Contents

|

How Include Capital Gains Distributions in Realized Gain/Loss Columns or Rows Works |

How Include Capital Gains Distributions in Realized Gain/Loss Columns or Rows Works

| Applies to: | ||

|---|---|---|

| ✔ Dynamic |

✔ Client Portal |

|

This setting allows you to include or exclude capital gains distributions in realized gain/loss calculations.

Because capital gains are taxed at a different rate than realized gains/losses from the sale of holdings, you may want to display them elsewhere or not display them at all. This setting allows you to determine how these types of distributions are displayed on each report.

In Dynamic Reports

-

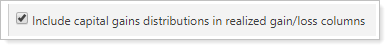

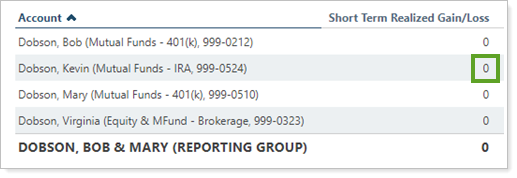

To exclude capital gains distributions, clear the Include capital gains distributions in realized gain/loss columns check box.

In this example, the account ending in 0524 had $4000 in capital gains distributions that are not reported.

-

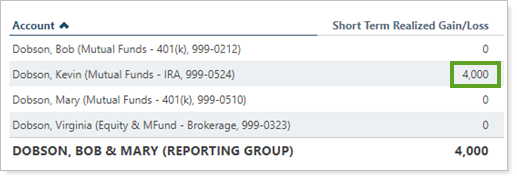

To include capital gains distributions, select the Include capital gains distributions in realized gain/loss columns check box.

In this example, the account ending in 0524 had $4000 in capital gains distributions that are reported.

In PDF Reports

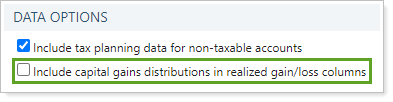

When you set Reporting data type to Tax planning data, the behavior of Include capital gains distributions in realized gain/loss columns changes slightly.

-

Selected. Realized gain/loss calculations include capital gains. To make sure capital gains results aren't reported twice and subtotals continue to make sense, you won't be able to add capital gains columns like Capital Gains Distributions: Long Term, Capital Gains Distributions: Short Term, or Capital Gains Distributions: Total.

For example, with the check box selected, the calculation might be: Total Realized Gain/Loss = Long Realized Gain/Loss + Short Realized Gain/Loss + Unclassified Realized Gain/Loss + Capital Gains

-

Cleared. Realized gain/loss calculations do not include capital gains. To include capital gains information in the report, add capital gains columns like Capital Gains Distributions: Long Term, Capital Gains Distributions: Short Term, or Capital Gains Distributions: Total in the Selected Columns list.

For example, with the check box cleared, the calculation might be: Total Realized Gain/Loss = Long Realized Gain/Loss + Short Realized Gain/Loss + Unclassified Realized Gain/Loss

Learn more about the details of how this setting works in PDF reports with this short video.

Reports With This Setting

Performance Reports|

|