Contents

Introduction

Clients want a holistic view of all accounts, assets, and liabilities to allow fully informed decision-making. To further support your efforts to become the single source for your clients' holistic financial data, we offer the Envestnet | Yodlee integration, which allows you to aggregate held-away accounts, assets, and liabilities.

With this integration, you and your clients can add and see outside accounts—examples include credit cards, investments, loans, and mortgages—on the Net Worth report and on the client portal. This type of account aggregation allows you to track total net worth and provide a holistic view of a Household's financial situation.

Envestnet | Yodlee includes a network of over 15,000 connections to financial institutions, billers, reward networks, and other end points—including a connection to automatically determine the value of a home.

What You Can Do With This Integration

With this integration, you can do the following:

-

Link balance-only, APD, and reconciled accounts to get account data that's updated daily.

-

See all of your clients' financial accounts summarized on the Net Worth report, including held-away accounts.

-

Add outside reconciled accounts in all available dynamic, PDF, and client portal reports.

Enrollment

If you'd like to take advantage of the Envestnet | Yodlee account aggregation integration features, contact TamaracAM@envestnet.com.

Linked Account Types

Through Yodlee, Tamarac offers three types of linked accounts:

Reconciled Accounts

Reconciled accounts are linked external investment accounts that you can add to groups and Households. This allows you to add data about these accounts to all dynamic and PDF performance, transaction, and holdings reports, as well as include them on client portals.

![]()

Advisor Permissioned Data (APD) Accounts

Use your advisor credentials to bring in custodial accounts that don't flow into your daily Tamarac data feed. Initially, APD accounts are only visible on the Aggregated Accounts page to prevent a large number of reconciled accounts from appearing all at once. However, you can convert them to reconciled accounts for full reporting.

![]()

Balance-Only Accounts

Balance-only accounts bring in assets and liabilities values from your clients' outside accounts such as mortgages, credit cards, checking and savings accounts, and more. When added, these accounts can be viewed on the Net Worth report for a fuller picture of a client's financial life. Some balance-only accounts can be converted to reconciled accounts.

![]()

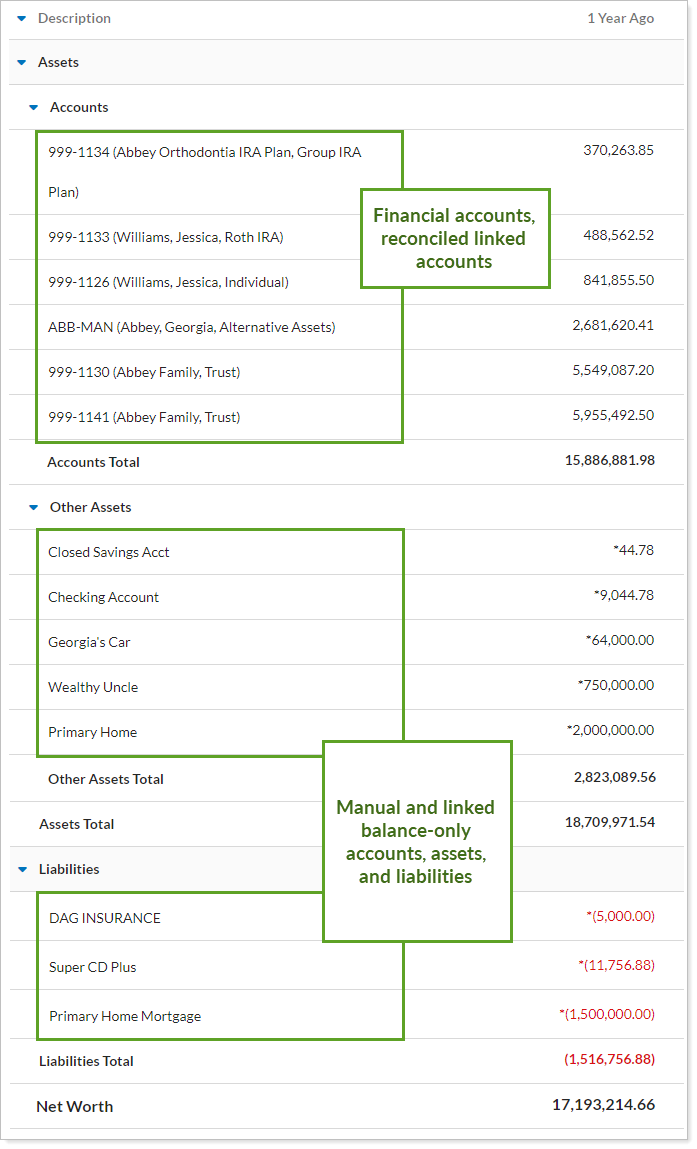

View Linked Accounts in Tamarac

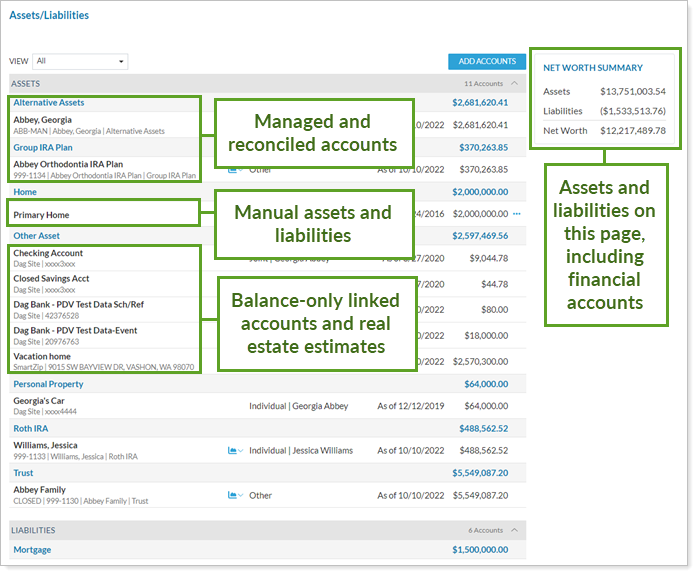

Once you've linked held-away assets, liabilities, or investment accounts using Yodlee, you can see those linked accounts in the following locations in Tamarac.

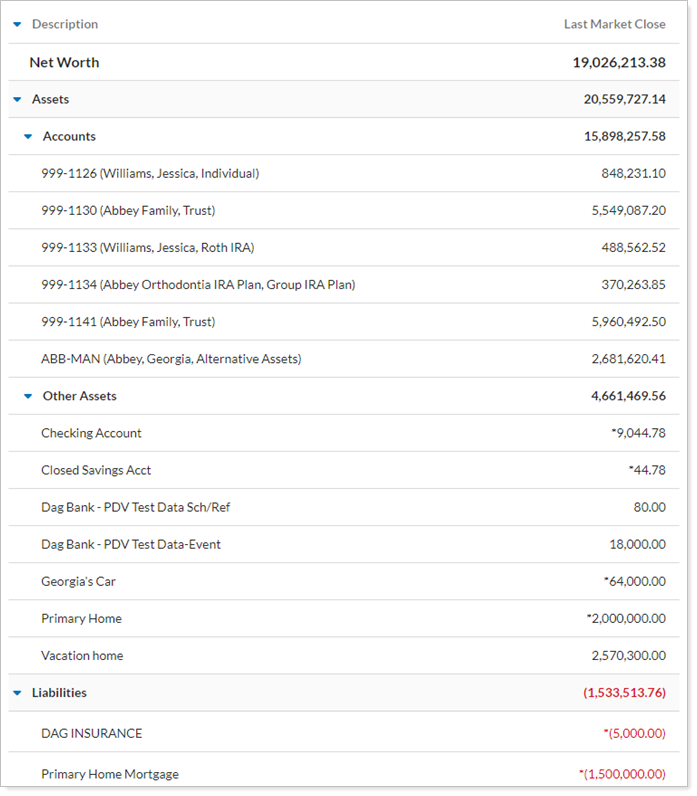

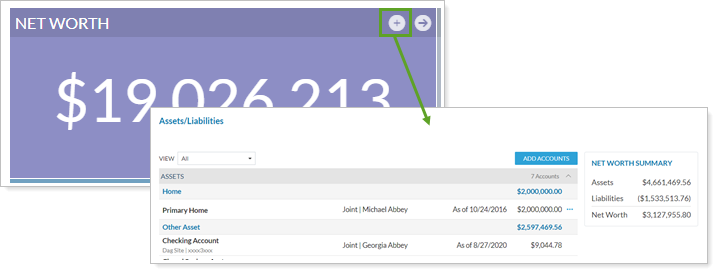

On the Net Worth Report

Linked balance-only accounts are displayed in the Net Worth report the same as manually-entered assets or liabilities. Reconciled accounts appear alongside standard Tamarac accounts.

For more information on how the Net Worth report displays different accounts types, see View and Add Assets and Liabilities on the Net Worth Report.

As with all assets and liabilities, linked accounts will be sorted according to the Asset Type selected. Linked accounts automatically come in with an Asset Type of Other Asset. Edit the Asset Type as applicable to ensure assets and liabilities are accurately sorted in the Net Worth report.

In Groups, Households, and Reports Throughout Tamarac

Because reconciled accounts appear on the Accounts page and are treated as standard accounts, you can add them to groups and Households and include them in all your regular PDF reporting packages and in dynamic reports.

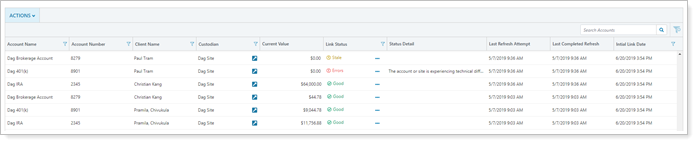

The Aggregated Accounts page displays reconciled account information, including client, custodian, current value, and link status.

For more information on the Aggregated Accounts page, see Aggregated Accounts Actions, Views, and Filters.

On the Client Portal

When visiting the client portal, clients can see accounts, assets, and liabilities linked through Yodlee in the following locations:

-

On the Net Worth report exactly as it appears in your dynamic reports.

-

Included in net worth totals on Net Worth dashboard tiles.

-

On the Assets/Liabilities page alongside managed financial accounts.

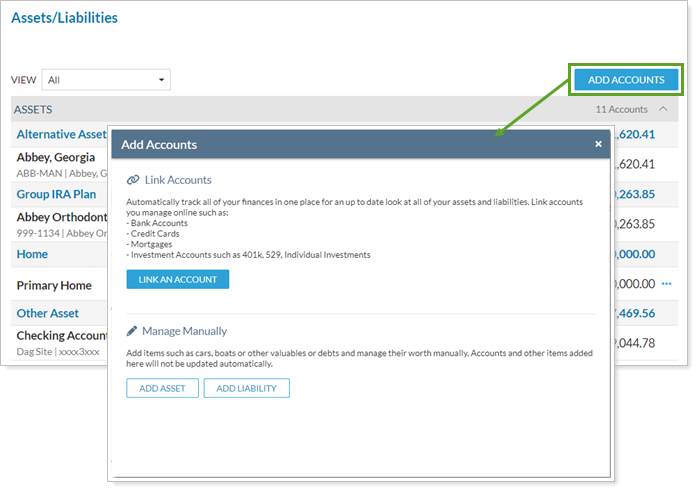

Places You Can Add and Edit Linked Accounts

Linking and unlinking workflows vary based on the linked account type. The following is a summary of the various ways you and your clients can add and edit linked accounts.

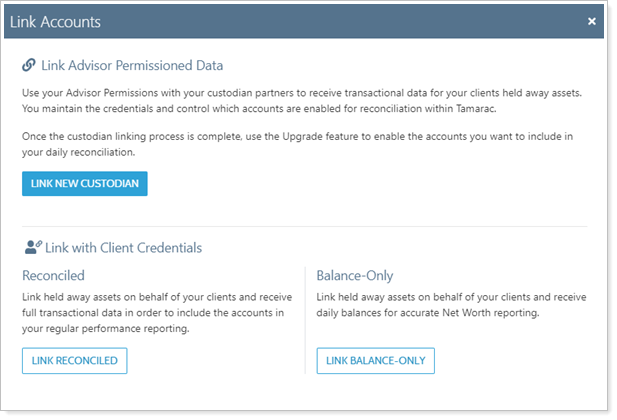

Aggregated Accounts Page

The Aggregated Accounts page lets you complete many linked accounts workflows, manage credentials, and manage accounts that belong to multiple Households. On the Aggregated Accounts page, you can add all of the linked account types and edit reconciled and balance-only accounts. You can link accounts using advisor or client credentials, depending on the account type.

For procedures to link, edit, or unlink accounts on the Aggregated Accounts page, see Link, Edit, or Unlink Accounts on the Aggregated Accounts Page.

> Permissions

You can only use the Aggregated Accounts page to manage linked accounts if:

-

Your firm has the Yodlee integration enabled. For more information, see Yodlee Integration.

-

Your user role has permission to see the Accounts | Aggregated Accounts page and the Accounts | Households page. For more information, see Aggregated Account and Linking Permissions.

Administrators automatically get access to the Aggregated Accounts page.

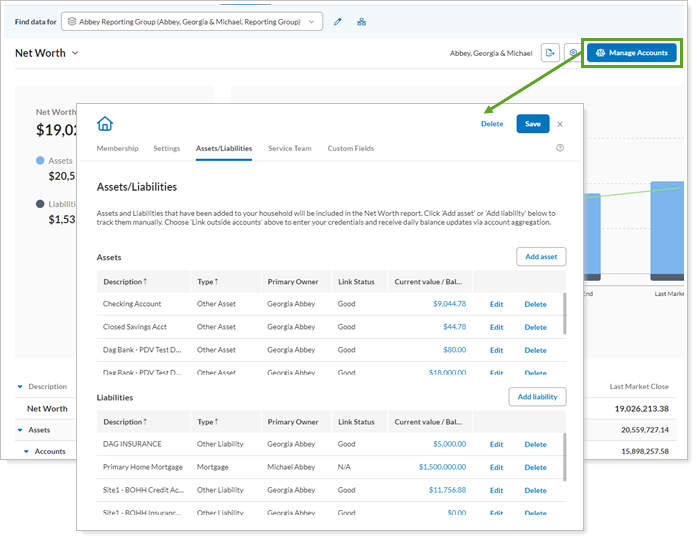

Households Page

When you edit a Household, the Assets/Liabilities tab allows you to add manual assets and liabilities at the Household level, but you can also add linked balance-only accounts using client credentials. Balance-only accounts become assets and liabilities, but some balance-only accounts can be converted to reconciled accounts.

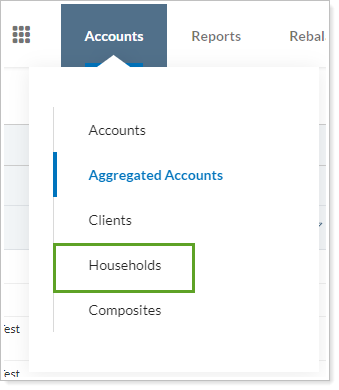

You can access a Household in the following places:

-

Under Accounts, by clicking Households.

-

On the Net Worth report, by clicking Manage Accounts.

For procedures to add, edit, and delete linked accounts and manual assets and liabilities on the Households, see Link, Edit, or Unlink Accounts on the Household.

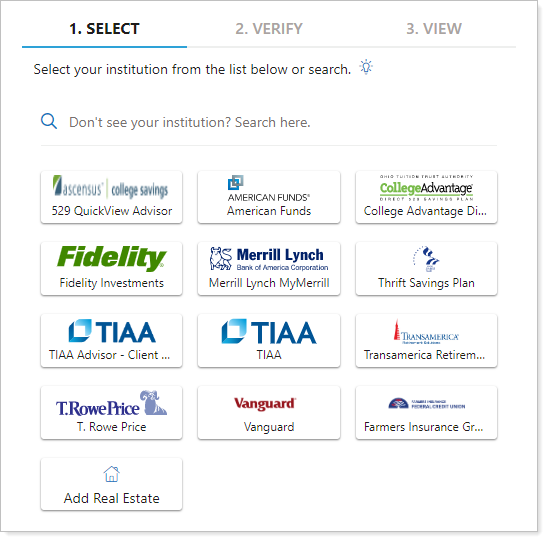

Client Portal and Mobile App

When enabled and configured, clients can add balance-only accounts in the client portal or mobile app using their credentials. When a client links an asset, liability, or account, it becomes a balance-only account. You can convert some balance-only financial accounts to reconciled accounts.

We recommend that you allow clients to manage assets and liabilities on their client portals. This avoids potential custody issues by allowing clients to establish and maintain linked accounts themselves.

For more client portal linking settings, see:

-

Add Assets and Liabilities to Client Portals: Learn about the different places assets and liabilities appear in the client portal and how to configure them.

-

Manually Add Assets and Liabilities From the Client Portal: Learn the steps your clients take to create, edit, or delete a manual asset or liability in the client portal.

-

Link, Edit, or Unlink Accounts on the Client Portal: Learn the steps your clients take to create, edit, or delete a balance-only linked account in the client portal.

-

Use the Client Portal Assets & Liabilities Page: Learn about the features of the client portal Assets & Liabilities page and the settings you use to control it.

For more information on assets and liabilities in the mobile app, see Mobile App Assets and Liabilities.

Troubleshoot the Yodlee Integration

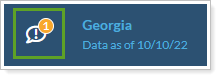

You and your clients will both receive notifications when there are issues with a link.

Best Practice: Let Clients Resolve Errors Clients are best suited to resolve most integration errors since they own the accounts and can address dual factor authentication requirements, login credential changes, or similar issues.

Your clients will see an alert when they log in to the client portal. Clicking on the alert icon will open the announcement and provide a link to the Assets/Liabilities page on the portal.

For detailed information about troubleshooting link errors, see Troubleshooting The Yodlee Integration.

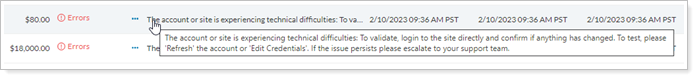

On the Aggregated Accounts Page

Error messages appear on the Aggregated Accounts page in the Link Status column for all linked accounts, including reconciled and balance-only accounts. Use the Aggregated Accounts page to address errors with multiple linked accounts at once.

The Status Detail column provides information about what is causing the error. Click the error message to see the full text.

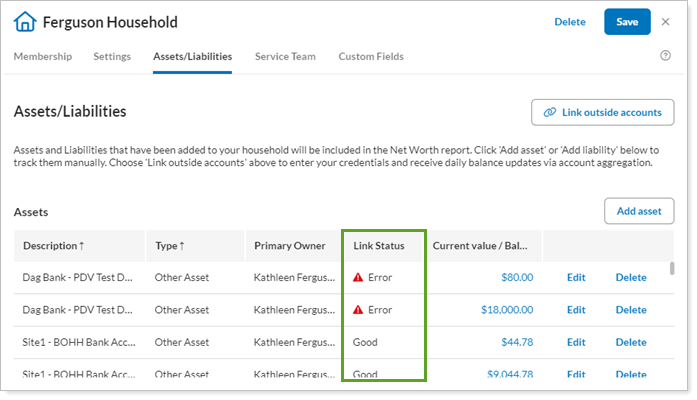

In the Household Assets/Liabilities Panel

The Assets/Liabilities panel of the Household holding the account in the Link Status column also displays error messages for balance-only assets and liabilities.

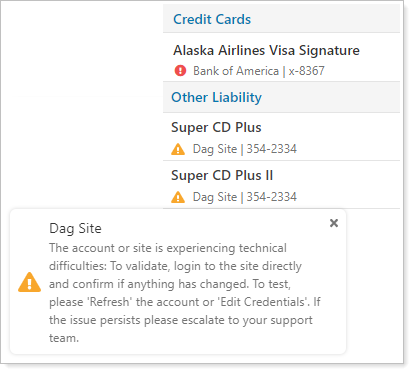

On the Client Portal

Clients see two types of errors on the Assets & Liabilities page:

-

Actionable linking errors Marked with

. Clients can resolve these errors. Example: Updating login credentials or provider site URL change.

. Clients can resolve these errors. Example: Updating login credentials or provider site URL change. -

Informational ErrorsMarked with

. Only you, the advisor, can resolve these errors. Example: Reconciled account mismatching or APD account credential issues.

. Only you, the advisor, can resolve these errors. Example: Reconciled account mismatching or APD account credential issues.