Contents

|

Mapping a Traded Security with a Custom Symbol What to Do When You See an Upload Error Map a Security Based on Security Type |

Introduction

Security mapping allows you to establish the value of a security as being represented by another security—for example, the values of Security X and Security Y are now represented throughout Tamarac Trading by Security A. The most common example is mapping your various sweep cash securities to the sweep cash ticker ($$$) in Tamarac Trading. When securities are correctly mapped, their values will reflect accurately in clients' accounts.

important

Do not map securities to tradable tickers.

Why Use Security Mapping?

The follow are reasons you may need to use the Security Mapping page:

-

You hold multiple sweep cash securities that you want to appear as cash ($$$).

-

You hold different individual bonds you want to appear as one symbol.

-

You hold limited partnerships and other alternative assets that you want to show up as a single security.

When mapping securities, there are three types of mapping you may want to do: map a security to cash, to a specific security type, or to a traded security using a custom symbol.

Mapping Cash

In some cases, you may need to map a security to cash, also called sweep cash. This applies to liquid investments or sweep cash that are represented in your portfolio accounting system (PAS) with symbols like TEF, TEFX, GSP, CASH, MMG, and CAF. After mapping these securities, these liquid investments will be treated like cash and will appear in Tamarac Trading as cash, $$$.

For example, let's say an advisor fails to map symbol TEF to $$$ in Tamarac Trading, then exports holdings out of the firm's PAS to upload those holdings into Tamarac Trading. Part of the exported holdings is a client with a 10,000 share position in TEF. While the advisor's PAS recognizes TEF as sweep cash priced at $1, Tamarac Trading recognizes TEF as the symbol for Telefónica, S.A., a stock trading at $9.75.

Upon uploading the holdings, Tamarac Trading shows that client's holdings in TEF to be valued at $97,500 (10,000 shares of TEF × $9.75). If the advisor had rebalanced this account, the client's account value would be grossly overvalued.

For position traded securities that aren't liquid and will require trading, create cash substitutes. When you create a cash substitute, the value of these securities will be counted like cash, but they will generate a trade when being bought or sold.

Mapping by Security Type

You can map securities to a dummy ticker using security type mapping. If a security is not priced through your security master—that is, if the security's pricing isn't flowing through to Tamarac Trading—and is not mapped directly to a dummy ticker, Tamarac Trading will then look to see if the security type is mapped to a dummy ticker. This method is often used with fixed income securities to combine a large number of fixed income securities into one ticker, FIXEDINCOME, that can be added to models rather than adding each of the fixed income securities individually.

Mapping a Traded Security with a Custom Symbol

You can map securities to a custom symbol. This allows you to take an unrecognized symbol that exists in your portfolio accounting system (PAS) and map that symbol to an alternate symbol in Tamarac Trading. The most common use for this feature is mapping sweep cash securities to the cash security that Tamarac Trading recognizes as sweep cash ($$$).

To map into Tamarac Trading, use the custom input feature. This takes symbols from your PAS and tells Tamarac Trading which symbols to use instead, use the custom input symbol feature.

To map out of Tamarac Trading, use the Custom output symbol feature under Trade File Group settings. This takes symbols from Tamarac Trading and uses the alternate symbols that you specify on trade files.

For more information, see Trade File Group Settings.

What to Do When You See an Upload Error

Review your upload error and warnings daily to identify possible security errors and resolve them so that your clients' account values are represented accurately. You can check these on the Upload Status page, found on the Setup menu. Any errors you see should be resolved because the values of the accounts holding that security won't be accurate. Map the securities with errors to make the account values accurate again.

If you see an error for a non-traded security, follow these steps to resolved it:

-

Identify the unknown security.

-

Identify the symbol or dummy ticker the unknown security should appear as in Tamarac Trading, and map the unknown security. If the securities with errors are cash securities, map the security or securities to cash ($$$).

-

Once you've mapped the securities with errors, upload from your PAS again and synchronize.

If the security is a traded security and you're seeing an Unknown security error, contact your Tamarac Service Team for further assistance.

Map Securities

Using security mapping, you can map a security to cash, to a specific security type, or to a traded security using a custom symbol.

Map a Security to Cash

To map a security to cash, follow these steps:

-

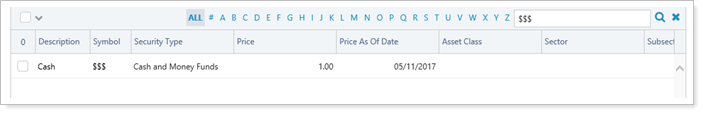

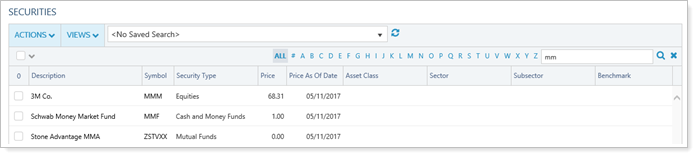

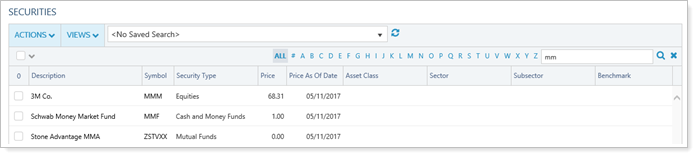

On the Setup menu, click Securities.

-

Enter $$$ in the Search Securities box and then hit Enter.

-

Click the $$$ symbol or description to open the security settings panel.

-

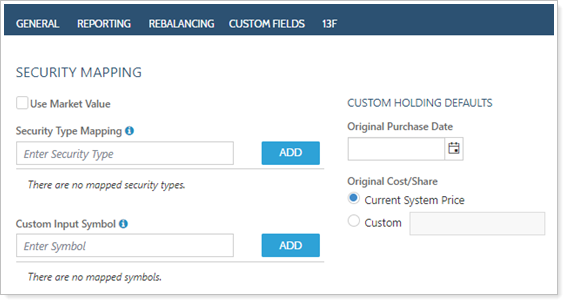

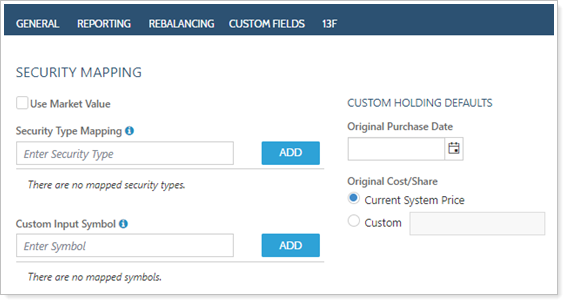

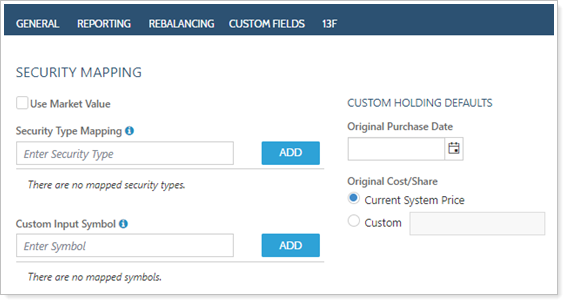

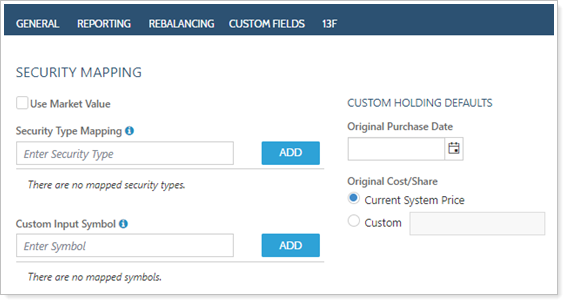

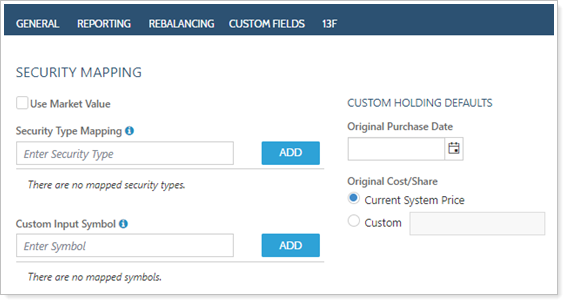

On the Rebalancing tab, choose Security Mapping.

-

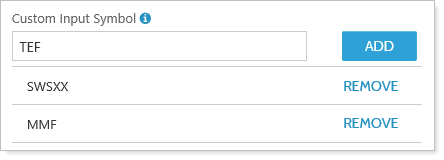

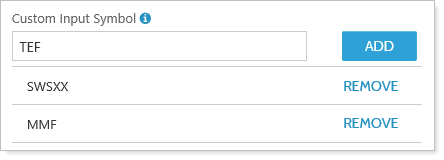

Under Custom Input Symbol, in the Enter Symbol field, enter the security you want to be mapped to cash and click Add.

-

Enter additional symbols in the Enter Symbol field, if necessary.

-

Click Save. These changes will take effect the next time you upload data.

Map a Security Based on Security Type

To map a security to a security type, follow these steps:

-

On the Setup menu, click Securities.

-

Enter the dummy ticker in the Search Securities box and then click Enter. If the dummy ticker doesn't exist, see Add and Maintain Securities to find more about creating a new security.

-

Click the dummy ticker symbol or description to open the security settings panel.

-

Choose Security Mapping on the Rebalancing tab.

-

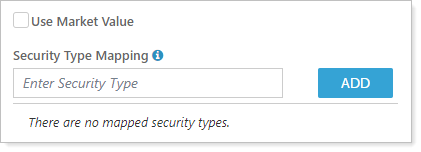

Select Use Market Value.

-

If mapping to a dummy ticker, select the Use Market Value check box to ensure that Tamarac Trading uses the market value from the upload.

-

If mapping to a security type that is a tradable security that Tamarac Trading recognizes, do not select the Use Market Value check box.

-

-

Under Security Type Mapping, in the Enter Security Type field, enter the security type that you want to show under the dummy ticker.

-

Click Save. The changes will take effect the next time you upload data.

Map a Traded Security

To set a custom input symbol, follow these steps:

-

On the Setup menu, click Securities.

-

Enter the target symbol in the Search Securities box and then hit Enter.

-

This will be the recognized symbol you are going to map your unrecognized symbol into.

-

If you enter a dummy ticker, verify that it is valid in Tamarac Trading. If the security you enter appears in the list, it is valid. If it doesn't appear in the list, it's not valid.

-

-

Click the target symbol or description to open the security settings panel.

-

Choose Security Mapping on the Rebalancing tab.

-

In the Enter Symbol field, under Custom Input Symbol, enter the security you want to be mapped to cash and click Add.

-

Click Save. The changes will take effect the next time you upload data.

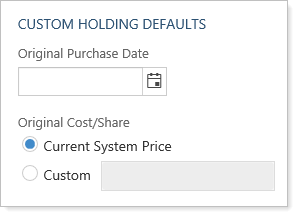

Default Original Cost Per Share

About Original Cost Per Share

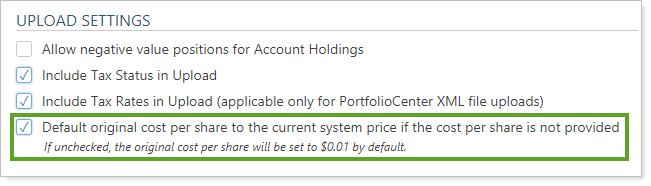

If an original cost per share wasn't provided for a security, you can apply a default original cost per share. This is not needed for traded securities, but may be necessary for non-traded securities in your clients' accounts. However, this is an uncommon scenario.

-

When selected, the default original cost per share on a security will be the current system price if you've not provided an original cost per share. If you choose this option, you won't see a gain/loss for the security because the cost basis will be set to the current system price.

-

When cleared, the original cost per share on a security will be $0.01 if you've not provided an original cost per share. If you choose this option, you will see a dramatic change in gains as the cost basis is set to a penny.

The Default original cost per share to the current system price if the cost per share is not provided option is a system setting that affects the way Tamarac Trading views original cost per share when it's not specified.

When you select this system setting, the default original cost per share on a security will be the current system price if you've not provided an original cost per share. If you choose this option, you won't see a gain/loss for the security because the cost basis will be set to the current system price. When this system setting is cleared, the original cost per share on a security will be $0.01 if you've not provided an original cost per share. If you choose this option, you will see a dramatic change in gains as the cost basis is set to a penny.

Set Original Cost Per Share

This is a global setting and, if set, will apply to every account holding that security.

To set default original cost per share, follow these steps:

-

On the Setup menu, click Securities.

-

Enter the security in the Search Securities box and then hit Enter.

-

Click the security's symbol or description to open the security settings panel.

-

Choose Security Mapping on the Rebalancing tab.

-

Under Original Cost/Share, choose one of the following:

-

Current system priceTamarac Trading will consider the original cost per share to be the current price of the security on the system.

-

CustomTamarac Trading will consider the original cost per share to be the custom price you enter in this box.

-

-

Click Save. The changes will take effect the next time you upload data.

Set Original Purchase Date

If an original purchase date wasn't provided for a security, you can apply a default original purchase date. However, this is an uncommon scenario.

To set a default original purchase date, follow these steps:

-

On the Setup menu, click Securities.

-

Enter the security in the Search Securities box and then hit Enter.

-

Click the security's symbol or description to open the security settings panel.

-

Choose Security Mapping on the Rebalancing tab.

-

In Original Purchase Date, type the default original purchase date.

-

This date must be greater than or equal to 01/01/1900.

-

This date must be less than or equal to the current trade date.

-

-

Click Save. The changes will take effect the next time you upload data.