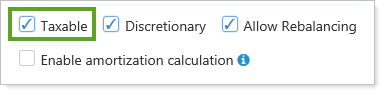

Designates whether the account is taxable or tax-deferred (non-taxable).

The tax status of an account can affect trading activity in the following ways:

-

One of the ways you can prioritize accounts on the Asset Location page is by tax status. For more on tax status and asset location within groups, see Set Account Priorities.

-

Security-specific settings on the Trade File Group Settings page can be different for taxable and tax-deferred accounts. For more on setting different trade file group settings for individual securities based on tax status, see Trade File Group Settings.

-

Security restrictions can prevent a security from being bought in either a taxable or tax-deferred accounts. For more on restricting the purchase of securities based on the account's tax status, see Security Restrictions.

-

The tax status of the account can affect the logic of which trades are recommended for certain rebalance types.

-

When you group the tax planning version of the Comparative Review report by Tax Status, it uses the Taxable setting to organize accounts.

This field affects both trading and reporting activity.

When you update this field for an individual account or accounts, you can sync those changes without running a full sync. To learn more about syncing account changes for individual accounts, see Synchronize Account Data With Tamarac Trading.

For more information on editing accounts, including how to navigate to this panel, see Maintaining Accounts.