Contents

How Include Non-Taxable Accounts Works

| Applies to: | ||

|---|---|---|

| ✔ Dynamic | ✔ Client Portal | |

This setting allows you to choose whether or not you want to include non-taxable accounts on the report. It is useful for "clearing the clutter" of extraneous data if you're looking at a report to evaluate tax consequences, such as an Income and Expense report or Realized Gains/Losses report.

In Dynamic Reports

-

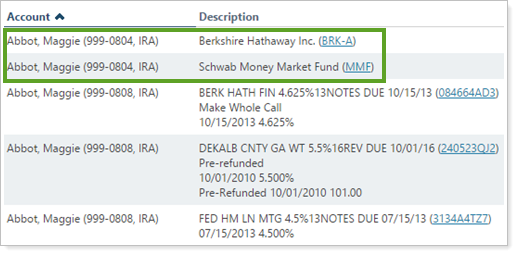

To exclude non-taxable accounts, clear Include non-taxable accounts.

In this example, the IRA ending in 0804 is not taxable. With the check box cleared, the non-taxable account is included in the report.

-

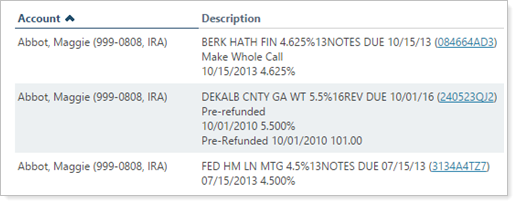

To include non-taxable accounts, select Include non-taxable accounts.

In this example, the IRA ending in 0804 is not taxable. With the check box selected, the non-taxable account is excluded from the report.

In PDF Reports

Functionality is the same in the PDF report templates as in dynamic reports.

In the Client Portal

Use Include non-taxable accounts to include or exclude non-taxable accounts on the Realized Gains/Losses page and widget.

Your options are:

-

Selected: The page includes both taxable and non-taxable accounts and clients can select non-taxable accounts in the Show data for list. Totals include both.

-

Cleared: The page includes only taxable accounts. This is the default.

Reports With This Setting

Holdings ReportsTransaction Reports

Related Settings

For more information on managing tax status of accounts, see Maintaining Accounts: The Account Settings Panel.