Contents

|

Rules for Alternate Security Sets |

Introduction

Alternate security sets allow you to cut down on the number of models you create. An alternate security set is a different version of a Security Level model and allows you to make unique models on the basis of the account. With alternate security sets, there's no need to create multiple Security Level models to accommodate different investors. Instead, you can apply an appropriate alternate security set.

Rules for Alternate Security Sets

-

Alternate security sets are assigned at the account level.

-

There are no limits to the number of alternate security sets you can create.

-

You can tie individual accounts to different alternate security sets while maintaining the same Allocation models. For example, a client's IRA can be assigned to Alternate Security Set A and the same client's taxable account, within the same group, can be assigned to Alternate Security Set B.

Ways to Use Alternate Security Sets

There are additional uses for alternate security sets:

-

Legacy positionsBuild different versions of the same model that use a client's legacy positions to integrate these positions into a client's model; you can also assign that client the version of the model without the legacy position to sell out of that position. For more information, see Legacy Positions.

-

Fixed income.Build different fixed income models for different account types. You can assign an alternate security set to accounts that are tax exempt and use more tax-friendly fixed income securities for models that are taxable.

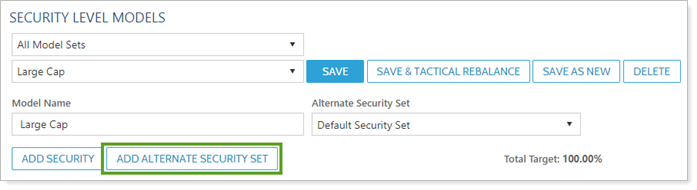

For instructions on creating an alternate security set, see Create, Edit, and Delete Security Level Models.

See Alternate Security Sets in Action

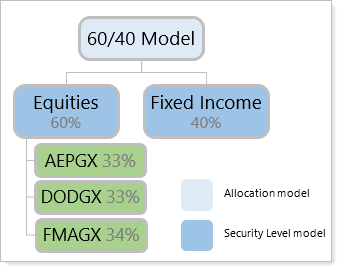

The following example illustrates how alternate security sets in models behave:

In your 60/40 Model, an allocation model, you want all accounts over $100,000 to have the following default allocations:

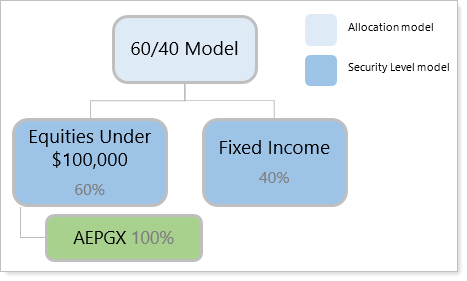

For accounts under $100,000, you want clients to only hold AEPGX for the 60% equity allocation.

To manage this, set up an alternate security set under the Equities Security Level model and call it something meaningful to you, like Equities Under $100,000. You would then give it the following allocation:

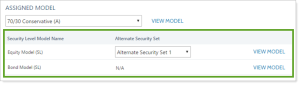

This alternate security set can be assigned to accounts under $100,000 on the Model Assignment panel. For more information, see Security Level Model Name/Alternate Security Set Settings.