Contents

Introduction

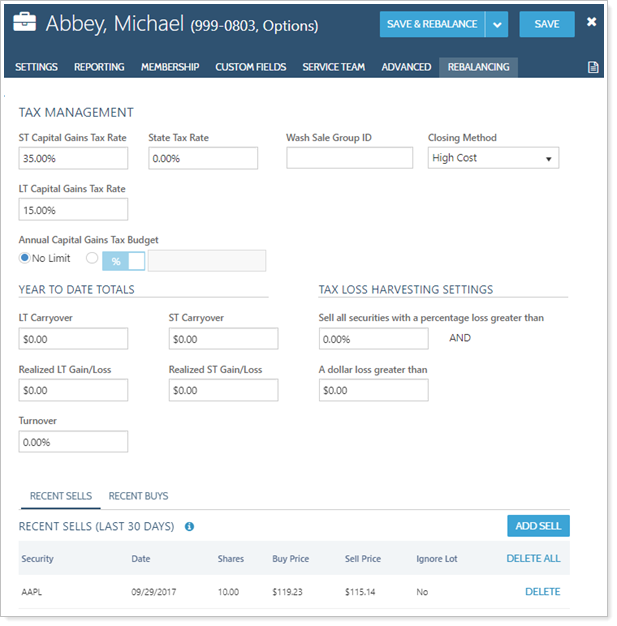

When you need to establish or edit tax management settings for an account, you can use the Tax Management panel.

You can edit and view the following settings on this panel:

- Tax Management. Set tax budgets, establish a closing method, and set up wash sale information.

- Year to Date Totals. View the YTD gains and losses information for the account.

- Tax Loss Harvesting. Establish the parameters you'll use to perform tax loss harvesting rebalances.

- Recent Sells and Recent Buys. View and add recent buys and sells in the account.

Tax Management Settings

You can access these settings under Accounts. Click on the account you want to edit. Under Rebalancing, click Tax Management.

The following account configuration settings are available:

ST Capital Gains Tax Rate: Specify the account's short-term capital gains tax rate.

LT Capital Gains Tax Rate: Specify the account's long-term capital gains tax rate.

Annual Capital Gains Tax Budget: Specify the maximum allowable amount of annual capital gains tax for the account or group.

State Tax Rate: Specify the state tax rate for the account.

Wash Sale Group ID: Establishes a Wash Sale Group ID for the account, allowing you to identify groups of accounts for the purpose of preventing wash sales.

Closing Method: Choose the closing method you'd like to use in this account.

Year To Date Totals: The fields in Year to Date Totals allow you to manually enter carryover, gain/loss, and other information.

Tax Loss Harvesting: These settings allow you to provide thresholds for tax loss harvesting rebalance activity.

Recent Sells and Recent Buys: View recent trades made in the account and add trades made in the account within the last 31 days for the purposes of avoiding violation of the wash sale rule.