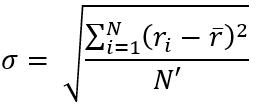

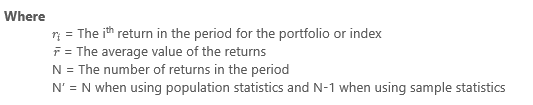

A statistical measure of the variability of a distribution. An advisor may wish to calculate the standard deviation of historical returns on a stock or a portfolio as a measure of the investment's risk. The higher the standard deviation of an investment's returns, the greater the relative risk because of uncertainty in the amount of return.

The Calculation

To find out if your firm is using population or sample statistics, please contact Tamarac Support.

When Standard Deviation Uses Net or Gross Returns

On the Account Analytics report, you can control whether this calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.