Upside capture ratio show you whether a given fund has outperformed—gained more or lost less than—a broad market benchmark during periods of market strength and weakness, and if so, by how much.

Upside capture ratios for funds are calculated by taking the fund's daily return during days when the benchmark had a positive return and dividing it by the benchmark return during that same month. Downside capture ratios are calculated by taking the fund's daily return during the periods of negative benchmark performance and dividing it by the benchmark return.

An upside capture ratio over 100 indicates a fund has generally outperformed the benchmark during periods of positive returns for the benchmark. Meanwhile, a downside capture ratio of less than 100 would indicate that a fund has lost less than its benchmark in periods when the benchmark has been in the red. If a fund generates positive returns, however, while the benchmark declines, the fund's downside capture ratio will be negative (meaning it has moved in the opposite direction of the benchmark).

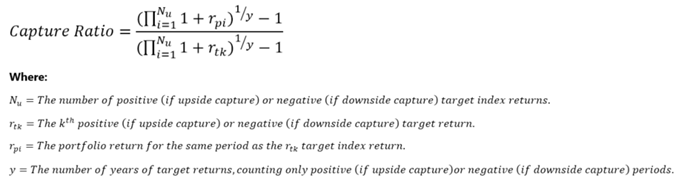

The Calculation

When Upside Capture Ratio Uses Net or Gross Returns

On the Account Analytics report, you can control whether this calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.

Learn More

See also: Downside Capture Ratio.