Contents

|

Putting Models Together and Model Targets |

Introduction

In Tamarac Trading, there are two types of models you can create: Security Level models and Allocation models. At a base level, models represent building blocks which you put together to represent your ideal strategy for a client. These two model types allow you to add these building blocks with flexibility and complexity.

Security Level Model

A Security Level model represents a grouping of individual securities and is the basic building block on which you can build a client's asset allocation strategy. These securities can be stocks, mutual funds, ETFs, fixed income securities, separate accounts, or other assets traded on an exchange. They can also be manual securities not traded on an exchange, such as like limited partnerships; you can add and update manual securities in Tamarac Trading and then add those manual securities to your models.

The securities within a Security Level model are grouped and given an allocation or target—for example, a security with a 50% target should make up half of the holdings in that model—in any way that makes sense for you. They are often created to represent an asset class.

For more information, see Learn More About Security Level Models.

Allocation Model

An Allocation model is a grouping of Security Level models or other Allocation models. These models are grouped together with a given allocation, or target, that you specify. An Allocation model can represent a grouping of Security Level models or can be used to represent a client's overall investment strategy. You can use an Allocation model if your investment strategy is focused on achieving target allocations at the asset class, sector, or other category of securities that you have defined.

Like Security Level models, Allocation models are also given a target or goal % that defines what the allocation should be for that model in an ideal situation.

For more information, see Learn More About Allocation Models.

Basic Model Rules

The following are basic rules that apply to the models you create in Tamarac Trading:

-

Top-tier models cannot use ranks. For more information on ranks, see Goals and Ranks in Models.

-

The sum of all submodel goals in an Allocation model must add up to 100%. Similarly, the sum of all security goals in a Security Level model must add up to 100%.

-

Target (goal) percentages for a Security Level models and Allocation models can range from 0% to 100%.

The 0% target is a technique you can use to accommodate restricted securities or legacy positions within your rank-based models. By giving that model a 0% target, clients can continue to hold positions and you can allocate these holdings towards the client's portfolio. Over time, clients can continue to hold these positions or trade them away.

Putting Models Together and Model Targets

Once you've created your Allocation and Security Level models, you'll put them together to create the models you'll eventually assign to clients' accounts. Tamarac Trading allows you to create a model with an unlimited number of tiers, allowing you to create model portfolios that can range from simple to complex.

Models are assembled with targets assigned to them. Targets, sometimes referred to as goals, are percentages you assign to each submodel or security within a model. Models are then assembled together in tiers and all models and securities within those models are given targets; each tier's targets must add up to 100%. Depending on the model type and strategy, targets can be anywhere from 0% to 100%.

See Security Level Models and Allocation Models in Action

Model Targets Example

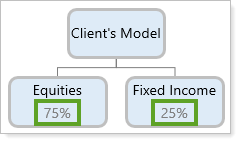

You create a model where you want this asset mix:

-

75% of the holdings to be in equities.

-

25% of the holdings in fixed income securities.

These percentages are your model's targets. As you build this model and make it more complex by adding more tiers, Tamarac Trading will know that 75% of the portfolio should be taken up by equities and 25% should be taken up by fixed income securities.

Security Level Model Example

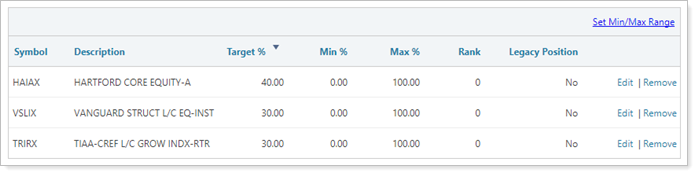

You want to create a Security Level model which you are going to assign to clients' accounts. You want this model to represent a mix of Large Cap securities. To do this, you create this Large Cap Security Level model:

In this example, HAIAX represents 40% of Large Cap Security Level Model while both TRIRX and VSLIX represents 30% of the model. Together, these allocations add up to 100%.

Allocation Model Example

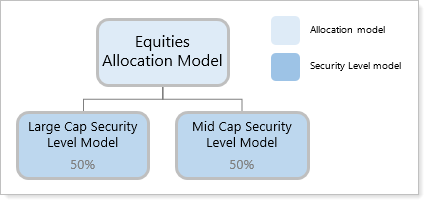

You want to create a model that represents the Equities sectors, but you want to put different asset classes within that model. To do that, you create an Allocation model. Within that Allocation model, you'll add Security Level models. These models, in turn, will contain the individual securities:

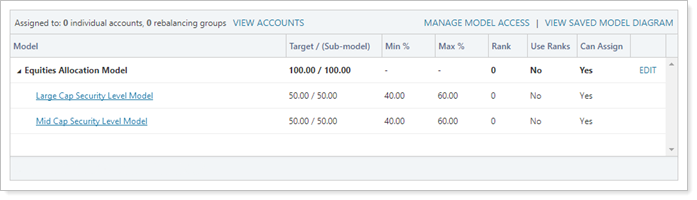

In this example, you've created Equities Allocation Model and added two submodels, both of which are Security Level models: Large Cap Security Level Model and Mid Cap Security Level Model.

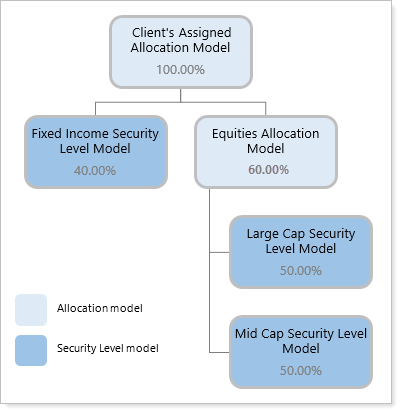

Example of Putting Models Together

You want to create an Allocation model which will be assigned to your client and you want this model to represent a specific mix of fixed income and equities:

This model is made of three tiers:

-

Top Tier, Assigned to Clients' Accounts.The top tier is always the model that will be assigned to the client's account; in this case, that's Client's Assigned Allocation Model.

-

Second Tier, High Level Asset Mix.The second tier contains two models, Fixed Income Security Level Model and Equities Allocation Model and represents the high-level mix of assets in the model.

-

Third Tier and Lower, Added Complexity.On the third tier, the Equities Allocation Model is made up of two Security Level models, further adding flexibility and complexity to the model.