A ratio of portfolio returns above the returns of a benchmark (usually an index) to the volatility of those returns. The information ratio (IR) measures a portfolio manager's ability to generate excess returns relative to a benchmark, but also attempts to identify the consistency of the investor. This ratio will identify if a manager has beaten the benchmark by a lot in a few months or a little every month. The higher the IR the more consistent a manager is and consistency is an ideal trait.

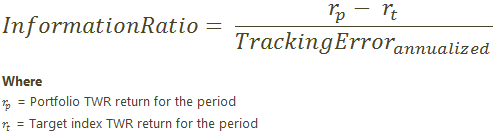

The Calculation

When Information Ratio Uses Net or Gross Returns

On the Account Analytics report, you can control whether this calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.