Back

Back

Back Back |

Home > Tamarac Reporting > Accounts-Groups-Households > Groups > Creating and Modifying Groups: The Report Settings Panel

|

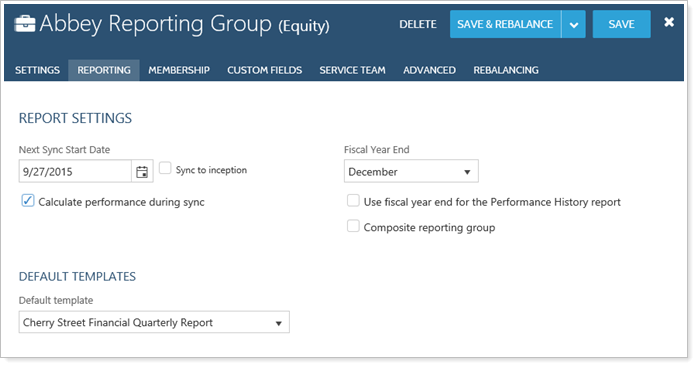

Creating and Modifying Groups: The Report Settings Panel

The Report Settings panel allows you to determine group level reporting options such as fiscal year end dates, default templates, and sync start dates.

This panel is available under the Reporting menu when you edit a group on the Accounts page. For more information on editing groups, visit Creating and Modifying Groups.

See below for descriptions of each of the settings on the page.

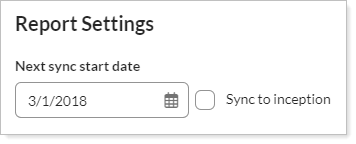

You can change this date to any date you want. You can also select the Sync to inception check box to set the sync date to the group inception date.

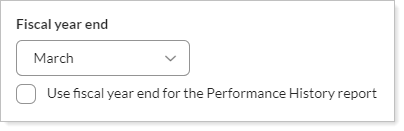

Select the month that the group's fiscal year ends. Leave the default of December if the group follows the calendar year.

You can also choose to Use fiscal year end for the Performance History report. Select this check box to use the fiscal year for the Performance History report. You will not see fiscal year mentioned on the report, but the quarterly and annual date periods will be adjusted to match the group's fiscal year.

For more information on using fiscal year ends in the Performance History report, see Base Date Periods On.

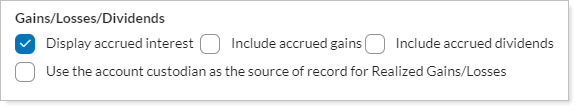

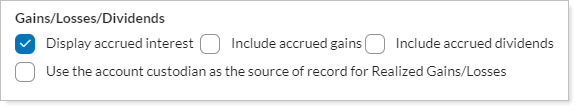

Select this check box if, when calculating the value of this group, you want to include interest accrued since the last interest payment. Interest is generated by bonds, CDs, and mortgage-backed securities.

Select this check box if, when calculating the value of this group, you want to include gains accrued since the last interest payment.

Select this check box if, when calculating the value of this group, you want to include dividends accrued since the last interest payment.

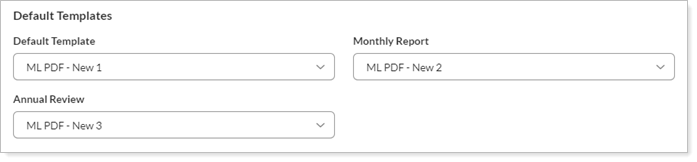

Choose the default PDF templates for the group.

Sometimes you need more than one default template. For example, you may need different default templates for tax returns, year-end reporting, and Q1, Q2 and Q3 reporting. Template Types allow you to specify default templates for each type of report you run. Once you set up your default templates for each template type, you can generate reports based on the template type.

For details on the template types, see Understand Template Types and Default Templates.

For more information on creating, editing, or deleting PDF templates, see Create, Edit, and Delete a PDF Template.

This setting allows you to indicate whether a group is eligible for composite reporting as a single entity. You will only see this check box if your firm is enabled for composite reporting. To enable composite reporting for your firm, please contact Tamarac Account Management.

A group will not be valid for composites if it contains groups or if it contains accounts that are in other composite groups.

You won't have to worry about creating invalid composites because the check box will be grayed out if the group is not valid for a composite.