Contents

How Annualize Returns Works

| Applies to: | ||

|---|---|---|

| ✔ Dynamic | ✔ Client Portal | |

This setting allows you to report the returns as annualized returns.

Annualization converts a cumulative rate over a number of years to the average yearly rate that, when compounded over the entire period, results in the cumulative rate. The goal of annualization is to normalize returns and state them in terms of what has been achieved in an average year for the account or position. This makes it easier to compare the performance an account has achieved relative to others that have been open for different lengths of time.

You might want to use this when using the report for comparisons: comparing accounts to a benchmark, comparing account data for different advisors, or comparing positions that have been held for differing periods of time.

We recommend that you annualize returns if you're doing a comparison and your time period is a year or longer. This ensures that you're comparing apples to apples.

In Dynamic Reports

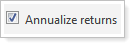

Select to Show Annualized Returns

-

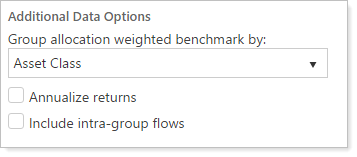

To choose to report returns on an annualized basis, select the Annualize returns check box.

-

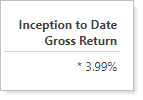

The return is annualized, making it easier to compare performance with other accounts that have been open other lengths of time.

-

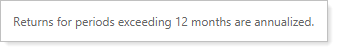

When you select this option, the report includes the following footer:

Clear to Show Cumulative Returns Based on Time Period

-

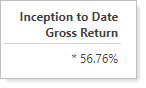

To choose to report returns cumulatively based on their time periods, clear the Annualize returns check box.

-

The cumulative return for the entire period is reported. It is not readily comparable to other accounts' performance unless the other account was open for the exact same date range.

-

When you select this option, the report includes the following footer:

In PDF Reports

Functionality is the same in the PDF report templates as in dynamic reports.

In Client Portal Reports

When you select this check box, Tamarac Reporting will convert the returns to a rate that reflects the rate on a yearly basis for reports on the client portal.

Reports With This Setting

Performance Reports