Contents

Real-Time Pricing for Equities and ETFs

Tamarac has partnered with Xignite to provide real-time pricing data in Advisor Rebalancing for U.S. equities and ETFs listed on U.S. stock exchanges, including NASDAQ, NYSE, NYSE Alternext, and over-the-counter exchanges.

There is an annual fee to subscribe to real-time pricing. For details, please contact Account Management at TamaracAM@envestnet.com.

To set up this new feature, follow these steps:

-

Contact Account Management to enable real-time pricing for your firm.

-

Once Account Management has enabled real-time pricing for your firm, on the Setup menu, click System Settings.

-

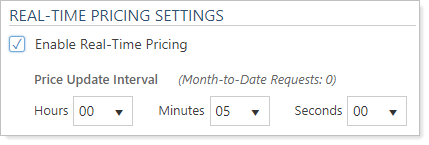

Select the Enable Real-Time Pricing check box.

-

In the Price update interval section, choose how often you want Advisor Rebalancing to refresh stock quote data for equities and ETFs. This setting will determine the oldest that your equity and ETF prices will be when trading.

By default, you can make up to 20,000 real-time pricing requests per month. When you're nearing your quota limit, Advisor Rebalancing will send you an automated email. And you can always check your month to date requests on the System Settings page.

If you anticipate that your firm will require a higher request quota, contact account management by email at TamaracAM@envestnet.com.

-

When finished, click Save.

Trade Review

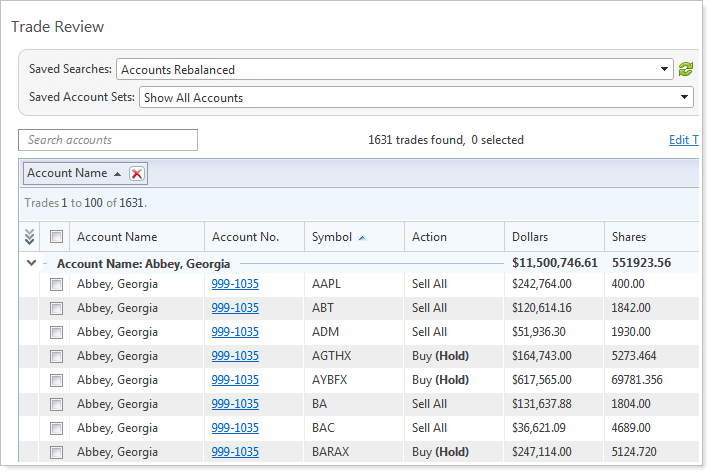

Over the years, many of you have asked for a quick and efficient way to create and review trades in bulk across multiple accounts. That's why we're excited to introduce the Trade Review page. On the Trade Review page, you can easily focus on the impact of your trades and create and edit trades in bulk for multiple accounts.

The Trade Review page delivers these powerful features:

-

Review Trades Across Multiple Accounts.With the Trade Review page, you can finally review all of your trades in one place. Simply open the Trade Review page and review your trades in an easy-to-use interface.

-

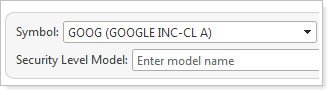

Focus on trades for a specific security.You can filter the Trade Review page by ticker, so you can edit trades for a specific security across multiple accounts.

-

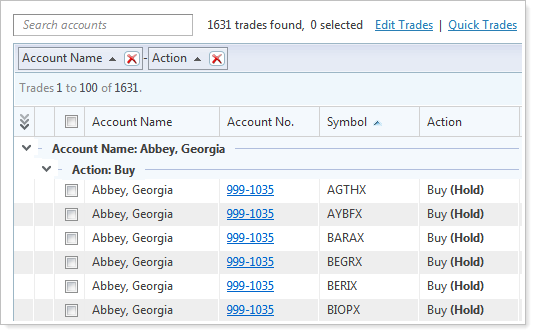

Group your trades.Group the trades on the Trade Review page by any column heading - for example, you can group the page by trade action so you can separate your buy and sell actions. When you group your trades, the dollars and shares values will be summed for your top three groupings.

-

Target a specific security level model.Filter the Trade Review page by any Security Level model, so you can identify issues or create or edit trades for the accounts assigned to the model.

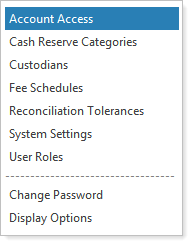

More Intuitive Setup Menu

In an effort to make the Setup menu more streamlined and intuitive, we've made the following changes:

-

Separately grouped firm-level items and user-level operations

-

Renamed General Enterprise Settings to Model Settings on the System Settings page

-

Moved the Holdings as of date section of the System Settings page to the Upload Settings page

-

Added Change Password as a separate menu option

-

Renamed User Preferences to Display Options

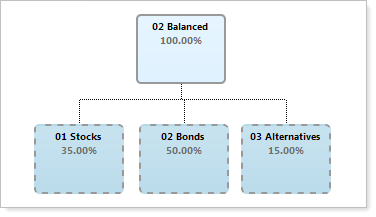

Improved Model Diagrams

The model diagrams in Advisor Rebalancing now visually differentiate the different model types.

When viewing your model diagrams, a  represents an Allocation model,

represents an Allocation model,  represents a Security Level model,

represents a Security Level model,  represents a rank-based model, and

represents a rank-based model, and  represents a goal-weighted model. In addition, rank-based Allocation models will display their submodel ranks in the diagram.

represents a goal-weighted model. In addition, rank-based Allocation models will display their submodel ranks in the diagram.

To check out the new model diagrams, on the Models menu, click Allocation Models. In the Select an Allocation Model list, choose the model where you want to view the model diagram and then click View Saved Model Diagram.

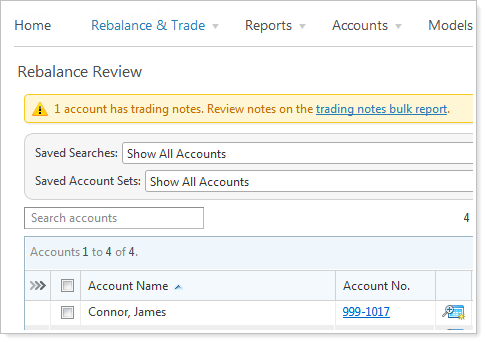

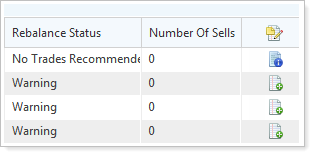

Trading Notes

Sometimes you want to add urgent notes to an account. Unlike account notes, you don't want a trader or other advisor in your firm to miss these notes.

With this common scenario in mind, you can use trading notes. When you add trading notes to an account, Tamarac Trading will highlight the notes differently than account notes so a trader or another advisor in your firm won't miss them. We've also made the trading notes easy to download, so you don't need to create a new bulk report to quickly access the trading context you need.

When you create trading notes, Tamarac Trading will add a note to the top of the account that lets you know that trading notes have been added to the account. In addition, Tamarac Trading also differentiates trading notes from account notes by placing a ![]() in the notes column for the account.

in the notes column for the account.

By default, Tamarac Trading will only differentiate trading notes from account notes for one day. However, you can specify the number of days you want Tamarac Trading to differentiate the notes.

Trading notes will always appear in your historical account notes and will not be deleted when the trading note expires.