Contents

|

See Assets and Liabilities in Advisor View See Net Worth Information With a New Report Exclude Capital Gains Distributions With No Data from the Realized Gains/Losses PDF Report |

Integration

See Assets and Liabilities in Advisor View

At Tamarac, we know that you and your clients want a holistic view of all accounts, assets, and liabilities. With the December release, we're paving the way toward a single book of record for all your clients' accounts, assets—including outside assets—and liabilities. Having one source of record for data creates endless efficiencies and allows you and your clients to make more informed decisions about their finances.

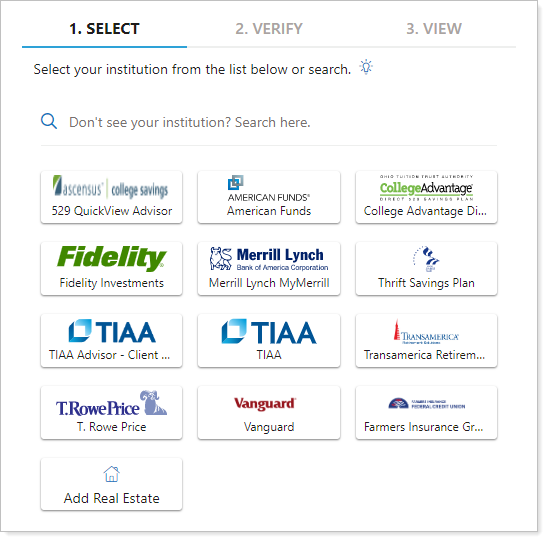

We're making most of this possible thanks to our new integration with Envestnet | Yodlee. With this release, you can now add assets and liabilities to expand your view beyond financial accounts. With this new integration, you and your clients can add and see outside accounts like credit cards, investments, loans, mortgages, and other financial account data on the new Net Worth report and on the client portal. Envestnet | Yodlee includes a network of over 15,000 connections to financial institutions, billers, reward networks, and other end points—including a connection to automatically determine the value of a home.

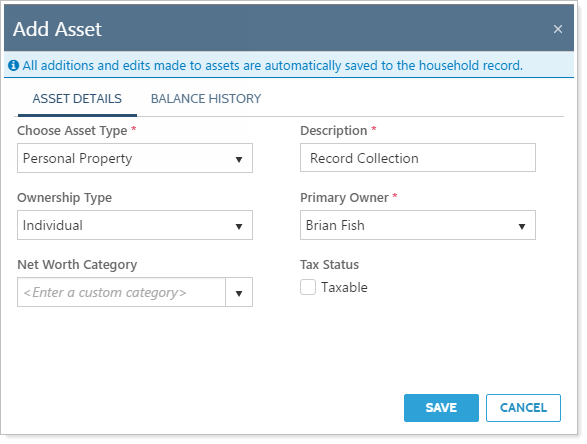

You can add and manage assets and liabilities on the Advisor View Households page under a new Assets/Liabilities tab. You can even enter assets not found in Envestnet | Yodlee, such as art collections. The information you enter can then be viewed in a new Net Worth report and on the client portal as well.

Clients can also add assets and liabilities, as well as edit attributes and update historical values when they edit a Household. All assets and liabilities added will be visible to all clients within the Household.

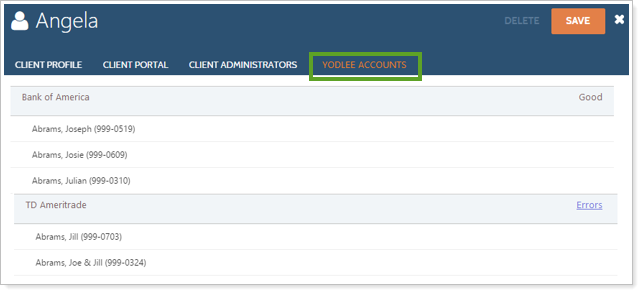

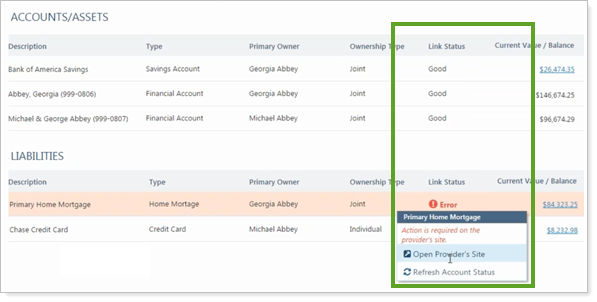

It's easy for your end clients to see whether assets that sync from Envestnet | Yodlee are updating correctly on the client portal, or whether there are errors that need to be addressed in order to continue accessing the information.

Advisors can also view this information with a new column on the Households page called Link Status. It allows you to see if an account link is good or has errors, or whether the account is not linked (N/A).

If you'd like to take advantage of the Envestnet | Yodlee outside account aggregation integration features, email TamaracAM@envestnet.com and learn about the associated cost. The Envestnet | Yodlee integration will be available in late December.

Reporting

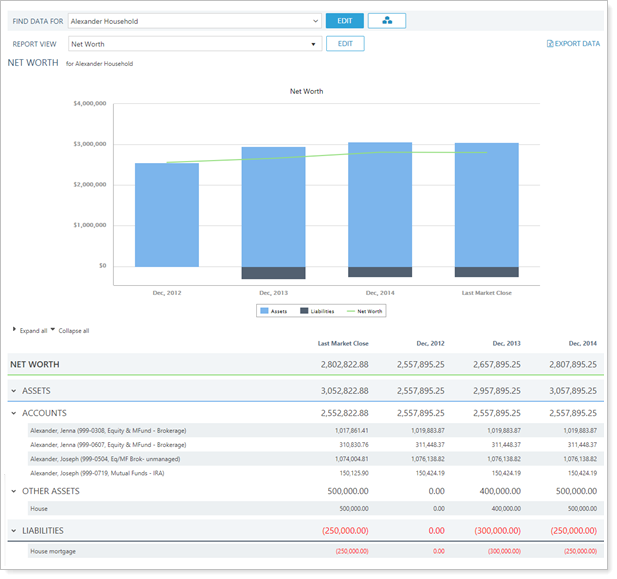

See Net Worth Information With a New Report

We know how valuable it is to integrate financial planning and performance in your reports, and we're excited to introduce a new Net Worth report. This report provides a true holistic view of your clients' portfolios—including accounts, assets and liabilities—so that you can combine financial planning with our existing performance-based reports.

You can view the report based on dates to see net worth over time, or you can base it on owners if you want to see the assets and liabilities each client owns. The ownership is assigned at the asset, liability and account levels. When assigning ownership, as an advisor, you will see all clients you have access to, whereas your clients will only see the clients within their Household.

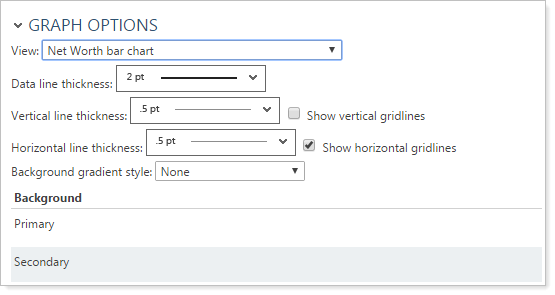

You can also customize themes and color options for this report as you would for other reports.

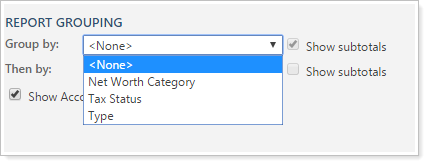

You can set custom categories if you want to group your assets and liabilities on the report. For instance, you could categorize them by whether they are liquid assets or not (this can be by assigning a Net Worth Category to your accounts, assets and liabilities). You can also group by tax status - as you choose whether the asset is taxable when you add the asset.

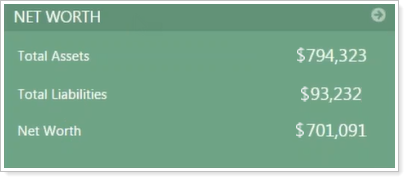

Your end clients can also see a complete picture of their finances in one location and won't need to log into multiple sites to track their net worth. They will be able to view their Net Worth report on the client portal, and clients can also see their net worth data in a tile on the dashboard.

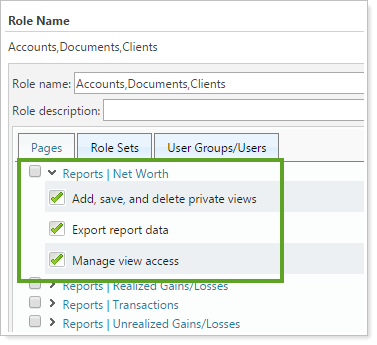

As with any of our other reports, you can choose who can export report data, add, save and delete private views, and manage view access by setting permissions for roles under User Management.

We have also provided bulk reports and uploads for assets and liabilities so that you can efficiently manage assets and liabilities for multiple accounts. The bulk reports and uploads are:

-

Household Assets and Liabilities.This allows you to see/add/change the assets and liabilities.

-

Household Assets and Liabilities Values.This allows you to see/add/change the values for the assets and liabilities. You must first create the assets and liabilities before you can upload the values.

If you also track your assets and liabilities in Advisor CRM, you'll likely want a quick and easy way to export the information from Advisor CRM to Advisor View, so you can take advantage of the robust functionality that Advisor View offers. With this in mind, we've added two new views that you can export from Advisor CRM and then immediately import into Advisor View. With these views, there's no need to manually create the upload data set—the files are formatted to Advisor View specifications. For details, see December 2016 - What's New in Advisor CRM.

Exclude Capital Gains Distributions With No Data from the Realized Gains/Losses PDF Report

In the October release, we streamlined PDF reports to reduce confusion and remove unnecessary blank pages. While we heard great feedback about these changes, we also heard that you wanted greater control over the handling of blank pages—specifically for the Realized Gains/Losses report.

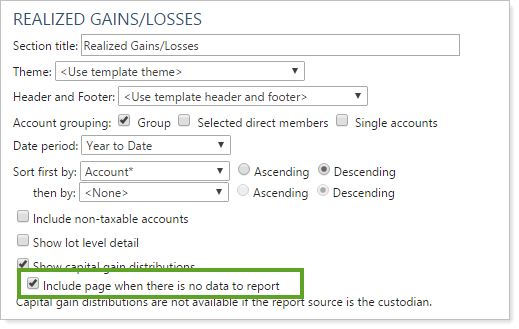

With your feedback in mind, we're providing additional flexibility over printing blank pages with your Realized Gains/Losses reports. When there is no data to report for a capital gains distribution, you can now exclude it on your Realized Gains/Losses PDF report—or you can choose to include it by selecting Include page when there is no data to report and the report will contain a message indicating that there is no data to report.

All Realized Gains/Losses PDF sections that include capital gains distributions will have the new setting enabled by default, which means that the blank pages will be printed. If you do not want the blank pages, you can clear the new Include page when there is no data to report check box.

Billing

Calculate Rebates From the Full Value of Net Fees

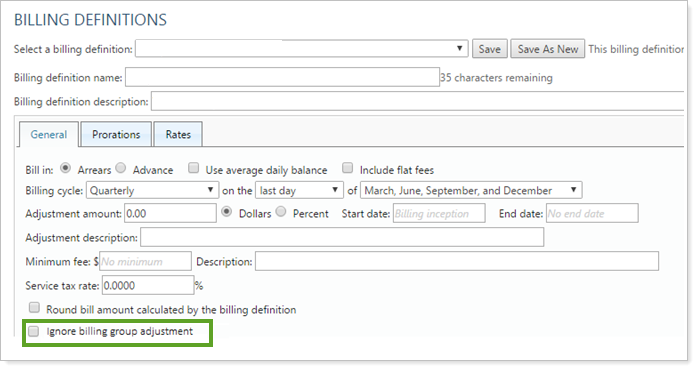

We're providing more flexibility around when billing group adjustments are applied with this release. If you want the billing group adjustment to only apply to a subset of your billing definitions within a single billing group, you can now simply flag which definitions to ignore for the calculation.

You can select the new Ignore billing group adjustment check box for a billing definition, and that definition will then be excluded from the calculation that determines the billing group adjustment.

This feature will be delivered by December 31 and will not be available on December 10.

Learn More - Watch the Release Video