Contents

|

Single Person Relationships: Accounts and Clients |

Introduction

Your clients trust you with financial data that can be quite complicated. Because of this, the Tamarac platform provides tools to build this data into relationships. By creating these relationships using your clients' accounts and data, you can use the Tamarac platform's available features to automate processes including reporting, administrative functions, and rebalancing, allowing you to spend more time with clients and less time maintaining their data.

Below is a description of the relationship types you can create in the Tamarac platform, as well as common scenarios and how to use these relationship types to achieve the desired outcome for clients.

Single Person Relationships: Accounts and Clients

Individual relationships can be customized in various ways to accurately represent your clients and their needs. These single relationships can then be combined into more complex relationships.

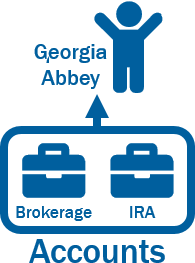

Accounts

An account is the single financial account for a client, and has these characteristics:

-

Creation.Accounts are imported into the Tamarac platform from your portfolio accounting system (PAS).

-

Additional Relationships.Accounts in the Tamarac platform can then be added to complex relationship structures like Households, billing groups, groups, and groups enabled for rebalancing.

-

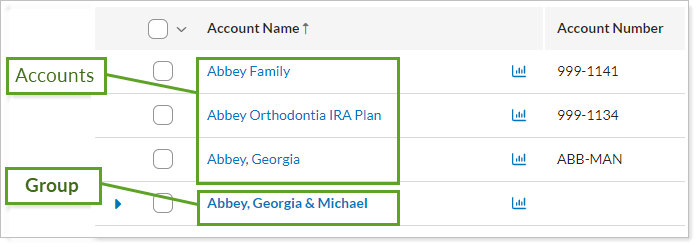

Finding Accounts.Accounts don't appear in bold font on the Accounts page.

For more information, see Create, Close, and Delete Accounts.

Clients

A client is a unique point of contact, designated by a unique email address, and has these characteristics:

-

Clients in Households.The clients you create are assigned to Households; you can then grant client portal access to those clients within the Household. A client can only be assigned to one Household.

-

Household MembersA client doesn't necessarily have to be an investor. You can grant portal access to third parties—for example, CPAs and attorneys—by adding these individuals as clients.

For more information, see Create, Edit, or Delete a Client.

What's the Difference Between an Account and a Client?

| Account | Client |

|---|---|

|

|

|

|

|

Complex Relationships: Groups and Households

The following are the more complex relationship types in the Advisor suite. Each of these relationships is built using accounts and clients.

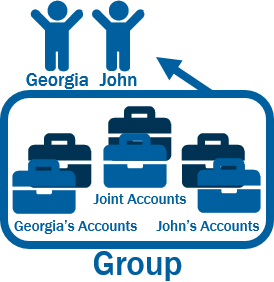

Groups for Reporting

A group is a collection of accounts you combine to facilitate group-level activity. In the context of reporting, a group has these characteristics:

-

Calculation and Reporting.Groups are often used for group-level performance calculations and reporting. You can run dynamic reports on groups but not on Households.

-

Separate from the accounts it contains.A group is a separate entity, set apart from the accounts that group contains. You can put as many accounts or other groups into a group for reporting as you wish.

-

Location.Groups appear in bold font on the Accounts page.

For more information, see Creating and Modifying Groups.

Groups for Rebalancing

A group is a collection of accounts you combine to facilitate group-level activity. In the context of rebalancing in trading, a group has these characteristics:

-

Asset Placement and Tax Aware Trading.Rebalancing at the group level lets you manage the placement of assets within the individual accounts, allows for more tax aware trading, and lets you trade all accounts toward the goals set in the model assigned to the group. You may place an account in multiple groups, but you can only enable that account for rebalancing in one group.

-

Usually a common beneficiary.Most often, accounts with a common beneficiary are rebalanced together as a group. This could be a single person, a couple, an immediate family, etc.

-

Must be enabled.Before accounts can be traded as a group, the Allow Rebalancingand Include in Group Rebalancing settings must be selected.

For more information, see Create, Edit, and Delete Groups for Rebalancing.

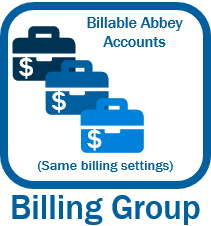

Billing Groups

A billing group is a collection of accounts that have the same billing settings and aggregate toward a total billable value, and has these characteristics:

-

Separate from reporting and trading groups.Billing groups often overlap or mirror Households or groups, but don't have to. Billing groups are created on the Billing Groups page, not on the Accounts page and are used only for billing, not for reporting or trading.

-

Billing Flexibility.In a tiered billing structure, you can add more family members' accounts into a billing group to obtain a lower billing rate. This may make the billing group different from a group created for reporting or trading. Any account that pays the billing fees for the billing group must be included in that billing group.

For more information on billing groups, see Billing Groups.

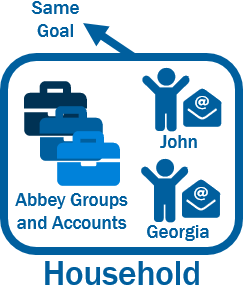

Households

A Household combines accounts, groups, clients, and client portals together in one place, and has the following characteristics:

-

Client portals, integrations, and reporting.The membership of a Households determines what can be seen within client portals. Households are also used to help you integrate third-party tools like MoneyGuide, Finance Logix, and eMoney. Some reporting, like the Net Worth report, is done at the Household level; however, all other dynamic reports are not run at the Household level. You can also generate PDFs at the Household level.

-

Shared Goal.Households should be based on goals so that each relationship within a Household works towards a common shared goal, regardless of living arrangements.

-

addresses Maintenance.You have the option to maintain addresses at the Household level and have them sync down to accounts/groups for easier maintenance.

-

Service Teams.Service teams are built to service Households. When you create Households, you can then associate service teams to your Households.

For more information, see Create a Household.

What's the Difference Between a Groups, Billing Groups, and Households?

| Groups | Households | Billing Groups |

|---|---|---|

|

|

|

|

|

|

|

Overview of Relationships

The following is a high-level overview of relationships:

| Definition | Creation | Relationship You can Add | Example |

|---|---|---|---|

Account |

|||

|

Single financial account imported from your portfolio accounting system |

Imported from your portfolio accounting system (PAS) | N/A | Examples of accounts include your client's IRAs, taxable brokerage accounts, etc. |

Client |

|||

| Single point of contact, defined by a unique email address, that can be a client or a third party. | Created on the Clients page | N/A | Georgia Abbey is a client, as is her husband who also has accounts with the firm. The couple's attorney can also be a client. |

Group |

|||

| Collection of accounts combined for group-level performance calculations, reporting, rebalancing, and/or trading. | Created on the Accounts page | Accounts, Groups | Georgia and John Abbey have multiple accounts, and combining them into a group allows for reporting across all accounts, giving the Abbeys a high-level picture of their portfolio. The accounts can also be rebalanced together so that each account is trading toward the same model. |

Household |

|||

| Collection of relationships, each with a common goal; they often mirror clients' living arrangements, but don't have to. | Created on the Households page | Accounts, Groups, Clients | Georgia and John Abbey have financial accounts, combined into a group, and are each listed as a client. They each share the same financial goal. These relationships can be combined into the Abbey Household for some kinds of reporting and some integrations. |

Billing Group |

|||

| Collection of accounts, each with the same billing settings, that aggregate toward a total billable value. | Created on the Billing Groups page | Accounts | Georgia and John Abbey have multiple accounts and pay the same billing fees for each of them. A billing group can be created to aggregate the billable value of these accounts. |