Back

Back

Back Back |

|

Resources to Help You Respond to Market Movement

|

Find Accounts Out of Tolerance With Saved Searches Securities With Unrealized Gain/Loss Allocation Within or Outside Tolerance Act on Tax Loss Harvesting Opportunities |

In periods of heightened market volatility, Tamarac Trading has several features you can use to identify portfolios that may need attention. Here are some common saved search filters and information about other tools that can be used to find portfolios that may have tax loss harvesting opportunities.

After large or sudden market changes, you'll likely want to identify the portfolios that are out of tolerance and prioritize action on accounts that meet other criteria—for example, taxable status, account size, strategy, and more. Here are a few common searches you can use to identify losses:

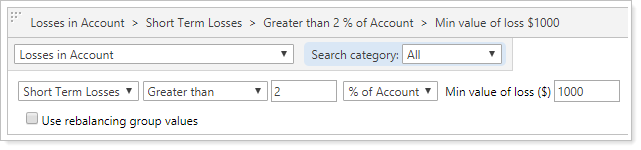

Use this filter to find short term losses, long term losses, or total losses within an account. You can look for specific dollar amounts or % of account values when searching. You can add additional filters to only find taxable accounts or accounts of a certain size, if desired.

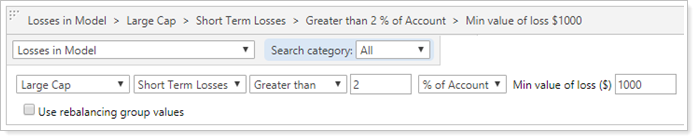

This filter allows you to select specific models and identify short term losses, long term losses, or total losses within those models. You can look for specific amounts of loss and can also consider group values when searching. You can add additional filters to find only taxable accounts or accounts of a certain size, if desired.

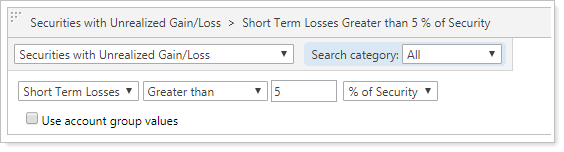

To find losses in individual security holdings, this filter allows you to pick a security and identify accounts with either losses or gains within that security that meet your threshold criteria. You can add additional filters to find only taxable accounts or accounts of a certain size, if desired.

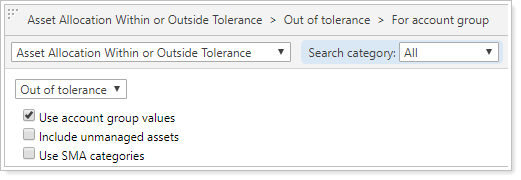

This filter is another method of finding accounts that have drifted outside of tolerance by finding accounts or groups where holdings have drifted outside of the target allocations you assigned to them. Target allocations let you define holdings goals so you can compare them to the goals of individual accounts or groups.

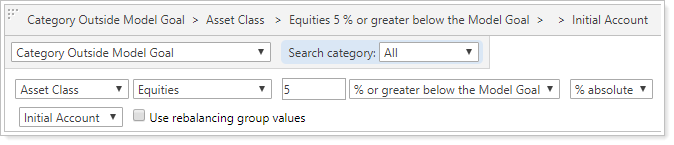

This filter accounts where the assigned model contains securities defined as a certain category—in this example, asset class—that are either above or below the model goal. You can specify the amount of deviation you want to search for in either absolute or relative terms.

For more information on creating saved searches, including more complicated saved searches, see Working With Saved Searches.

Once you've found losses in your accounts, you can use tools in Tamarac Trading to complete tax loss harvesting in your clients portfolios. The following tools and information can help you through this process.

Use a tax loss harvesting rebalance type, either the Tax Loss Harvesting & Rebalance or the Tax Loss Harvesting Rebalance to complete a rebalance in clients' accounts. For more information on tax loss harvesting with these rebalance types, see Using Tamarac Trading for Tax Loss Harvesting.

Depending on your trading strategy, wash sales may be of concern for you. For more comprehensive information about the tools available in Tamarac Trading for avoiding wash sales, see Wash Sales.

After harvesting losses, you can reinvest cash back into your clients' models using a saved search or you can create a custom field to track accounts with tax loss harvesting activity that also have excess cash. For more information on cash management in tax loss harvesting, see Tax Loss Harvesting and Tax Management Strategies.For more complete information on cash management in Tamarac Trading, see Cash Management Strategies.