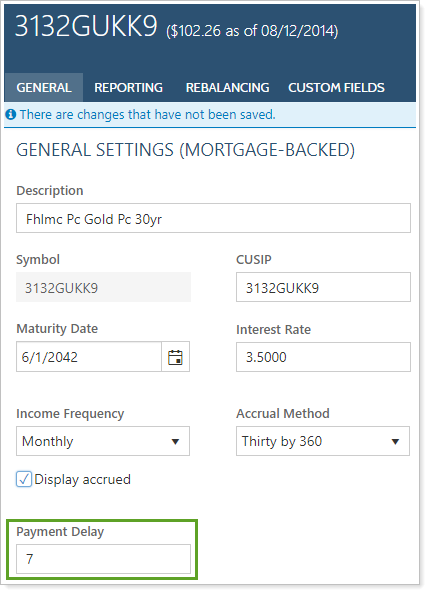

To improve the accuracy of the accrued interest calculations, use the Payment Delay setting to enter the number of days each mortgage-backed security delays payments. This indicates how many days after the coupon date the payment is delayed. By default, all mortgage-backed securities have a payment delay of 0 days.

Impact of Payment Delay on Accrual and Performance

Adding payment delay impacts the periods for which Tamarac includes the accrued interest as part of the account's value.

-

If you don't add a payment delay, the accrued interest drops to zero on the coupon date.

For example, if you have a bond that pays a $300 coupon every month on the 1st, you accrue income at a rate of $10 per day throughout the month. After 30 days, you reach $300 in accrued income and receive that payment. On the coupon payment date, your accrued interest goes to zero.

-

If you do add a payment delay, the account continues to hold the accrued interest until the day corresponding to the number of payment delay days after the coupon date.

If we add a payment delay of 15 days to the previous example, you would still accrue income at the rate of $10 per day throughout the month, and on the 1st you would still have $300 in accrued interest. But instead of paying out on the 1st, the $300 in accrued interest for the previous month sits for 15 days before being paid out. Meanwhile, the next month's interest starts accruing at $10 per day. On the 15th, you receive a payment of the $300 in accrued interest from 15 days before.

The additional $150 in accrued interest that’s been growing in the current month is not paid out on the 15th. That accrued interest for the current month continues growing at the same rate of $10 per day.

Note that you'll only see a payment delay impact Tamarac's calculations if you turn on accrued interest in security valuations. For more information on accrued interest, see Display Accrued Interest.

Learn More

For more information on editing payment delay, see Add Payment Delay for Mortgage-Backed Securities.

For more information about maintaining securities, see Maintain Securities.

For more information about using securities, see Learn More About Assets, Liabilities, Securities, and Categories.