Contents

Introduction

Setting account and model priorities on the Asset Location pages allows you to specify priorities within groups during a rebalance. Allocation goals in the account are first determined by asset location preference, and setting account priorities is a powerful way to ensure that, over time, assets are placed in the accounts where they're desired.

An efficient asset location strategy can provide increased returns for an investor by reducing tax liability. However, a common problem advisors face with this approach is how to efficiently implement this strategy over a large number of accounts.

The directions on this page show you how to set account priorities for your groups. For information on setting individual model priorities, see Set Model Priorities.

The Asset Location and Priorities Creation Process

Setting your asset location preferences involves first setting up your accounts the way you'd like them and then establishing your priorities. Here's an overview of the process:

-

Create asset location preference labels.These labels identify your various types of accounts.

-

Add Labels To Accounts.Add the labels you created in the first step to the various account types within your groups.

-

Set Account Priorities.Your account priorities establish priority based on account labels you created.

-

Set Default Model Priorities.These priorities establish which models take higher priority within a group during the rebalancing process.

-

Set Specific Model Priorities.Specific model priorities override default model priorities and can accommodate priority changes for some circumstances.

See Account and Model Priorities in Action

Mr. and Mrs. Jones just opened two new accounts using cash. They opened a tax-exempt retirement account, worth $300,000, with the Asset Location Preference label Tax Exempt. The second account is a taxable account, worth $700,000, which is labeled as Taxable.

You create the Jones Group and include both accounts. You then set up your account priorities this way:

You want the most trades to be in the tax exempt account, so you place Tax Exempt as a lower priority. Taxable is higher priority because you want that account to contain fewer trades during future rebalances.

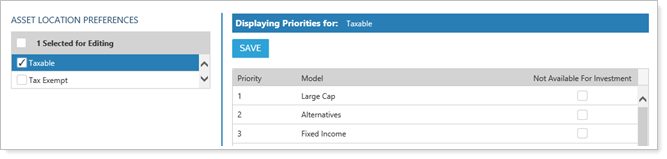

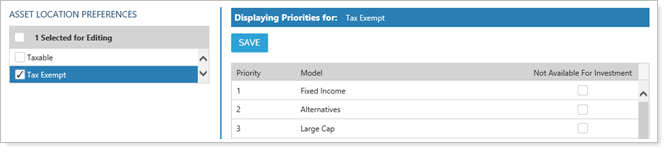

Next, you specify model priorities for Jones Group. The group is assigned a model which contains three Security Level models: Large Cap, Alternatives, and Fixed Income.

You set up your model priorities for Taxable this way:

You set up your model priorities for Tax Exempt this way:

In future rebalances, Tamarac Trading will sell overweight securities from the least preferred account and buy underweight securities in the most preferred account when cash is available. For Taxable, you want to prioritize selling the less tax-advantaged Fixed Income out of the account and bring in the more tax-advantaged assets found in Large Cap. For Tax Exempt, you place the models in reverse order so that the less tax-advantaged assets in Fixed Income are moved from Taxable into Tax Exempt.

Rebalancing Group Settings

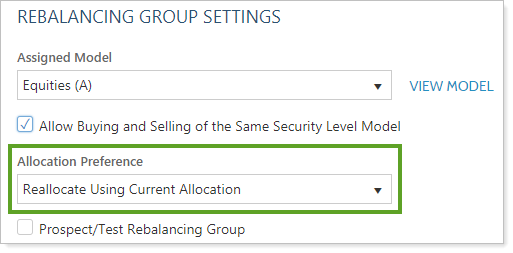

The Allocation Preference setting is available on the Rebalancing Group Settings panel, located on the edit accounts pane that appears when you edit accounts or groups on the Accounts page. This setting allows you to specify, at the group level, how you'd like securities to be allocated during a rebalance. This setting determines how strictly your account and model priorities will be enforced during a rebalance. This setting can be used in conjunction with setting account and model priorities for more granular control of allocations.

For more information on setting the Allocation Preference setting, see Rebalancing Group Settings.

Asset Location vs. Model Targets

You may have confusion about how model target weights differ from asset location and how these two concepts interact. Here is a brief summary of both concepts:

-

Model Target.Model targets are the specific weights for the securities or submodels within that model. You define model targets during the model creation process. Model targets dictate the weight of each security or submodel in your ideal allocation.

-

Asset Location.During the rebalance process, asset location preferences allows you to place the Security Level models within a group's model into their preferred account type. Asset location dictates placement within the accounts in a group.

The difference between these concepts is that model target weights are the ideal mixture of securities you'd find within an account that uses that model. Asset Location is a tool you can use to specify the ideal location of securities within a group, even if the models within the account are underweight or overweight.

Asset Location Preference Labels

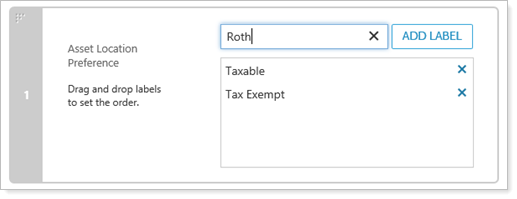

On the Account Priorities page, you can create asset location preference labels. These labels are a way for you to identify the types of accounts, using any labels that make sense to you. You can then attach those labels to individual accounts.

The asset location preference label is your way of deciding which accounts will get priority over others in a group. The higher the priority, the fewer recommended trades that particular account will receive.

Create an Asset Location Preference Label

To create an asset location preference label, follow these steps:

-

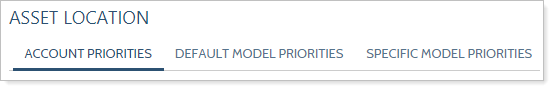

On the Rebalance & Trade menu, click Asset Location.

-

If not already selected, choose Account Priorities.

-

Under Asset Location Preference, type your new label.

-

Click Add Label.

-

Click Save.

Delete an Asset Location Preference Label

-

On the Rebalance & Trade menu, click Asset Location.

-

If not already selected, choose Account Priorities.

-

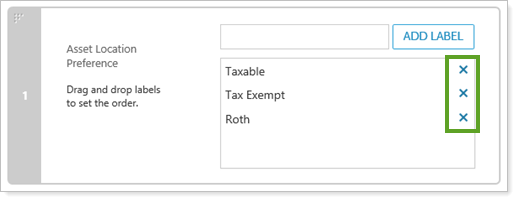

Under Asset Location Preference, click the X next to the label you are deleting.

-

On the dialog box that opens, click Delete.

-

Click Save.

Assign an Asset Location Preference Label to an Account

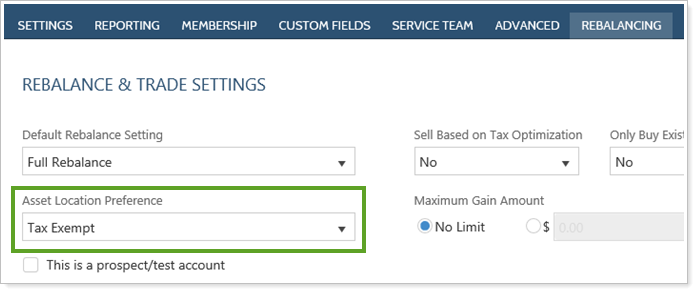

Once you create asset location preference labels, you can then set Asset Location Preference in individual accounts using the labels you've already created. This setting is found on the Rebalance & Trade Settings panel, found on the Rebalancing tab within an account's settings.

You can also use upload to set an asset location preference and use account multi-edit to apply a preference to many accounts at once.

Set Account Priorities

To set account priorities, follow these steps:

-

On the Rebalance & Trade menu, click Asset Location.

-

If not already selected, choose Account Priorities.

-

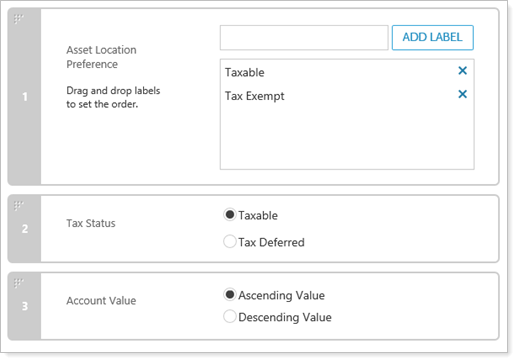

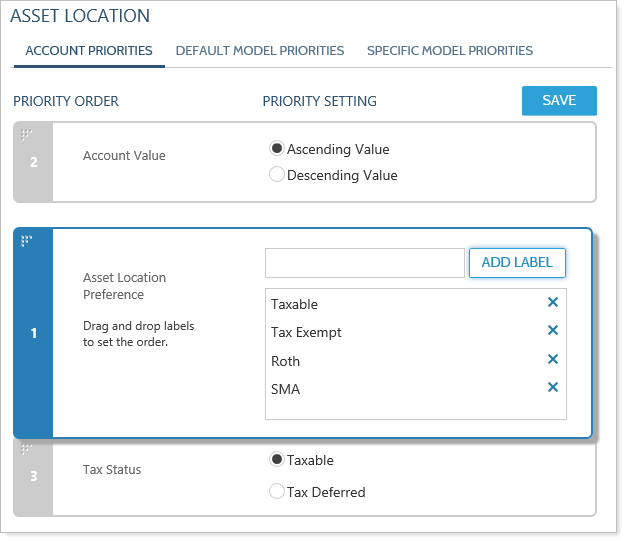

Drag and drop the three categories—Asset Location Preference, Account Value, and Tax Status—into your preferred order.

Asset Location Preference is usually given highest priority, followed by Tax Status, and then Account Value.

-

Set priority preferences within these categories:

-

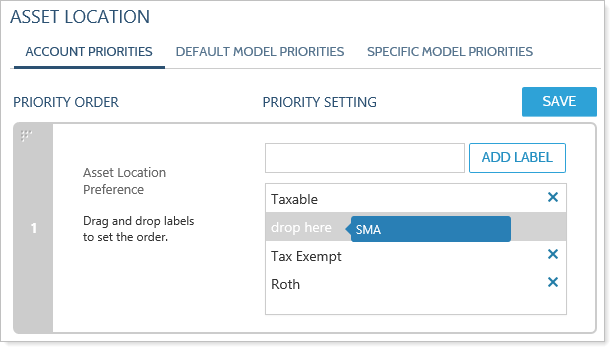

ASSET LOCATION PREFERENCE. Drag and drop the labels into your preferred order. For more information on these labels, see Asset Location Preference Labels.

It's best practice to give highest priority to accounts you want to trade the least, usually taxable accounts. Accounts with lower priority will have more trading; these are usually tax-exempt accounts.

-

TAX STATUS. Choose either Taxable or Tax Deferred as your priority. The option you choose will be allocated first. Tax Status serves as a tie breaker when two or more accounts have the same Asset Location Preference label.

-

ACCOUNT VALUE. Choose either Ascending Value or Descending Value as your priority. Account Value is based on total market value plus or minus the current cash position. To buy in the smallest account in a group first, choose the Ascending Value option. Account Value serves as a tie breaker when two or more accounts have the same Asset Location Preference label.

It's best practice to give smaller accounts higher priority.

-

-

Click Save.