Contents

|

Make Changes to Security Settings |

Introduction

In Tamarac, you can add securities and change specific settings for those securities, including adding category information, reporting information, setting trading restrictions, adding custom fields, and more. Editing these settings allow you to report and trade securities accurately.

Maintaining your securities gives you these important benefits:

-

Easy to maintain.You can maintain your security information in one place. There's no toggling between programs and no synchronization necessary.

-

Multi-edit functionality.Increase productivity by editing multiple securities at a time.

-

Customization.Customize how your securities appear by controlling the order they appear on reports, adding custom fields, customizing how the security is traded, and more.

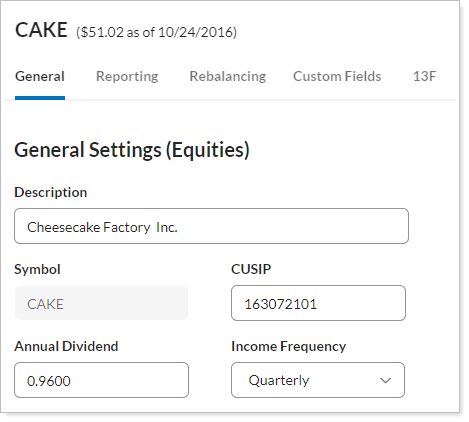

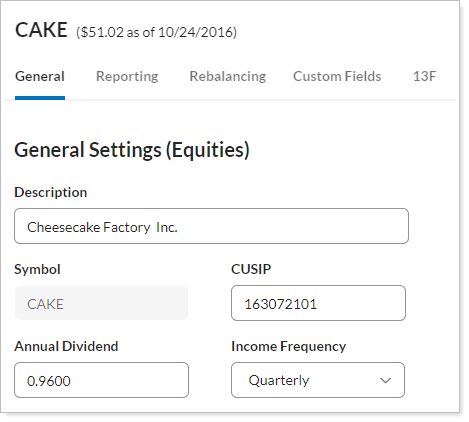

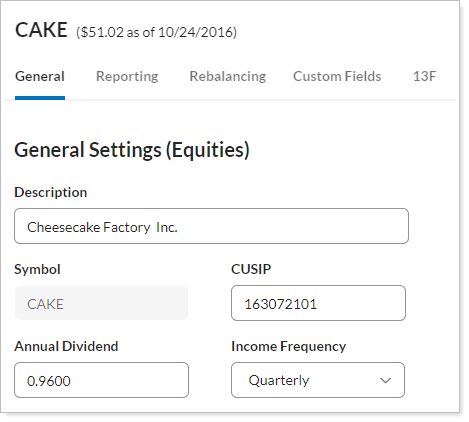

When you edit a security, you'll be able to see the price as of date, along with the symbol, CUSIP, and other details. Different settings may appear for each security type, such as qualified status, description, interest rate, dividend dates, etc. For more information, see Security General Settings.

For more information on creating views and filtering results on the Securities page, see Securities Page Actions, Views, and Filters.

Security Types

The following security types are available. You cannot change an existing security type. For more information, contact your Tamarac Service Team.

-

EquitiesCommon stock, preferred stock, and warrants.

-

CDsCertificates of deposit and interest-bearing commercial paper.

-

Commercial PaperDiscounted commercial paper.

-

Fixed IncomeTreasury bonds, treasury notes, corporate bonds, municipal bonds, notes, zero coupon bonds, fixed annuities.

-

Cash & Money FundsMoney market mutual funds, bank money funds.

-

Mortgage-Backed.GNMA, FHLMC, and FNMA mortgage pass through securities, CMOs.

-

Mutual FundsMutual funds (except money market mutual funds), closed-end funds.

-

OptionsOption calls and puts, but not futures.

-

T-BillsTreasury bills.

-

Unit TrustsUnit Investment Trusts (UITs), including GNMA unit trusts.

-

User DefinedLimited partnerships, insurance, variable annuities, real estate, REITs.

Create a Security

If you need to add a security that a client has never held before, you want to add a security that's currently unknown, or add a security for the purpose of security mapping, you can create a security using the following steps:

-

On the Setup menu, under Security Settings, click Securities.

-

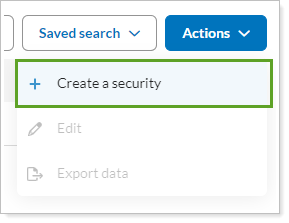

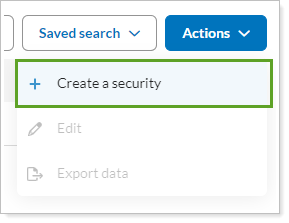

Select Create New Security in the Actions list.

-

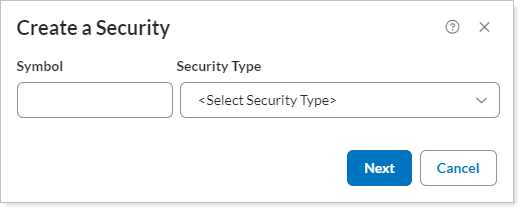

Enter the Symbol and Security Type for the new security, and click Next. For more information on security types, see Security Types. Once created, Security Type cannot be changed.

-

On the security settings panel, enter applicable settings for the security on the following tabs. Description, CUSIP. Before trading, enter and verify the CUSIP, description, and custom trade price.

Settings Tab More Information Change general information about the security such as the qualified status, annual dividend, description, and more.

Reporting

Change information that affects how a security appears in reporting, such as assigning a benchmark and assigning category information.

Rebalancing

Add restrictions to the security such as limiting the security to only taxable or tax deferred accounts, setting the security as unmanaged, or adding a buy or sell only restriction.

Add a substitute, or a direct equivalent security that can be traded in place of the selected security.

Update the specific trading behavior for the security on a per-custodian basis. These settings include specifying an initial investment, round trip period, establishing a transaction fee fund, and more.

Add custom settings for the specific security such as a custom round lot.

Establish an alternate security to represent the selected security—for example, the value of Security ABC is represented by the selected security.

If your firm has created security-specific custom fields, enter those values here.

13F Shows the SEC CUSIP and other 13F-related information for the last 8 quarters for the security you're viewing. -

Click Save.

Select Securities

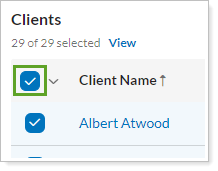

You can select all the records by clicking the check box in the column heading. For more selection-related actions, including selecting a single page, clearing all selections, and viewing only the selections, click ˅.

To learn more about the Select All check box functionality, see The Select All Check Box.

Make Changes to Security Settings

To change the general, reporting, or rebalancing settings for a security, follow these steps:

-

On the Setup menu, under Security Settings, click Securities.

-

Select Create New Security in the Actions list.

-

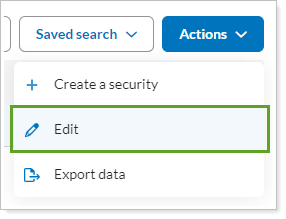

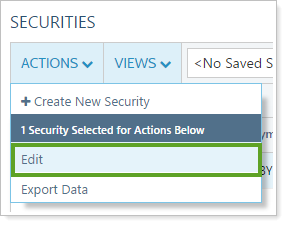

Select the security you want to edit and choose Edit in the Actions list.

-

On the security settings panel, edit the applicable settings for the security on the following tabs:

Settings Tab More Information Change general information about the security such as the qualified status, annual dividend, description, and more.

Change information that affects how a security appears in reporting, such as assigning a benchmark and assigning category information.

Restrictions

Add restrictions to the security such as limiting the security to only taxable or tax deferred accounts, setting the security as unmanaged, or adding a buy or sell only restriction.

Substitutes

Add a substitute, or a direct equivalent security that can be traded in place of the selected security.

Trade File Group Settings

Update the specific trading behavior for the security on a per-custodian basis. These settings include specifying an initial investment, round trip period, establishing a transaction fee fund, and more.

Custom Settings

Add custom settings for the specific security such as a custom round lot.

Security Mapping

Establish an alternate security to represent the selected security—for example, the value of Security ABC is represented by the selected security.

If your firm has created security-specific custom fields, enter those values here.

13F Shows the SEC CUSIP and other 13F-related information for the last 8 quarters for the security you're viewing. -

Click Save.

Assign a Benchmark to a Security

When evaluating the performance of any investment, it's likely that you'll want to compare it against an appropriate benchmark. Tamarac Reporting includes hundreds of indexes that you can use to gauge the performance of a security, including the S&P 500, the Dow Jones Industrial Average, the Russell 2000 Index, etc. On the Securities page, you can assign benchmarks to specific securities.

For a complete list of the indexes available in Tamarac Reporting, visit List of Available Indexes.

To assign a benchmark to a security:

-

On the Setup menu, under Security Settings, click Securities.

-

Select one or more securities where you want to assign a benchmark.

If you are having trouble finding a particular security, you can apply filters to the Views lists available, click the starting letter in the alphabet bar, or search for the particular security in the Search Securities box.

-

Click the name of the security you want to edit. Or you can select the select the check box next to the security you want to edit and then click Edit in the Actions list.

-

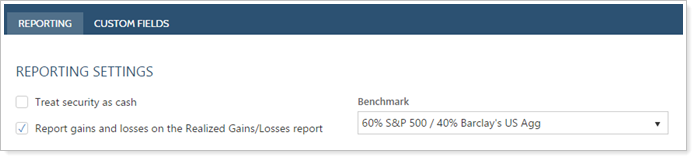

Click the Reporting tab. Under Benchmark, select from the list the benchmark you want to assign.

-

Click Save.

Delete a Security

Portfolio Accounting System and Deleted Securities

If a security is deleted from your portfolio accounting system (PAS), you may also want to delete the security from Tamarac.

-

If you choose to delete securities from your PAS, they will not be deleted from Tamarac. You will have to manually delete the securities from Tamarac.

-

Only firms managing their own security master can delete securities from Tamarac.

If you manually create a security, or if your firm is managing your security master in Reporting, you can delete a security with the following process:

-

On the Setup menu, click Securities.

-

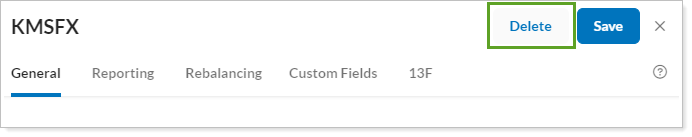

Click the name of the security you want to delete to open it.

-

Click Delete.

-

In the Delete Security window, click Delete to confirm deletion.