Back

Back

Back Back |

Home > Tamarac Trading > Rebalances and Trades > Start a Rebalance > Sell Only to Raise Cash Rebalance

|

Sell Only to Raise Cash Rebalance

|

Sell Only to Raise Cash Rebalance Best Practices Account Settings: Account Settings Panel |

The Sell Only to Raise Cash rebalance is a tax sensitive, sell-only rebalance used to raise cash for cash reserves in client accounts. The goal of this rebalance is to raise cash from overweight securities with the lowest tax consequences for taxable accounts.

The Sell Only to Raise Cash rebalance sells securities to raise cash in the fewest trades and with the lowest tax consequences possible for taxable accounts.

For taxable accounts, Tamarac Trading first sells Unassigned overweight securities in order of greatest to least losses. Next, it sells overweight securities in the assigned model in order of greatest to least losses. If additional cash still needs to be raised, the following logic applies:

If your Default Sell Order option is set to Most to Least Overweight, Tamarac Trading sells securities with gains from Unassigned, most overweight first. Next, it sells securities with gains, within the assigned model, most overweight first.

If your Default Sell Order option is set to Least to Greatest Realized Gains, Tamarac Trading sells securities with gains, least gains first. This option does not prioritize Unassigned securities first.

For non-taxable accounts, Tamarac Trading sells securities from Unassigned, most overweight first. Next, it sells overweight securities in the assigned model, most overweight first.

Because the Sell Only to Raise Cash rebalance is a sell-only rebalance, it is not typically set as an account default. The following are some situations where this rebalance type is useful:

There's an account which needs to raise cash and you want to fill the reserve in that account but don't want to also fill any needed model cash.

You want to raise cash by selling overweight positions without making buys.

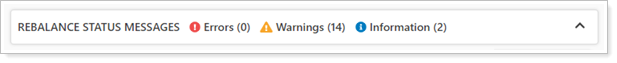

It is important to review any warnings under Rebalance Status Messages on the Rebalance Summary. These warnings let you know about any applicable account, security, or system-level settings.

If you need to raise underweight cash within the model in a client's account, in addition to raising cash for the cash reserve, use the Min/Max Rebalance type instead.

The Sell Only to Raise Cash rebalance is a sell-only type of rebalance. The following settings may affect this rebalance:

| Setting | More Information |

|---|---|

|

Define the order in which the rebalance will generate sells; this setting behaves differently based on the account's tax status. If you choose Most to Least Overweight, all securities in the Unassigned model will be prioritized before securities held in the model. |

|

|

This settling allows you to adjust how Tamarac Trading determines which trades to recommend. The larger the improvement percentage, the more trades the system can recommend as there is a wider range to meet. A smaller improvement percentage becomes more restrictive and could recommend few trades as there is a more narrow range to meet. |

|

|

Tells Tamarac Trading how to calculate deviation away from model targets when determining buy and sell order. Absolute deviation uses the absolute calculation of deviation. Relative deviation calculates deviation relative to the parent model's target. |

| Setting | More Information |

|---|---|

|

This setting determines whether the account is taxable or tax-deferred; this changes the logic of the rebalance. See Rebalance Logic. |

| Setting | More Information |

|---|---|

|

When Yes, Tamarac Trading temporarily ignores model ranks and rebalances to your investment targets at the lowest possible tax cost to the client. It will then ignore ranks and sell losses first, followed by securities with no tax consequences, and then finally, it will sell gains. |

|

|

These can be set as either dollar amounts or percentages. Tamarac Trading applies the greater of these two and will prevent a trade if it doesn't meet these requirements. |

|

|

These settings apply to all securities held in the account and a rebalance can cause a recommendation to liquidate a security if the resulting trade would cause the security to fall under the minimum holding size set at the account level. |

|

|

When selected, this setting prevents any trading in an account. When an underlying account in a group is on hold and the amount of an asset class it holds is above the max for the group, the group won't complete the rebalance in tolerance. |

|

|

The rebalance adheres to account-specific restrictions like Range to Hold and any Buy/Sell Restrictions. |

| Setting | More Information |

|---|---|

|

The rebalance adheres to security-specific restrictions like Hold Do Not Trade. |

|

|

The rebalance adheres to security-specific custom settings like Custom round lot or Custom trade price. |