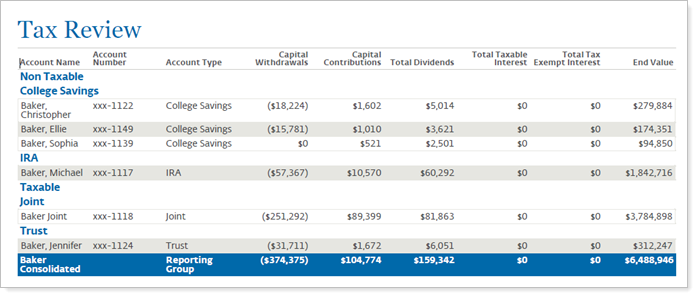

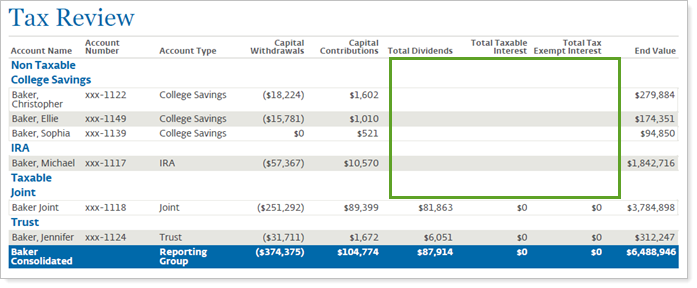

Use this setting to control whether the Comparative Review PDF report displays tax-related data points like dividends, interest, capital gains distributions for non-taxable accounts. You only see this option when you set Reporting data type to Tax planning data.

You can choose:

-

Selected. See data for all data points for all accounts. Totals include values for all accounts. This is the default option.

-

Cleared. For non-taxable accounts, only see values for capital contributions, capital withdrawals, value, and weight. Exclude all income, expense, realized gains/losses, and capital gains distribution data from the report. You won't see the values listed in any applicable columns, and the subtotals do not include those values.

For more information about the Comparative Review report, see Comparative Review Report.

To learn more about the tax planning version of the Comparative Review report, see Tax Planning Report.