Contents

How Use Multiple Security Categories Works

| Applies to: | |||

|---|---|---|---|

| ✔ Dynamic | ✔ Client Portal | ✔ Report Studio | |

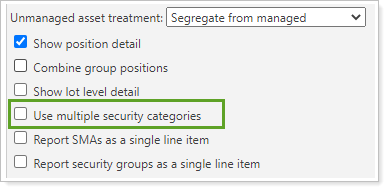

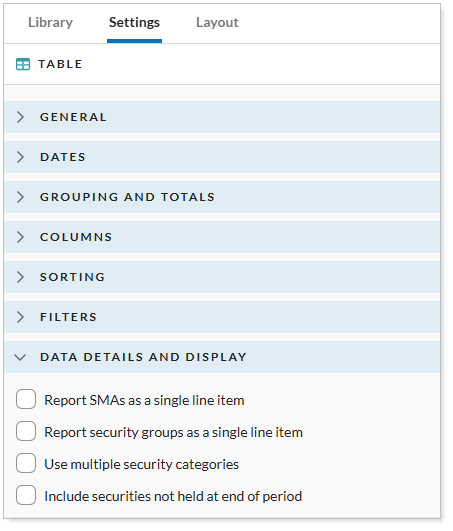

Some securities may be assigned to multiple categories where the allocations are proportionally split by the weighted percentage of those categories. This setting allows you to choose how reports display securities assigned to multiple categories. Use the multiple categories when assigned or use only the designated primary category in reporting.

In Dynamic Reports

You have the following options:

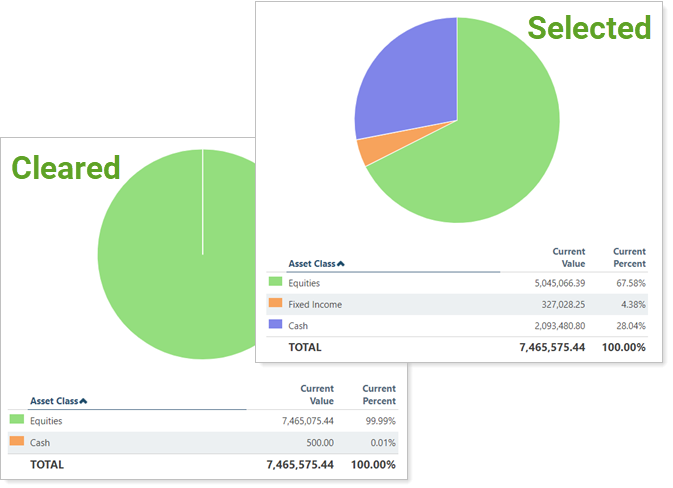

Selected

To see the report respect multiple categories assigned to a security, select Use multiple security categories. The report will show the security split proportionally based on the percentage weight assigned to each category.

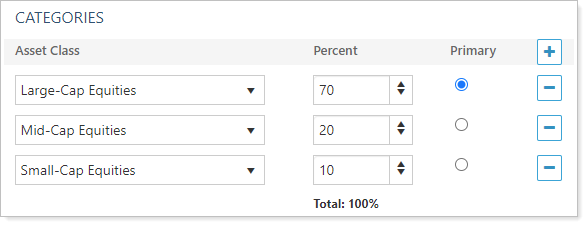

For example, the mutual fund XYZZX is assigned three Asset Class categories: Large-Cap Equities at 70%, Mid-Cap Equities at 20%, and Small-Cap Equities at 10%:

Your client holds 100 shares valued at $10 a share. In reports that support multiple security categories and where Use multiple security categories is enabled, XYZZX will show values proportionally to the percent of each category in the report.

| Category | Category Weight | Proportional Number of Shares | Proportional Dollar Value |

|---|---|---|---|

| Large-Cap Equities | 70% | 70 shares | $700 |

| Mid-Cap Equities | 20% | 20 shares | $200 |

| Small-Cap Equities | 10% | 10 shares | $100 |

| 100 total shares held $1,000 total value |

|||

Cleared

To see the report only use the primary category used in reporting, clear Use multiple security categories.

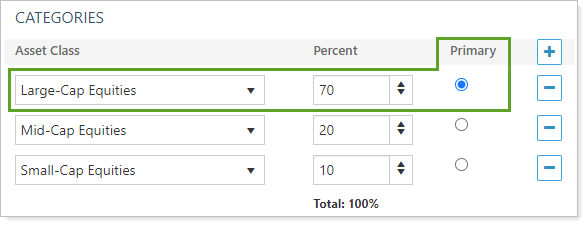

In the above example of XYZZX, Large-Cap Equities is marked as Primary:

Because of this, if Use Multiple security categories is cleared, XYZZX will use Large-Cap Equities as its only category for Asset Class.

| Category | Total Number of Shares | Total Dollar Value |

|---|---|---|

| Large-Cap Equities | 100 | $1,000 |

In PDF Reports

Functionality is the same in the PDF report templates as in dynamic reports.

In Report Studio

Functionality is the same in Report Studio as in PDF report templates and dynamic reports.

Reports With This Setting

Holdings Reports

|

|

Related Settings

For more information about security categories, see Security Categories.