Contents

|

Why Use the Tax Planning Report? See the Tax Planning Version of the Comparative Review Report in Action Features of the Tax Planning Review Report Customize Data and Columns Included |

Introduction

| Applies to: | |||

|---|---|---|---|

| Dynamic | Mobile | Client Portal | |

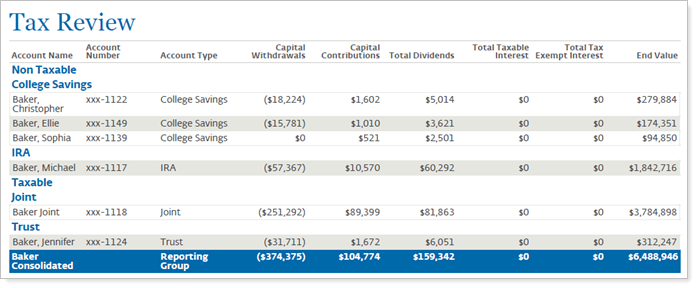

The tax planning version of the Comparative Review PDF report presents account- and group-level data including long- and short-term capital gains and losses and realized gains and losses, federal and state taxable dividends and interest, and more for a given date period. This version of the report brings together all the account activity details tax planners need in one place.

On this report, you'll see a table listing each account and its tax data for the selected date period. Grouping and sorting options allow you to configure the table for clear interpretation.

To create a tax planning version of the Comparative Review PDF template, set Reporting data type to Tax planning data in the PDF template settings.

For more information about using the Comparative Review report for performance data reporting, see Comparative Review Report.

Best Practice

This report is intended to provide guidance for advisors and investors. It does not replace official tax forms. Always use the custodian's documents as the source of record when filing taxes.

Why Use the Tax Planning Report?

In the tax planning version of the Comparative Review report, you will find versatile sorting and grouping options and detailed columns that let you answer many questions about accounts and groups, such as:

-

What taxable income did the account or group receive this year?Report on various income and expense sources, including state and federal taxable income and dividends, fees, interest, and more.

-

What Realized and capital Gains Did This Account Accumulate Over the Period? Create a tax planning version of the Comparative Review PDF report to see and share tax planning data points for realized gains and losses, and more, with clients and their tax preparers.

-

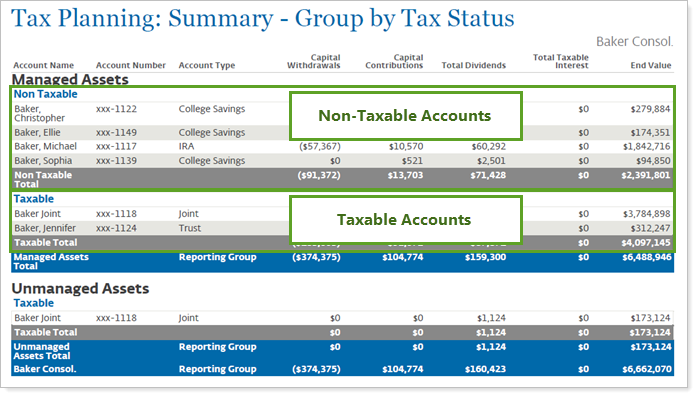

What about taxable and non-taxable accounts?Group accounts by tax status to separate taxable and non-taxable accounts and include or omit tax details from non-taxable accounts.

See the Tax Planning Version of the Comparative Review Report in Action

It's tax season and you need to deliver detailed tax planning information to clients. Clients need to provide their accountants with details on dividends, interest, and gains, losses for each of their taxable accounts.

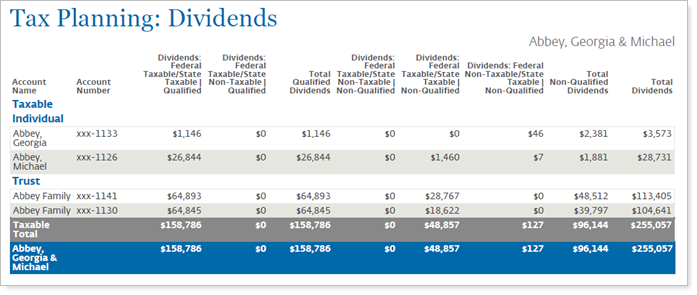

You create a tax planning version of the Comparative Review PDF template, configuring each section with your choice of data points. For this report, you add one section each for dividends, interest, and gains, losses, and capital gains. Each page includes columns that report data for that particular type of activity. You group the entire report section by tax status.

The dividends page, which summarizes various types of dividend payments received for the year, appears below.

Features of the Tax Planning Review Report

The tax planning version of the Comparative Review PDF report helps you group and sort data to drill down to meaningful results.

Customize Data and Columns Included

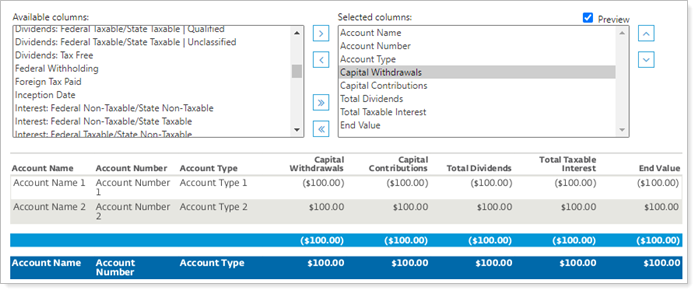

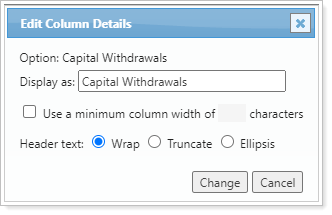

Customize the data displayed to show only relevant data. You control what data the report displays and which columns the report includes, in what order, so you can create the exact report you need.

For example, to customize the name of the Start Value and End Value data points using merge fields to insert {Date} or {Date Period Name}. For more information on how to customize data point names, see Customize the Name of Column Headings for Reports.

Group By Tax Status

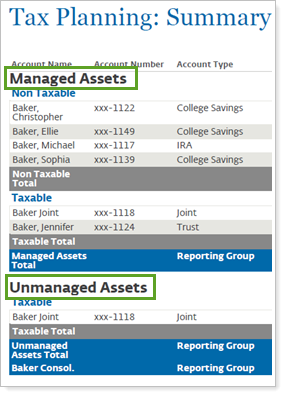

Although you can group the tax planning report by any of the many grouping options, we recommend that you Group by Tax Status to sort accounts based on each account's Taxable setting. This grouping allows you to organize the report to optimize for tax data.

Show Managed and Unmanaged Assets

Group by managed and unmanaged accounts to split the report up by what you are responsible for. For more information, see How Reports Handle Unmanaged Assets.

Customize Naming

You can customize the name of most selected columns and the Managed/Unmanaged labels used for the headings and captions.

For more information, see Customize the Name of Column Headings for PDF Reports.

Tax Planning Report Settings

The following settings are available for the tax planning version of the Comparative Review PDF report. Click the setting name for more details.

| Setting | Details | Available in... |

|---|---|---|

| PDF Report | ||

| Account Grouping | Control grouping of accounts and groups. | X |

| Available/Selected Columns | Choose which columns are included, in what order. | X |

| Select the date period you want to use for the report. | X | |

| Group By/Then By |

Organize a report by various categories. |

X |

| Header and Footer | Choose a unique header and footer for the section or use defaults. | X |

| Include Capital Gains Distributions in Realized Gain/Loss Columns | Include or exclude capital gains distributions. | X |

| Include Page Break After This Section |

Control where page breaks occur in PDF reports. |

X |

| Include Tax Planning Data for Non-Taxable Accounts | Control whether the report displays tax-related data for non-taxable accounts. | X |

| Preview |

See a sample of added columns or rows with the selected settings. |

X |

| Report Direct Member Groups as a Single Line Item | Show or hide all the direct members of a group within a group. | X |

| Reporting Data Type | Create a performance report or a tax planning report. | X |

| Section Title | Designate what the section will be called in the PDF report. | X |

| Show Subtotals |

Add subtotals to each grouping level when you Group by. |

X |

| Sort First By/Then By |

Determine the default order in which the data is displayed. In the PDF Dashboard, the sort options are slightly different. |

X |

| Theme | Designate what theme the section will use. | X |

| Unmanaged Asset Treatment |

Choose how you want to treat unmanaged assets on the report. |

X |

Report Actions

To learn more about reports in Tamarac, see Introduction to Reports.

To learn more about how to generate a report, change the data displayed, print or export the report data, and more, see Basics of Working With Reports.

To learn more about creating and using PDF reports, see Understanding PDF Reports and Workflow: Generate a PDF Report.