Contents

Introduction

Both directed trades and the rebalance process produce trades, but the logic and best uses for these options are different. Depending on your needs, one may be a better option than the other.

Directed trading enables you to focus on individual securities. In general, directed trades are best suited for situations where you want to create a trade using a specific security and quantity. Directed trades are useful when you want to make tactical trades across a set of your accounts, but are not looking to rebalance the other securities in the account. Directed trades can also be used in conjunction with completing a rebalance on your accounts.

Below are some common scenarios where directed trades are useful.

Quick Reaction to Market Changes

The markets are always changing. Directed trades allow you to take advantage of big changes in the market and apply those changes to multiple accounts at once. You can use directed trades to buy exciting opportunities or sell disappointing securities in several accounts, allowing you to react quickly to market change.

For example, ABC Corporation (ABC) has been doing very well lately and shows signs that it will continue to grow in value. Because of this, you'd like to find client accounts with a certain amount of excess cash and then use that cash to purchase ABC. Using saved searches, you can identify clients who have excess cash and then create a directed trade to purchase ABC in their accounts.

Swapping Securities

Directed trades can be used to sell one security and those proceeds can then be used to purchase another security.

For example, the addition of the new ZZYYX fund to the marketplace provides a better alternative for some clients who hold a similar fund. By using directed trades, you can create a linked trade for those clients. You can sell their shares in the old fund, and use those proceeds to buy ZZYYX.

For more information, see Strategies Using Directed Trades.

Trading a Single Security for Tax Management Reasons

A directed trade can be used as a tax management tool when a single security presents an opportunity to harvest a loss or a gain within an account. The Sell Losses and Sell Gains directed trade types allow you to find lots with losses or gains and sell that security if it meets the loss or gain thresholds you specify. For more information, see Trade Type and Quantity Definitions in Directed Trades.

Consider a Rebalance in These Situations

A rebalance is suited for moving models and model sleeves toward your goals where the specific securities and quantities traded are less important. Below are some scenarios where completing a rebalance provides advantages over directed trades.

Moving a Portfolio Towards a Target

The most basic function of a rebalance is to move a portfolio towards predetermined model targets. The method and speed of the rebalance process is determined by you as well.

For more information on rebalance settings and types, see the following pages:

Tax Loss Harvesting

A loss harvest rebalance can be used to realize losses across accounts when the losses meet account-specific criteria. This method provides the option to sell losses within the account and allows you to create a strategy for any cash raised as a result of those sells.

For more information on tax loss harvesting, see Tax Loss Harvesting and Tax Management Strategies and Using Tamarac Trading for Tax Loss Harvesting.

Model Changes: Consider Either Directed Trades or a Rebalance

When you make changes to your models—either Allocation or Security Level models—there are situations where either a rebalance or directed trade could serve your needs.

Rebalance and Model Changes

In some cases, a tactical rebalance is most appropriate. Consider this example:

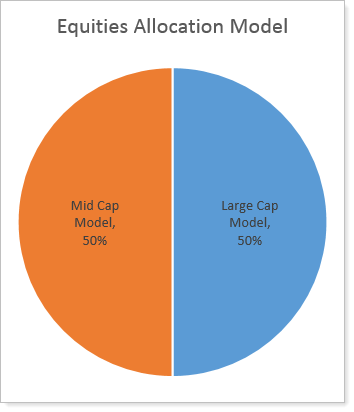

Your Equities Allocation Model contains two Security Level models (Mid Cap Model and Large Cap Model), both allocated to 50% of the model:

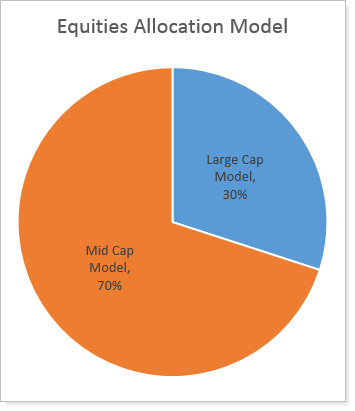

You decide to change the allocations for the Equities Allocation Model so that the submodels remain the same but the allocations change:

Because of the wide reaching impact of this change and how it will affect client portfolios, this would be an appropriate situation for a tactical rebalance. A tactical rebalance will bring clients with this model in their portfolios towards the new allocation goals.

It is best practice to use a tactical rebalance when making allocation changes within your models. For more information, see Tactical Rebalance.

Directed Trades and Model Changes

In some cases, a directed trade is a best practice for model changes. Consider this example:

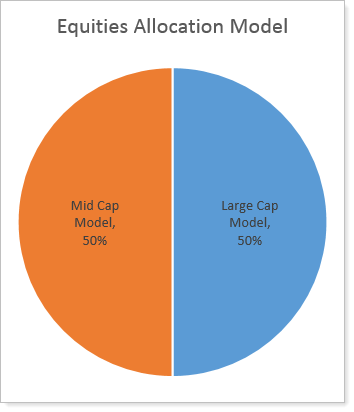

Your Equities Allocation Model contains two Security Level models (Mid Cap Model and Large Cap Model), both allocated to 50% of the model:

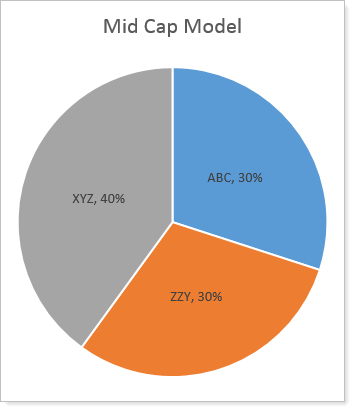

Your Mid Cap Model contains the following securities:

You decide to change the Mid Cap Model to remove ABC. ZZY and XYZ will remain in the model. In the Equities Allocation Model, the Mid Cap Model remains at 50% allocation.

In this situation, you can use a directed trade to sell ABC from the portfolios that contain it.

For more information on directed trades, see Strategies Using Directed Trades. For more information on completing a directed trade, see Directed Trades Process.