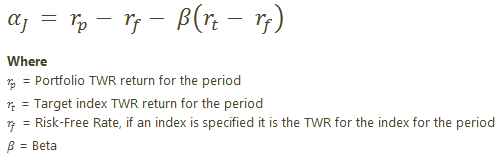

A risk-adjusted performance measure that represents the average return on a portfolio over and above that predicted by the capital asset pricing model (CAPM), given the portfolio's beta and the average market return. This is the portfolio's alpha. In fact, the concept is sometimes referred to as "Jensen's measure."

The Calculation

When Jensen's Alpha Uses Net or Gross Returns

On the Account Analytics report, you can control whether this calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.