As you build more models, you may find that many clients don't fit perfectly into your models. This may be because of industry restrictions, legacy positions, personal preferences in investing, and other reasons that make assigning models challenging. However, rather than building new models for each of these exceptions, you can significantly cut down on the number of models you need to maintain with the following features in Tamarac

-

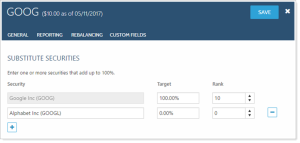

Substitute and Equivalent Securities.Substitutes allow you to assign similar replacement securities in your Security Level models. For example, you can provide an alternative fund for a mutual fund which is closed to new investors. For more details, see Substitute and Equivalent Securities in Models.

-

Alternate Security Sets.Alternate security sets allow you to create different versions of the same Security Level model, which you can then assign to specific accounts. These also allow you to create alternate versions of a model using different asset classes to accommodate different account types and sizes. For more details, see Alternate Security Sets in Models.

-

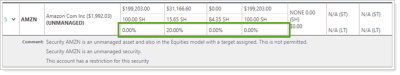

Unmanaged securities in models.Unmanaged securities can be part of a model, allowing you to get a better overall picture of a client's holdings without allocating that security within your models. For more details, see Unmanaged Securities in Models.