Contents

Introduction

Many of your clients have external accounts like credit cards, mortgages, checking and savings accounts, externally held 401(k) accounts, and 529 accounts that you may monitor, but that don't come through your main Tamarac custodian feed.

Linked accounts aggregate these types of held-away assets, liabilities, and investment accounts within Tamarac to give you and your clients a holistic view of your clients' financial picture, including financial assets and liabilities not managed directly by your firm. Depending on the linked account type, linked accounts receive daily balance updates or even full transaction details for complete reporting, so you can see them on the Net Worth report, on the client portal, and in reporting throughout Tamarac.

Before You Start

In order to add linked accounts to Tamarac, your firm must be enrolled in the Yodlee integration. For more information, see Yodlee Integration.

Types of Linked Accounts

Depending on the financial account you're bringing into Tamarac, there are three types of linked accounts in Tamarac using the Yodlee integration. Below, find detailed information about each account type.

Balance-Only Accounts

Balance-only accounts bring in assets and liabilities values from your clients' outside accounts such as mortgages, credit cards, checking and savings accounts, and more. When added, these accounts can be viewed on the Net Worth report for a fuller picture of a client's financial life. Some balance-only accounts can be converted to reconciled accounts.

Examples of balance-only accounts include credit cards, checking and savings accounts, mortgages, student loans, real estate value.

![]()

The following shows additional details about balance-only accounts:

Where to Create |

|

Login Credentials Used |

Client credentials |

Update Frequency |

Value or balance updates daily |

Where to Manage in Tamarac |

View, edit settings, manage credentials, and unlink on the Aggregated Accounts page |

How to Identify on the Aggregated Accounts Page |

|

Advisor Permissioned Data (APD) Accounts

Use your advisor credentials to bring in custodial accounts that don't flow into your daily Tamarac data feed. Initially, APD accounts are only visible on the Aggregated Accounts page to prevent a large number of reconciled accounts from appearing all at once. However, you can convert them to reconciled accounts for full reporting.

![]()

The following shows additional details about APD accounts:

Where to Create |

Add or convert APD accounts on the Aggregated Accounts page |

Login Credentials Used |

Advisor credentials |

Update Frequency |

Value updates daily |

Where to Manage in Tamarac |

View, link, and manage credentials on the Aggregated Accounts page. You cannot edit an APD account in Tamarac until the account is converted to be a reconciled account. |

How to Identify on the Aggregated Accounts Page |

|

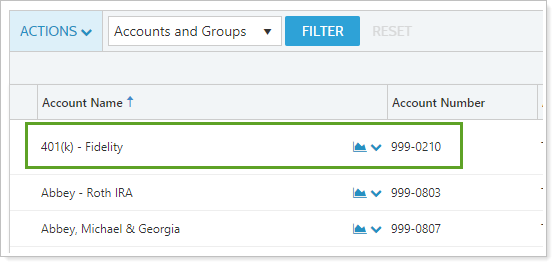

Reconciled Accounts

Reconciled accounts are linked external investment accounts that behave like your other Tamarac accounts. You can add reconciled accounts to groups and Households. This allows you to add data about these accounts to all dynamic and PDF performance, transaction, and holdings reports, as well as include them on client portals.

Examples of reconciled accounts are 401(k) accounts, 529 accounts, trusts, and other custodial accounts.

![]()

The following shows additional details about reconciled accounts:

Where to Create |

|

Login Credentials Used |

|

Update Frequency |

Balance, transactions, and holdings update daily |

Where to Manage in Tamarac |

|

How to Identify on the Aggregated Accounts Page |

|

Convert Balance-Only and Advisor Permissioned Data (APD) Accounts to Reconciled Accounts

In some cases, the data you receive from a linked balance-only account is appropriate. For example, linking a client's mortgage will give you a more complete picture of that client's net worth, but you likely won't need data more detailed than a regular balance update.

However, if you want to view transactions and holdings data for a linked balance-only or advisor permissioned data (APD) account, that account must be a converted into a reconciled account. You can convert balance-only accounts on an individual account basis. However, to convert APD accounts, you will first use your login information with the associated custodian to initially bring multiple accounts with that custodian into Tamarac. Then, you can individually convert each of these accounts to be reconciled accounts. This final conversion step will allow you to see transactional data for these accounts.

For more information on this process, see Convert Balance-Only Accounts to Reconciled Accounts.

Using Linked Accounts in Tamarac Reports

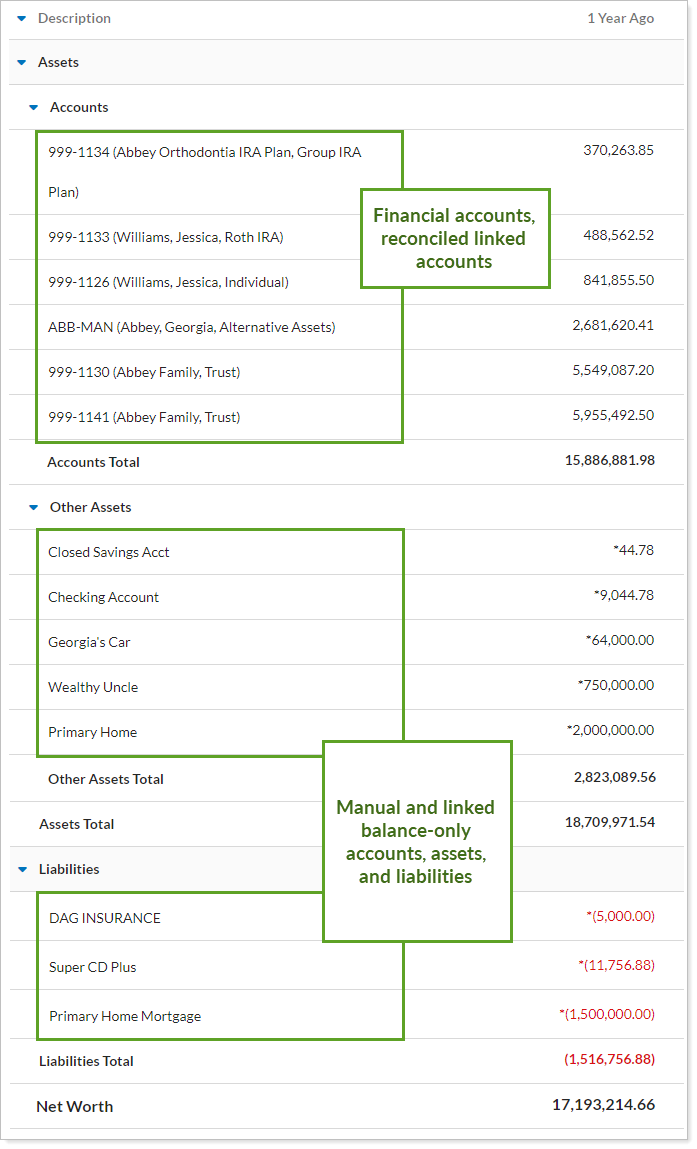

Creating linked accounts lets you report on clients assets, liabilities, and held-away accounts on the Net Worth report.

You can also use reconciled accounts in other reports in Tamarac. The following is a summary of how you can use linked accounts in Tamarac Reporting.

Balance-Only Accounts

The Net Worth report displays balance-only linked accounts the same as manually-entered assets or liabilities. They appear in the Other Assets section of the Net Worth report.

Advisor Permissioned Data (APD) Accounts

APD accounts can be viewed on the Aggregated Accounts page but are not available for any report in Tamarac. To add an APD account to the Net Worth or any other report in Tamarac, convert the account from an APD account to a reconciled account.

Reconciled Accounts

Reconciled accounts will appear in the Accounts section of the Net Worth report if added to a Household.

You can use reconciled accounts in any PDF or dynamic report throughout Tamarac. You can also include reconciled accounts in Client Views.

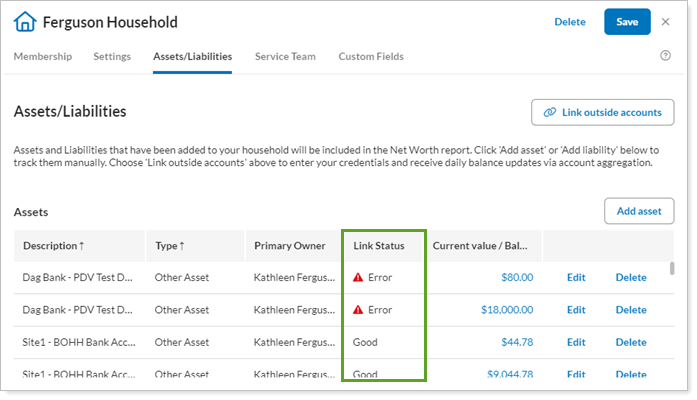

Linked Accounts in Households and Groups

Linked accounts allow you to report on assets not held in Tamarac. Because of this, it is helpful to know how linked accounts interact with groups and Households.

Balance-Only Accounts

You cannot add balance-only accounts to groups.

To add balance only accounts, use:

Balance-only accounts appear in a Household's Assets/Liabilities tab. Like manually entered assets and liabilities, you can edit any of the information about the account, including adding balance history.

Advisor Permissioned Data (APD) Accounts

You cannot add APD accounts to groups or Households. However, you can convert APD accounts to be reconciled accounts to add the account to a group or Household.

Reconciled Accounts

You can add reconciled accounts to groups and Households. In Households, you can see linked accounts listed with the other Tamarac accounts on the Direct Members tab.

Linked Accounts on the Client Portal

When you add the Assets/Liabilities page to the client portal and enable linked accounts, your clients can interact with linked accounts in two ways:

-

Add or manage balance-only accounts directly.

-

View the data for reconciled accounts that you link.

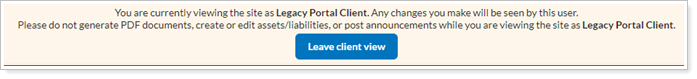

Remember, we recommend that you do not edit assets or liabilities when viewing the client portal as your client sees it.

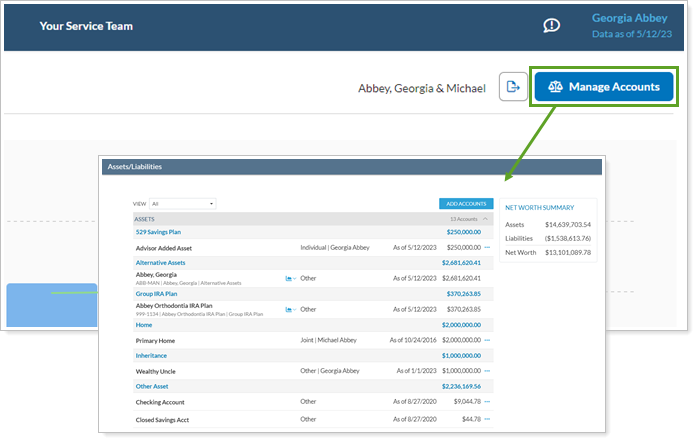

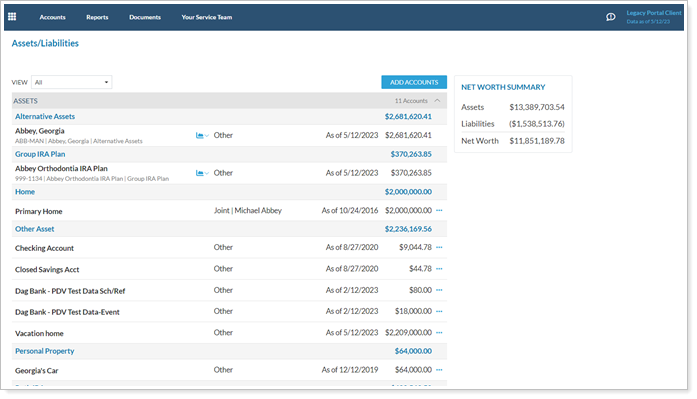

Clients Add and Manage Balance-Only Accounts in the Client Portal

Clients readily access the Assets & Liabilities page in the client portal from:

-

The Accounts menu.

-

The Net Worth report, using the new Manage Accounts button.

The Assets/Liabilities page displays all accounts, assets, and liabilities together. Clients can manage linked balance-only and manual assets and liabilities from this page.

The primary difference between what you see and what a clients sees on the Assets and Liabilities page is when choosing primary owners. When assigning ownership as an advisor, you can select any client that you have set up in Tamarac Reporting. However, when your clients add or edit assets through their client portal they will only be able to assign members of their Household.

For information about enabling linking for clients, see Client Views - Assets and Liabilities Page and Allow Clients to Manage Assets and Liabilities on the Portal.

Clients View Linked Account Data in the Client Portal

When clients link balance-only accounts, you have the option to convert them to reconciled accounts for greater reporting detail. All reconciled accounts show up on the client portal alongside all the standard Tamarac accounts in dashboard tiles and on reports, but clients cannot edit those accounts.

When you add reconciled accounts, clients see them listed among their financial accounts on the Accounts page and on the Assets/Liabilities page.