On some reports, you can group by category such as asset class, security type, and more. In some cases, such as mutual funds, a security might be better suited to having more than one category assigned to it.

When maintaining securities, these security settings lists allow you to configure what categories the security belongs to. When you group by on accounts, the security will be displayed according to these categorizations.

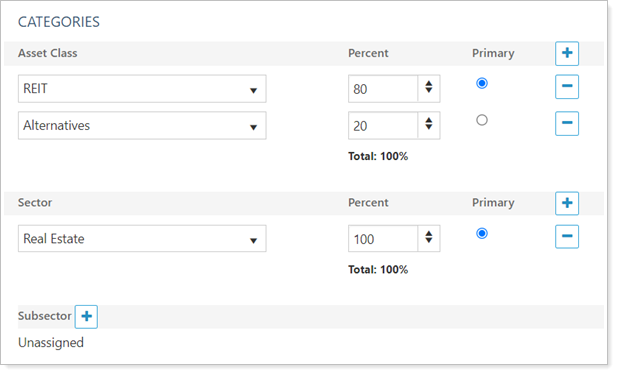

You may assign multiple categories for a single security. For example, for a mutual fund that is made of up 80% equities and 20% bonds, you can assign the multiple appropriate asset classes, sectors, and subsectors based on the makeup of the mutual fund.

Assign Categories to a Security

To add multiple categories, select the initial category, define the percentage allocation of that category, then click  to add all the additional categories and define their percentage allocations. Remember that the total for each category type—for example, Asset Class or Sector—must equal 100%.

to add all the additional categories and define their percentage allocations. Remember that the total for each category type—for example, Asset Class or Sector—must equal 100%.

Set Primary the category designation to indicate which category a report should use if the report doesn't support multiple security categories or when this option is turned off.

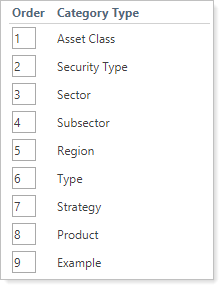

The exact categories available varies from firm to firm, based on what categories your firm creates under Setup.

For more information on categories, see Categories.

For more information about maintaining securities, see Maintain Securities.

For more information about using securities, see Learn More About Assets, Liabilities, Securities, and Categories.