A ratio developed by Frank A. Sortino to differentiate between good and bad volatility in the Sharpe ratio. This differentiation of upwards and downwards volatility allows the calculation to provide a risk-adjusted measure of a security or fund's performance without penalizing it for upward price changes.

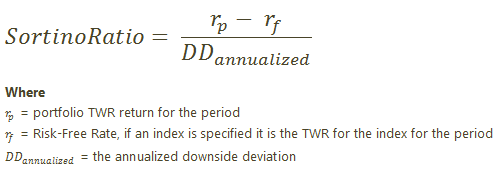

The Calculation

See the related definitions for Downside Deviation and Sharpe Ratio.

When Sortino Ratio Uses Gross or Net Returns

On the Account Analytics report, you can control whether this calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.