Contents

Introduction

One of the challenges with billing is making sure you're billing as accurately as possible. If your client makes a substantial contribution to an account partway through the period, how do you accurately reflect the amount of time you spent managing that money? If a new client comes on board partway through a period, how do you makes sure your first invoice accurately reflects the time you did and didn't manage those accounts? When the value of the billing group changes, you may want to be able to have the final invoice reflect the changes to the billable value.

One way to account for this is to bill based on average daily balance. If you prefer to bill based on average monthly balance or a final billed amount at the end of the period, you can still account for value changes using prorations in the billing definition.

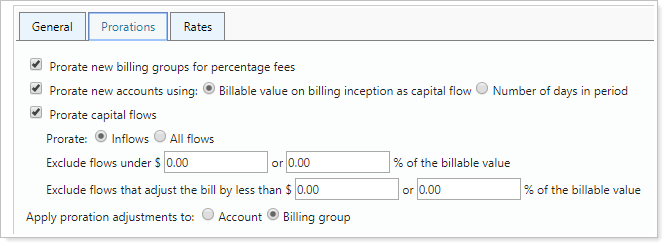

Prorations allow you to charge a fee based only on the amount of time an account or assets were under your firm's management. In Tamarac, prorations can be applied in the following ways:

-

To new billing groups

-

To new accounts added to an existing billing group

-

Based on inflows or all flows

Prorations are configured within billing definitions. For more information on billing definitions, see Understanding Billing Definitions and Billing Definitions Settings.

Prorate New Billing Groups

When you add a new client partway through a billing period, Tamarac can prorate new billing groups, allowing your fees to reflect the fact that a billing group may have been created in the middle of the period. Prorations begin when the first account added to the billing group was open and funded.

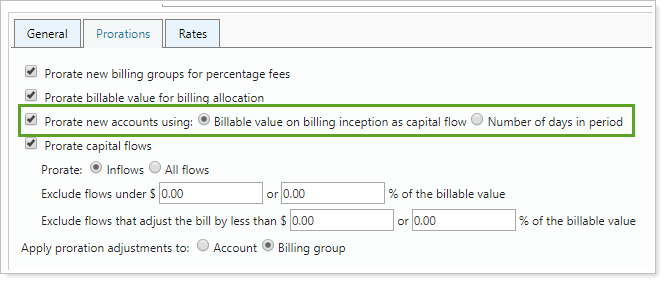

To prorate the percentage fee for the period of time the first account within a new billing group was open and funded, use:

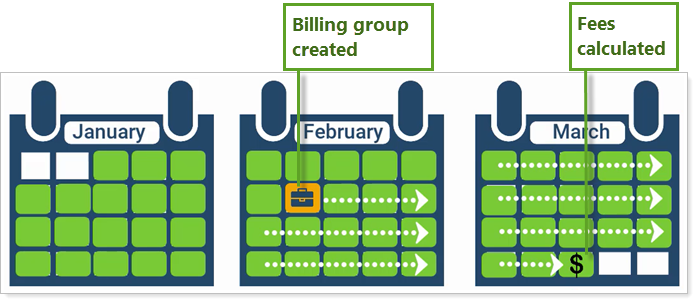

See Prorations in Action: New Billing Group Added Partway Through a Billing Period

Cherry Street Financial bills in percentage fees in arrears. A new client comes onboard in the middle of the billing period, and the new accounts are added to a new billing group. Billing in arrears means that the system will calculate the fees based on the value of the portfolio at the end of the billing cycle. Cherry Street only wants to charge their client for the portion of the billing period that they actually managed the accounts, rather than for the entire period.

In the billing definition, Cherry Street has selected Prorate new billing groups for percentage fees. As a result, Tamarac will charge a prorated fee for the time in the quarter that the new account or group was opened.

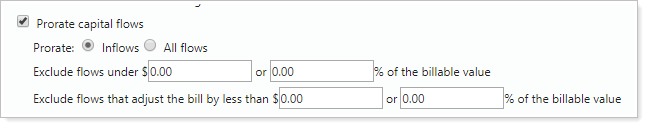

Prorate Capital Flows

When you want to account for the change in value that occurs when inflows or outflows occur within an account in an existing billing group, you can select Prorate capital flows. This option allows you to prorate capital flows that occurred in the previous billing cycle. When you select this check box, Tamarac makes prorated adjustments for capital flows in the previous billing cycle.

If you choose to prorate capital flows, Tamarac allows you to prorate based on inflows only, or on all inflows and outflows that occur. This allows you to bill more accurately, rather than over- or under-billing.

| Additional Capital Flow Proration Settings |

|---|

| Prorate Inflows or All Flows |

| Exclude Flows Under $X or X% of the Billable Value |

| Exclude Flows That Adjust the Bill By Less Than |

| Apply Proration Adjustments To |

See Prorations in Action: Capital Flows Into an Account

Cherry Street manages a client's accounts for an entire billing period. Two days from the end of the period, the client receives a $100,000 inflow. Cherry Street prorates capital flows at the account level. This ensures that, instead of billing the client as if they had managed the $100,000 for the entire period, Cherry Street only bills for the two days they actually managed it.

Prorate New Accounts

When new accounts come in partway through a period, you don't want to bill as if you managed their assets for the whole time. In this case, some firms will want to prorate the new account based only on the number of days in the period, helping to reduce the impact of market changes on the account before the first invoice is issued. Other firms may prefer to treat the new account as a capital flow, and adjust accordingly.

Tamarac offers the following options for prorating new account value:

| Prorate Fee Based on Number of Days in Period | Prorate Fee by Treating Billing Inception Value as a Capital Flow | |

|---|---|---|

| What Billing Method | Arrears only | Arrears and advance |

| How It Uses Flows | Calculates new account prorations excluding any flows, just based on number of days. | Calculates new account prorations as a capital flow. |

| How Adjustment Amount Is Determined |

Determines the adjustment amount by applying a ratio of the number of days in the period as a proration to the fee. This is a simpler method that readily allows you to audit the total fee based on the calculations reported on the billing statement. |

Determines adjustment amount based on the capital flow adjustment calculation combined with number of days. This is a more complex method that can be more difficult to audit. |

| Importance of Billing Inception Value | Ignores the initial value of the account. Instead, it prorates a new account based on number of days the new account was in the period and the billable value at the end of the billing period. | Allows you to prorate a new account based on the value when the account was initially added to the billing group. |

| Billing Inception Date | You do not need to set billing inception date. | You need to set billing inception date. |

For steps on how to set up a billing definition to prorate new accounts, see Prorate New Accounts.

Prorate Fee Based on Number of Days

When you add an account to a billing group whose billing definition prorates new accounts based on ending market value, you don't need to take any further action to ensure accurate proration. Tamarac identifies the new account and prorates it according to how many days elapsed in the billing period before the account was added.

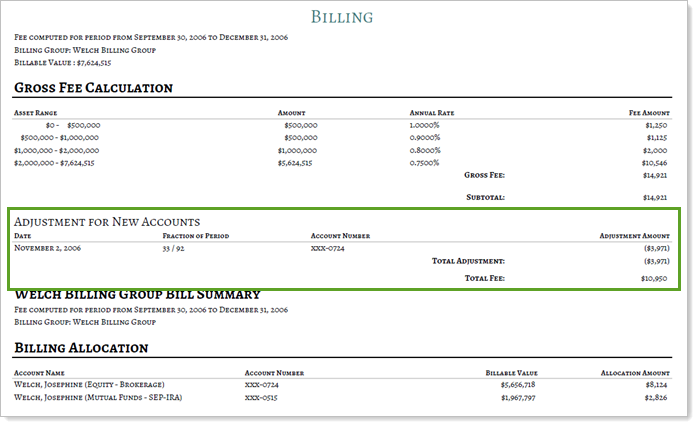

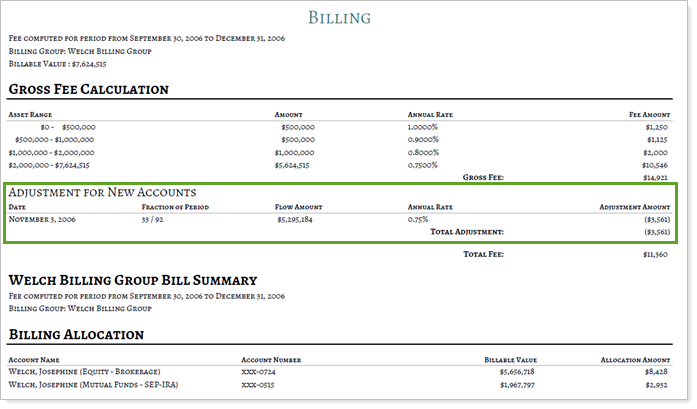

When you generate a billing statement, it includes an Adjustment for New Accounts section that details the adjustment amount.

Prorating new accounts using number of days in the period:

-

Eliminates the need to set billing inception date for every new account.

-

Enhances flexibility and accuracy by allowing you prorate new accounts independently of capital flows.

-

Improves transparency on the billing statement by adding a section just for new account adjustments.

Limitations and calculations:

-

Prorate new accounts using number of days in period is only available when billing in arrears. It is not available when billing in advance or when using average daily or monthly balance.

-

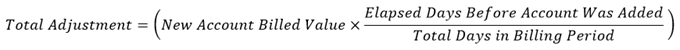

To calculate prorate new accounts based on number of days in the period, Tamarac uses the following equation:

| Additional Settings | Details |

|---|---|

| Prorate New Accounts Using | Choose Number of days in the period to prorate based on ending market value. |

| Show Adjustments | When a new account adjustment occurs, if you select Show Adjustments, Tamarac adds the Adjustments for New and Closed Accounts Title section to the statement. |

See Prorate Fee Based on Number of Days in Action

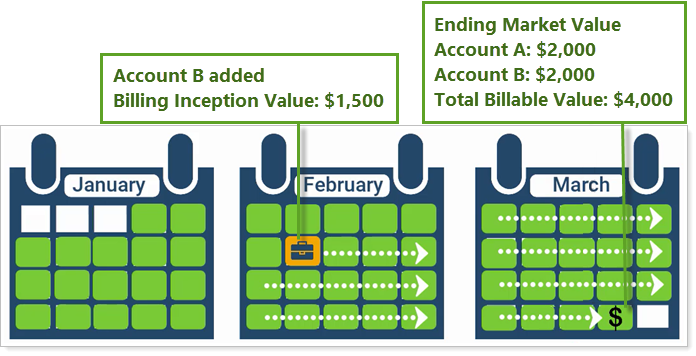

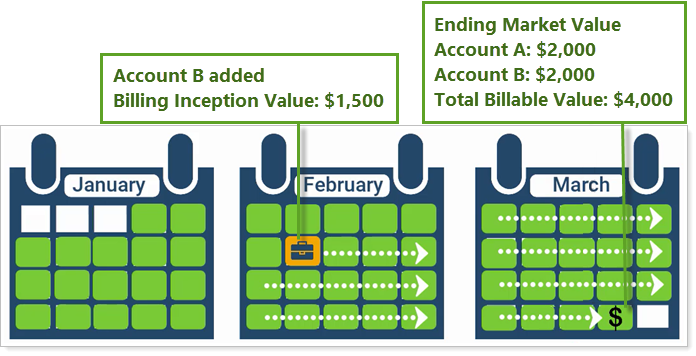

A billing group contains two accounts: Account A and Account B. Account B is a new account that was opened 23 days into the period with a $1,500 value. At the end of the billing period, each account has an ending market value of $2,000, giving the billing group a total billable value of $4,000.

Calculating the fee using a simple number of days proration produces a total fee of $8.75, as detailed below:

Billing Group Values at the End of the Period:

- Account A: $2,000

- Account B: $2,000

- Total Billable Value: $4,000

- Allocation: 50% to each account

New Account Details:

- Billing inception value: $1,500

- Billing inception date: 23 days into the billing period

To calculate the total fee:

- Calculate the gross fee

- Calculate the adjustment amount

- Apply the adjustment to the gross fee

| Calculate Gross Fee | |

|---|---|

|

Billable value: |

$4000 |

|

Annual rate: |

1% or 0.25%/quarter |

|

Gross quarterly fee: |

$4000 × 0.25% = $10.00 |

| Billed value for each account: | $10.00 × ($2,000/$4,000) = $5.00 |

| Calculate the Adjustment Amount | |

| Billed value: | $5.00 |

| Elapsed number of days in period: | 23 |

| Total number of days in period: | 92 |

| Calculate adjustment amount: | $5.00 × (23/92) = $1.25 |

| Apply New Account adjustment to Gross Fee | |

| Total fee: | $10.00 - $1.25 = $8.75 |

Prorate Fee by Treating Billing Inception Value as a Capital Flow

When you add an account to a billing group whose billing definition prorates new accounts based on billing inception value as capital flow, you must set the billing inception date for the first date the new account has value. Tamarac treats the value on the billing inception date as a capital flow and prorates it based on how many days elapsed in the billing period before the account was added.

When you generate a billing statement, it includes an Adjustment for New Accounts section that details the adjustment amount.

Calculations:

-

To calculate prorate new accounts by treating the billing inception value as a capital flow, Tamarac uses the following equation:

| Additional Settings | Details |

|---|---|

| Prorate New Accounts Using | Choose Billing inception value as capital flow to prorate based on billing inception value. |

| Show Adjustments | When a new account adjustment occurs, if you select Show Adjustments, Tamarac adds the Adjustments for New and Closed Accounts Title section to the statement. |

See Calculate Fee by Treating Billing Inception Value as a Capital Flow in Action

A billing group contains two accounts: Account A and Account B. Account B is a new account that was opened 23 days into the period with a $1,500 value. At the end of the billing period, each account has an ending market value of $2,000, giving the billing group a total billable value of $4,000.

Calculating the fee including an adjustment based on billing inception value produces a total fee of $9.06, as detailed below:

Billing Group Values at the End of the Period:

- Account A: $2,000

- Account B: $2,000

- Total Billable Value: $4,000

New Account Details:

- Billing inception value: $1,500

- Billing inception date: 23 days into the billing period

To calculate the total fee:

- Calculate the gross fee

- Calculate the adjustment amount

- Apply the adjustment to the gross fee

| Calculate Gross Fee | |

|---|---|

|

Billable value: |

$4000 |

|

Annual rate: |

1% or 0.25%/quarter |

|

Gross quarterly fee: |

$4000 × 0.25% = $10.00 |

| Calculate the Adjustment Amount | |

|

Billing inception value for new account: |

$1500 |

|

Elapsed number of days in period: |

23 |

|

Total number of days in period: |

92 |

|

Adjustment rate: |

$1500 × (23/92) × 0.25% = $0.94 |

| Apply New Account adjustment to Gross Fee | |

|

Total Fee: |

$10.00 - $0.94 = $9.06 |