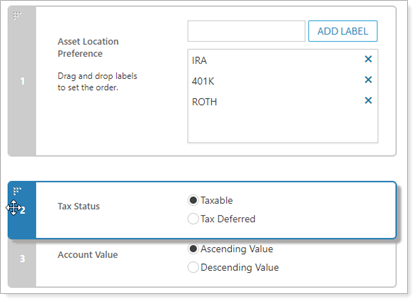

When setting asset location preferences, Tax Status lets you set the priority for whether Taxable or Tax Deferred accounts will be allocated first.

Select the tax status that you want allocated first. Tax Status serves as a tie breaker when two or more accounts have the same Asset Location Preference label. We recommend that you give highest priority to accounts you want to trade the least, usually taxable accounts. Accounts with lower priority will have more trading; these are usually tax-exempt accounts.

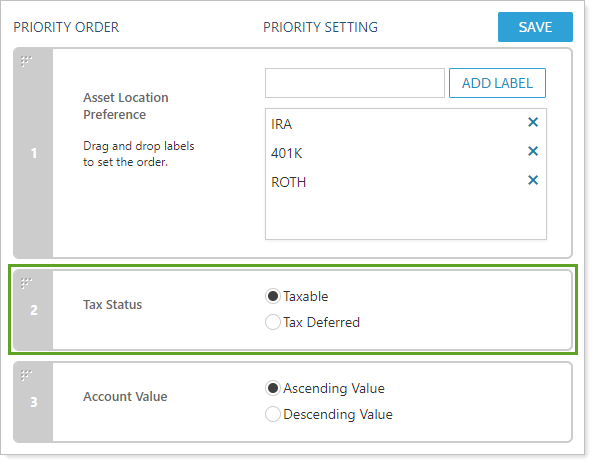

To prioritize among Asset Location Preference, Tax Status, and Account Value for the accounts within a group, drag each section into your preferred order. Many firms give Asset Location Preference highest priority, followed by Tax Status, and then Account Value.

For more detailed information on asset location, see Set Account Priorities and Set Model Priorities.