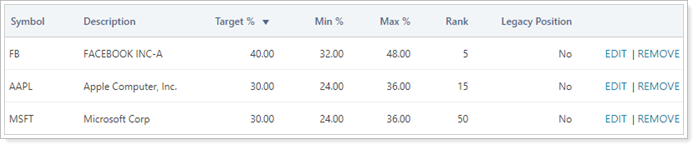

You set up Large Cap Technology, a Security Level model, and put a min and a max range on each security to allow some variation due to fluctuating prices:

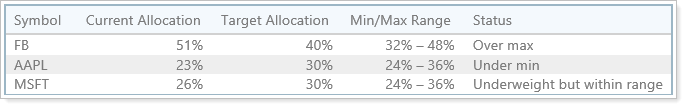

Over time, a client's allocations in Large Cap Technology shifted to the following allocation:

If you run the Min/Max Rebalance on this account, Tamarac Trading will suggest the following trades:

-

FB will have recommended sells because it is over the Max % you set.

-

AAPL will have recommended buys because it is under the Min % you set.

-

MSFT will have no recommended trades because it is still within its min/max range.

Example of When NOT to Use the Min/Max Rebalance

In some cases, maintaining a more strict model allocation is appropriate. Consider this example:

You assign a client to your 70/30 Model where 70% of the account is in equities and 30% of the account is in fixed income. At the top level, you want to maintain those allocations strictly. For example, a drift to 75% equities and 25% fixed income would drastically change the portfolio and perhaps your expectations from your client, so adhering to the 70/30 ratio is important. In this case, you wouldn't set a min/max band for your top-level model.

At lower tiers in the model, you decide there can be more leeway in allocations. Within the 70% equities model, you set min and max tolerances around models containing large cap equities. For these models, you set the minimum and maximum bands because you don't mind variation within these models, so long as they stay within the tolerances you set.

When To Use

The Min/Max Rebalance is the most commonly used default rebalance type. It can be used to bring accounts to tolerance, but generates fewer trades than the Full Rebalance. The Min/Max Rebalance minimizes turnover and fees in your clients' accounts.

The following are possible situations to use the Min/Max Rebalance:

-

Accounts where you'd like to generate less turnover and fewer fees.

-

Accounts where strictly adhering to specific targets isn't necessary.

-

Situations where you'd like more frequent rebalancing opportunities rather than calendar-driven or periodic rebalances.

The Min/Max Rebalance is only appropriate for accounts with models that have min/max tolerances. Setting min/max tolerances is appropriate for models where some drift among the allocations within those models is acceptable, allowing you to maintain your investment philosophy while reducing the number of trades needed to maintain that philosophy.

It is important to review any warnings under Rebalance Status Messages on the Rebalance Summary. These warnings let you know about any applicable account, security, or system-level settings.

Applicable Settings

The Min/Max Rebalance adheres to many settings and rules at the account, security, and system level. The following settings may affect the Min/Max Rebalance:

Rebalancing System Settings

| Setting | More Information |

|---|---|

|

Choose how Tamarac Trading will use cash during the rebalance. |

|

|

Define the order in which the rebalance will generate sells. |

|

|

Define the order in which the rebalance will generate buys. |

|

|

This settling allows you to adjust how Tamarac Trading determines which trades to recommend. The larger the improvement percentage, the more trades the system can recommend as there is a wider range to meet. A smaller improvement percentage becomes more restrictive and could recommend few trades as there is a more narrow range to meet. |

|

|

If selected, Tamarac Trading uses excess cash to purchase additional securities, even if they are within model targets. |

|

|

If selected, Tamarac Trading sells any unassigned securities during a Min/Max Rebalance, even if all models are within their targets. |

|

|

Use all available cash, including cash allocated to the model, before selling to generate cash |

If selected, Tamarac Trading uses excess cash, including model cash, before selling securities to complete a buy. |

|

Tells Tamarac Trading how to calculate deviation away from model targets when determining buy and sell order. Absolute deviation uses the absolute calculation of deviation. Relative deviation calculates deviation relative to the parent model's target. |

Account Settings: Rebalance & Trade Settings Panel

| Setting | More Information |

|---|---|

|

When Yes, Tamarac Trading temporarily ignores model ranks and rebalances to your investment targets at the lowest possible tax cost to the client. It will then ignore ranks and sell losses first, followed by securities with no tax consequences, and then finally, it will sell gains. |

|

|

These can be set as either dollar amounts or percentages. Tamarac Trading applies the greater of these two and will prevent a trade if it doesn't meet these requirements. |

|

|

These settings apply to all securities held in the account and a rebalance can cause a recommendation to liquidate a security if the resulting trade would cause the security to fall under the minimum holding size set at the account level. |

|

|

When selected, this setting prevents any trading in an account. When an underlying account in a group is on hold and the amount of an asset class it holds is above the max for the group, the group won't complete the rebalance in tolerance. |

|

|

The rebalance adheres to account-specific restrictions like Range to Hold and any Buy/Sell Restrictions. |

Securities Settings

| Setting | More Information |

|---|---|

| Restrictions |

The rebalance adheres to security-specific restrictions like Hold Do Not Trade. |

| Custom Settings |

The rebalance adheres to security-specific custom settings like Custom round lot or Custom trade price. |