Back

Back

Back Back |

Home > Tamarac Reporting > Data Setup & Calculations > Calculations > Understanding Performance in Tamarac Reporting

|

Understanding Performance in Tamarac Reporting

|

Portfolio, Asset Class, and Position Returns vs Their Underlying Returns Partial Period Returns (Closed Positions, Asset Classes, or Accounts) |

Tamarac Reporting calculates returns in a variety of ways. It is important to understand the implications of using each return method and how the portfolio data will affect the final result.

For more information on how Tamarac handles specific situations, see Learn More About Calculations.

To calculate returns, Tamarac Reporting uses intervals. Intervals are calculated at the position, sector, asset class, portfolio, and group level. An interval represents the change in value for that level over a specific period of time. Tamarac Reporting stores intervals on a daily basis.

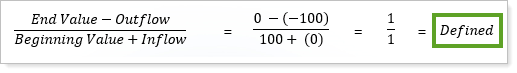

The core structure of an interval is defined by the following and is calculated by the following formula:

|

By subtracting the negative outflow total, you are essentially adding the absolute value of the outflow total to the numerator.

When a return does not match expectations, the intervals are the best place to begin investigating. Large returns in the interval performance may be indicative of issues with the underlying data. Common circumstances that cause interval performances spikes include:

It is possible for extremely large performance numbers to be accurate; however, it is always best practice to investigate these spikes.

If an account holds a very small amount in a MMF ($2.00) and then receives a large dividend assigned to the money fund ($50.00), the resulting 2500% net return shown on the daily interval is legitimate performance.

It is important to remember that each interval is based on the specific level (position, sector, asset class, account, or group) values at the beginning and end of the day. An underlying level’s interval return will exhibit different performance behavior than the interval return of the larger level it is a part of (ex. asset class and account). This is examined in greater detail in the More Information examples.

Individual daily intervals only calculate the percentage of change for that day. As a result, large capital flows can have a major effect on the starting and ending values in a level, affecting all the performance afterward.

A $50 dividend in a $100 account creates a much larger positive daily return than a $50 dollar dividend in a $1,000 account.

This is particularly important when looking at a time weighted return for a period. Breaking the return periods into sections around large flows can provide a better perspective on which periods are exerting the most influence on the total return.

For more information on transaction types and their effect on performance, see Transactions and Their Effect on Performance.

Time-weighted return (TWR) is a performance indicator reflecting the manager’s decisions. It is a measure of investment gain or loss negating all contributions by the investor and measures growth of investment by changes in market value for each period.

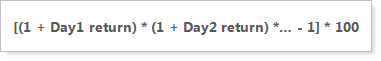

The daily interval performance values are calculated based on the ending value, beginning value, and flow of each day. These interval returns are stored and then linked together to produce Tamarac Reporting’s time-weighted returns.

In other words, Tamarac uses a daily linked-IRR for our TWR methodology. Net and gross of fee options are available, as are cumulative and annualized. However, all returns for periods shorter than 12 months are cumulative.

Notice how the all of the individual daily intervals in the period have an equal weight within the TWR calculation.

Period returns are converted to a decimal format for use in the linking formula.

IRR is an absolute measurement of how the portfolio performed and represents the rate in which the net present value of all contributions and withdrawals to or from the portfolio equal zero. The size and timing of flows can greatly impact a portfolio, for example large flows at the beginning of the measured time period will have a greater effect on the overall return than smaller flows later in the period.

IRR is available in addition to TWR. IRR cannot be computed directly. The IRR must be computed using a trial and error procedure in which you “guess” an answer, plug the guess into the equation, then modify the guess depending on the results. The new guess is plugged back into the equation, and the process is repeated until a satisfactory degree of precision is achieved.

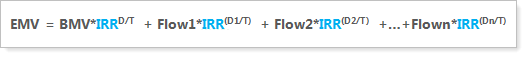

The calculation for IRR splits the return into separate periods around the flows in an account, creating a single rate of return which can be applied to each period to generate the ending market value.

We use a simple actual IRR calculation with a million iteration limit. This method is more resource intensive, but more accurate than a modified equation such as the Dietz or average capital base.

Where:

D = Days until ending date in the period

T = total days in the period from beginning to ending date

IRR = Rate of return + 1

The following table summarizes differences between TWR and IRR.

| TWR | IRR | |

|---|---|---|

| Impact of flows on calculation | Size and timing of flows are negated. | The size and timing of flows can greatly impact the return, as they are factored into the return calculation. |

| What it's good for | Comparing to a market index or benchmark. | Comparisons for absolute returns on an investment. |

| When to use it | When the advisor doesn't have control over the timing of flows in and out of the account. | When the advisor has control over the timing of the flows in and out of the account. |

| Other Information |

Generally accepted as the industry standard since it accounts for flows.

If you are using TWR and the portfolio has large flows, you could see situations where investment gain seems to conflict with the TWR (positive/negative). This can look odd to the investor and, although the returns are correct, generate confusion. Some examples of this are explored in greater detail More Information. |

Since IRR is comparing the ending and beginning market values for the period, the IRR return will always be positive when the investment gain is positive and negative when the investment gain is negative. For more information, see TWR vs. Investment Gain. |

Sometimes we encounter situations where the performance return or Investment gain for a period does not match expectations and requires a more thorough investigation verify the results. Below are some examples of common situations and their explanations:

Investment Gain is the total difference between the start and end values for an account or group in a selected date period minus the net contribution for the selected date period:

End Value - Start Value - (Inflows - Outflows)

There are certain situations where TWR produces a positive return, but the overall investment dollar gain is negative and vice versa; a negative TWR with a corresponding overall investment dollar gain.

It is important to remember that TWR is a geometric mean of a daily calculation and each interval value is represented by a daily percentage return; an interval calculation is a return relative to the market value of the account on that given day.

Investment gain is a total dollar gain not impacted by the size of the portfolio but rather a cumulative dollar amount over the reporting period.

Tamarac Reporting is capable of calculating multiple levels of returns, including position, sector, asset class, account, and group.

A common mistake when looking at a performance report, such as the Account Performance report, is to expect the underlying asset class returns to add up to the total account return for the same period (or for account returns add up to the total group level return). It is important to remember that each level is its own separate return calculation, using its own set of intervals and is not reliant on the underlying category returns.

Since each return level is going through its own independent daily interval return calculation before those intervals are linked during the TWR return calculation for that level. The intervals used for the return calculation at one level are never mixed with the intervals used to calculate the return for levels above or below it.

Once the TWR return calculation begins in step two, combining all of the daily intervals to create the TWR return for each level, the ending TWR returns for each account will bear no resemblance to each other or the household.

This concept also applies to the account level returns and their underlying asset class level returns: While the daily starting/ending values for the underlying asset classes will equal the daily starting/ending values for the account, the daily interval returns are level specific. Each asset class will be affected differently by flows, daily value fluctuations, and corporate actions over the course of the return period, creating a unique set of daily intervals which only reflect the performance for that asset class: comparing the TWR returns from different levels on a one-to-one basis is not mathematically sound.

Closed accounts and assets not held for the full performance reporting period still impact performance at their level, though they may not appear as line items depending on your report settings: with the introduction of the enhanced performance calculation, closed accounts and partial period returns can now be enabled for both dynamic and PDF reports.

In the dynamic Account Performance report, the Only show returns for positions held at the end of the period check box controls whether securities no longer held will appear. These positions are marked with an *.

In the PDF report section Account Performance, the Include closed accounts check box under the General section controls whether closed accounts have their returns listed as line items.

Any securities identified at the account level (or at the global security level) as excluded from performance will not affect asset level performance. However, cash dividends received from excluded securities will affect cash performance in an account and appear as flows.

| Category | Term | Definition |

|---|---|---|

| Portfolio Valuation | Beginning Value | Total value of the portfolio at the beginning of the reporting period as determined from the intervals. |

| Portfolio Valuation | Ending Value | Total value of the portfolio at the end of the reporting period as determined from the calculated performance interval market values. |

| Contributions | Net contribution | Value of all contributions minus the value of all withdrawals for the reporting period. |

| Contributions | Contributions (Inflows) | Capital flows into the portfolio during the reporting period. |

| Contributions | Withdrawals (Outflows) | Capital flows out of the portfolio during the reporting period. |

| Appreciation | Capital Appreciation | The change in portfolio value attributed to increase in value in the portfolio. |

| Appreciation | Unrealized Gains |

Gain or loss in value of securities still held from the beginning of the reporting period. NotesThis calculation is not based on the asset’s cost basis. |

| Appreciation | Realized Gains |

Gain or loss in value of asset from beginning of the reporting period until the asset is sold. NotesThis calculation is not based on the holding’s cost basis. |

| Appreciation | Transfers | The total of all movement into or out of the portfolio that is not a net contribution. Most of these movements net to zero. However, there are some situations where these movements do not net to zero. This line only appears if these movements do not net to zero. |

| Incomes | Income | All income generated by investments for the reporting period. |

| Incomes | Dividend Income | Total dividends received during the reporting period. |

| Incomes | Interest Income | Total interest received during the reporting period including accrued interest received on sells of fixed income. |

| Expenses | Expenses | All expenses for the reporting period. |

| Expenses | Management Fees | Total management fees assessed to the account or group over the reporting period. When calculating net performance, management fees are typically treated as an “investment loss” and reduce net returns. When calculating gross performance, management fees are typically treated as an “outflow” and do not reduce gross returns. |

| Expenses | Other Expenses | Total expenses assessed to the account or group over the reporting period that are not assessed by the reporting advisor. |

| Expenses | External Fee Payments | Management fees which are paid by check or other deposit. |

| Change in Accrued | Change in Accrued | The change in the accrued income during the reporting period. |

| Change in Accrued | Beginning Accrued | Total accrued income at the beginning of the reporting period. |

| Change in Accrued | Accrued Paid | Total of the accrued paid field in buys and sells of fixed income, mortgage backed and CDs after the first day and on or before the last day of the period. |

| Change in Accrued | Ending Accrued | Accrued income at the end of the reporting period. |

| Transaction Name | Description | Applies To | Effect on Performance |

|---|---|---|---|

| Amortization | Adjusts the cost basis of a security either up (accretion) or down (amortization). | All Securities except cash | Portfolio Level:

None. Asset Class Level:None. Position Level:None. |

| Buy | Opening position transaction. Each buy is considered a trade lot. | All Securities except cash | Portfolio Level:

None unless the security OR cash is excluded from performance. Asset Class Level:A flow in as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:A flow into the position and out of cash. |

| Buy/Close | Opening position for a short option. | Options | Portfolio

Level:

None unless the security OR cash is excluded from performance. Asset Class Level:A flow in as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:A flow into the position and out of cash. |

| Buy/Open | Opening position for a long option. | Options | Portfolio

Level:

None unless the security OR cash is excluded from performance. Asset Class Level:A flow in as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:A flow into the position and out of cash. |

| Credit | Opening position transaction adding shares to a position. | All securities except cash | Portfolio

Level:

Capital appreciation, except if the security is excluded from performance. Asset Class Level:A flow in as long as the security is not excluded from performance. Position Level:Flow in except if the security is excluded from performance. |

| Cover | Closing position transaction adding shares to a short position. | Equities | Portfolio

Level:

None, unless the security OR cash is excluded from performance. Asset Class Level:A flow in as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:Flow in, unless the security and/or cash are excluded from performance. |

| Debit | Closing transaction that reduces the cost basis based on matching method. | All Securities except cash | Portfolio

Level:

Capital appreciation, except if the security is excluded from performance. Asset Class Level:A flow out as long as the security is not excluded from performance. Position Level:Flow out except if the security is excluded from performance. |

| Deposit | Opening capital flow position transaction for cash | Cash | Portfolio

Level:

Flow in, unless cash is excluded from performance. Asset Class Level:Flow in, unless cash is excluded from performance. Position Level:Flow in, unless cash is excluded from performance. |

| Expense | Fees charged to the account and deducted from cash. Expenses can be classified | Cash | Portfolio

Level:

If set to reduce gross, it is a loss on the portfolio; if set to reduce net, it is a flow out of the portfolio, except if cash is excluded from performance. Asset Class Level:A flow out as long as the cash is not excluded from performance. Position Level:Flow out, regardless of reduce net/reduce gross settings. |

| Income - Cash | Income generated by other securities in the portfolio, including dividends, interest, long-term gain, short-term gain and unclassified gains | Cash | Portfolio

Level:

None, except if the security is generating the income OR cash is excluded from performance. Asset Class Level:A flow out as long as the security generating the income and cash are not in the same asset Class and/or either the security OR cash is excluded from performance. Position Level:Flow out of the position generating the income, flow in for cash. |

| Income - Reinvested | Income generated by a security in the portfolio and added back to the security generating the income – technically, it is treated as both an income and a buy |

|

Portfolio Level:

None, other than the price of the security should drop a bit because of the income. Asset Class Level:None. Position Level:None. |

| Journal | Used to move cash into or out of a portfolio | Cash | Portfolio

Level:

Capital appreciation, unless cash is excluded from performance. Asset Class Level:A flow, unless cash is excluded from performance. Position Level:A flow unless cash is excluded from performance. |

| Money Transfer | Used to move cash around within a portfolio, usually from CASH to a money market or vice versa | Cash | Portfolio

Level:

None, unless one of the cash symbols is excluded from performance. Asset Class Level:None, unless one of the cash symbols is excluded from performance or if the cash symbols are in different asset classes. Position Level:Flow in or out of different cash symbols, unless both cash symbols are excluded from performance. |

| Receipt of Securities | Opening capital flow transaction bringing assets into the portfolio. Enter cost basis and original trade date to keep track of original trade lot information | All securities except for cash | Portfolio

Level:

Flow in, unless the security is excluded from performance. Asset Class Level:Flow in, unless the security is excluded from performance. Position Level:Flow in unless the security is excluded from performance. |

| Return of Principal (ROP) | Converts a security’s cost basis to cash |

|

Portfolio Level:

None, unless cash or the security generating the ROP is excluded from performance. Asset Class Level:A flow out as long as the security receiving the ROP and cash are not in the same asset class and/or either the security or cash is excluded from performance. Position Level:Flow out of position, into cash, unless the security is excluded from performance. |

| Sell | Closing position, dual entry transaction; reduces the cost basis of the position based on the matching method selected | All securities except cash | Portfolio

Level:

None, unless the security or cash is excluded from performance. Asset Class Level:A flow out as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:Flow into cash out of the position. |

| Sell/Close | Closing transaction for long options. Changes cost basis based on matching method selected | Options | Portfolio

Level:

None, unless the security OR cash is excluded from performance. Asset Class Level:A flow out as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:Flow out of position and into cash, unless the security and/or cash are excluded from performance. |

| Sell/Open | Opening transaction for short options | Options | Portfolio

Level:

None, unless the security OR cash is excluded from performance. Asset Class Level:A flow out as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:Flow out of position and into cash, unless the security and/or cash are excluded from performance. |

| Short | Opening position transaction creating a short position (negative shares) | Equities | Portfolio

Level:

None, unless the security OR cash is excluded from performance. Asset Class Level:A flow out as long as the security and cash are in different asset classes and/or not excluded from performance. Position Level:Flow out of position into cash, unless the security and/or cash are excluded from performance. |

| Split | Increases or decreases the number of shares held in a particular security, but leaves the total cost basis and overall position the same on the day of the split | Equity, Option and User Defined | Portfolio

Level:

None, unless fractional shares are generated and sold and either the security OR cash are excluded from performance. Asset Class Level:None, unless fractional shares are generated and sold and either the security OR cash are excluded from performance and the security and cash are in different asset classes. Position Level:None, unless fractional shares are generated and sold. |

| Transfer of Securities | Closing capital flow transaction taking assets out of the portfolio. Cost basis is reduced based on the matching method selected | All securities except cash | Portfolio

Level:

Flow out, unless the security is excluded from performance. Asset Class Level:Flow out, unless the security is excluded from performance. Position Level:Flow out, unless the security is excluded from performance. |

| Withdrawal | Closing capital flow position transaction for cash. | Cash | Portfolio

Level:

Flow out, unless cash is excluded from performance. Asset Class Level:Flow out, unless cash is excluded from performance. Position Level:Flow out, unless cash is excluded from performance. |

For more detail, see Summary Report Data Point Calculations.