Quantity held and security details; accrual method, interest rate, income frequency, and last payment date.

Adjusted quantity is based on the security type. The adjusted quantity for each security type is:

| Security Type | Adjusted Quantity |

| Fixed Income, CD, T-Bill, Commercial Paper, & Cash | Quantity / 100 |

| Mortgage-backed | (Quantity / 100) * Security factor |

| Option | Quantity * Shares per contract |

| All other security types | Quantity |

Calculation

Calculated using annual income per share: Annual income rate × Adjusted quantity

Example

Principal: $20,000

Interest rate: 5% annual interest rate with a 30 by 360 accrual method = 0.014% daily

Period: 142 days

$20,000 × 0.014% × 142 days = $394.44 accrued income

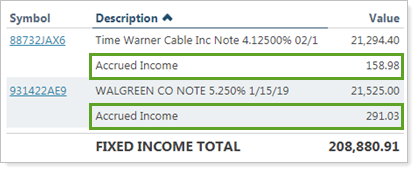

Where You'll See Accrued Income Used

You'll see accrued income in the following locations:

| Location | Available Data Point |

|---|---|

|

Automatically displayed in the row for every holding that has accrued interest.

|

|

|

Automatically displayed in the row for every holding that has accrued interest.

|

|

| Change in Accrued | |

| Change in Accrued | |

| Account Holdings bulk report | Accrued Income |

| Security Holdings bulk report | Accrued Income |

| Account Information bulk report | Display Accrued Interest |

| Account Security Information bulk report | Display Accrued Interest |