Contents

|

Improve Trading Communication with PDF Reports of Rebalance Summary Information More Accountability and Control When Trading Restricted Securities |

Improve Trading Communication with PDF Reports of Rebalance Summary Information

The Rebalance Summary is a highly used visual tool that lets you see clients' trade recommendations in the context of the models and available cash in their accounts. Now this powerful tool is available as a PDF report. With new PDF reporting, you can show trade recommendations and cash information for a single account or group, all in an easy-to-read format that fits your firm's branding and the needs of your clients.

If you're also a Tamarac Reporting user, you might already know about how PDF reporting can be an effective tool for client communication and internal analysis. PDF reports, including the new Rebalance Summary reporting, offer these benefits:

-

Designed for printing or sharing in electronic PDF format.

-

Customizable to your firm's brand and individual client's needs.

-

Shareable through the mail, secure file sharing, or, if you also use Tamarac Reporting, through the Tamarac client portal.

-

Demonstrates your firm's value and increases client communication and transparency.

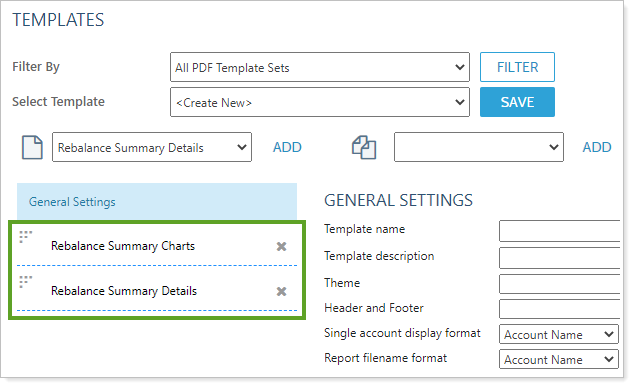

You build PDF reports by adding individual report sections together. In Tamarac Reporting, these sections can be reports like the Holdings or Asset Allocation reports. With this release, you'll see two new report sections for creating PDF reports with Rebalance Summary data: Rebalance Summary Charts and Rebalance Summary Details.

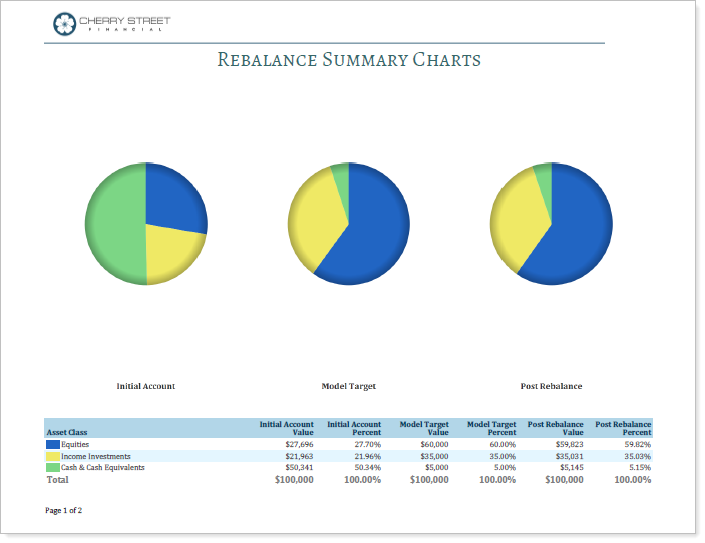

Rebalance Summary Charts

This section shows side-by-side pie charts with a configurable legend. This allows you to compare rebalance information visually.

In the Rebalance Summary Charts section, you can customize these details:

-

Which category, such as asset class, is used to group securities.

-

Whether charts show initial account, post rebalance, or model target data.

-

What is included in the chart legend.

-

And more!

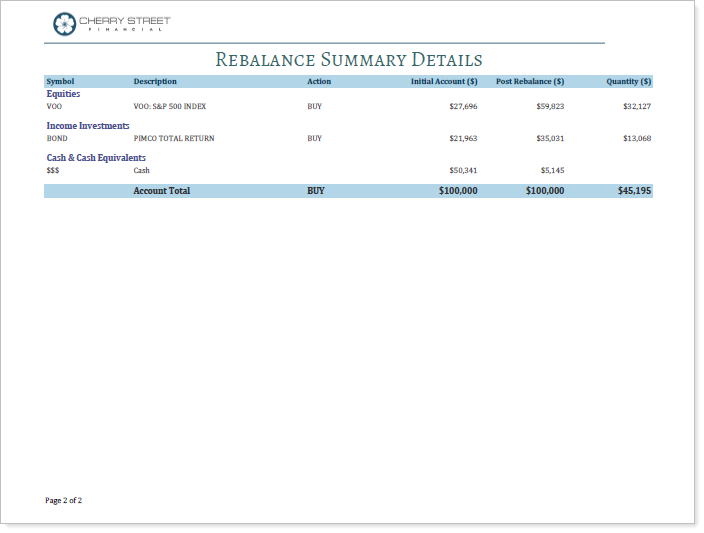

Rebalance Summary Details

This section shows rebalance details in a table that you can configure to include shares, model percentages, dollar differences, short term gains and losses, cash information, and more.

In the Rebalance Summary Details section, you can customize these details:

-

Grouping or single account presentation.

-

Subtotal configuration.

-

Security grouping.

-

Which columns appear, including initial and post rebalance values, share quantity, dollar values, commissions, and transaction fees.

-

And more!

Now, with two new ways to show Rebalance Summary data, you have a new tool to internally review trades and better communicate your trading strategy with your clients.

More Accountability and Control When Trading Restricted Securities

In Tamarac Trading, there are multiple ways to restrict trading in certain securities at the individual account level, group level, or globally throughout your firm. In this release, we introduce an optional additional layer of accountability and control for restricted securities trading. When enabled, these restriction override features offer an improved warning system, more opportunities for documentation, and tools for auditing and oversight. Now, when faced with those special circumstances and one-off trade situations, you have more features to help you do the job.

Restrictions During Trade Approval

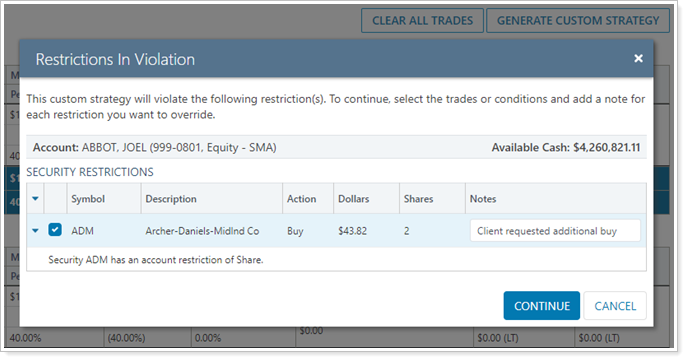

During the trading workflow, your firm may require a trader to document a reason for a trade in restricted securities. One enhancement added during this release is a restriction override warning and documentation feature. After creating a trade that violated a security restriction as a quick trade or custom strategy, the trader will see this detailed summary of the trade and its restricted security:

Now the trader or trade approver will have more information about the security restrictions including the type of restriction and account notes that can provide details and context. Using this information, the trade can be approved or canceled and additional documentation can provide a reason for the trade.

Auditing Restriction Overrides

Auditing trades in restricted securities is now easier with these features:

-

Alerts.The yellow banner at the top of the page lets you quickly download a bulk report that will show account notes, including any notes about restriction overrides.

-

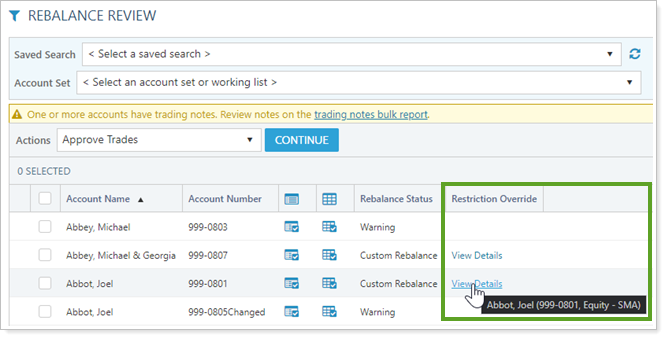

New Restriction Override column.The Restriction Override column is now available on many pages, including the Trade List, Rebalance Review, and Trade Review. This column is available to all users, regardless of whether you enable the additional restriction overrides approval level or not.

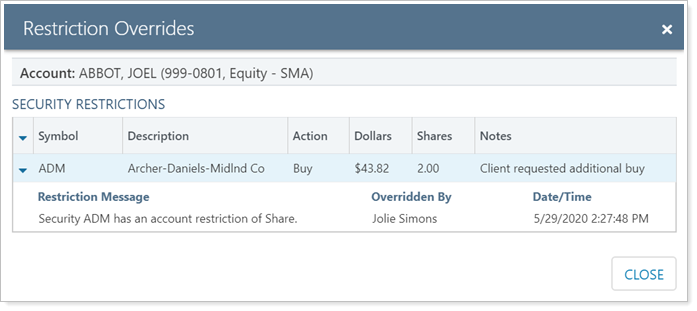

This column contains a link so you can view a comprehensive summary of security restriction overrides.

-

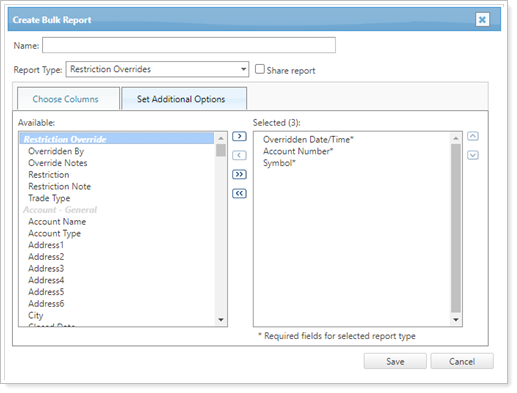

New bulk report and additional columns in other bulk reports.For compliance or auditing purposes, you may want to see details about security restriction overrides in bulk. For this purpose, we created the Restriction Overrides bulk report for comprehensive restriction override information. In addition, a new Restriction Override section of columns now appears in other bulk reports. These columns allow you to see specific details about trades in restricted securities, such as the name of the trader, the date and time of the trade, the restriction that was overridden, and more.

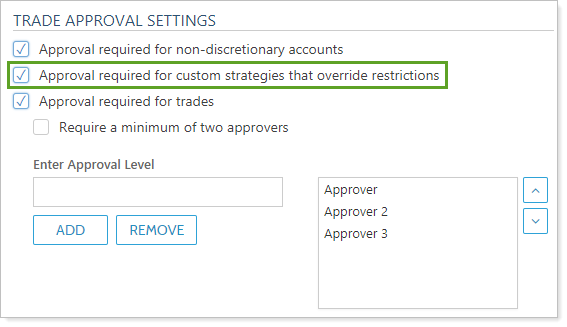

To enable this feature, an administrative user can select the Approval required for custom strategies that override restrictions option in Rebalancing System Settings.

Performance Enhancements

As part of our ongoing effort to improve speed and reliability on the Tamarac Platform, we are continuing to make enhancements under the hood. The table highlights improvements we've made between our last release and this release:

| Improvement Made | Type of Improvement |

|---|---|

| We've changed how our engine accesses indexes and benchmarks. Now indexes calculate 10x faster on average, Allocation Weighted Benchmark returns calculate up to 50x faster, and index-related system slowness has been dramatically decreased across the platform. | Database/Code |

|

On average, reduced sync times by 22% and made data available to firms 15 minutes earlier in the day from Q1 to Q2. These faster, more consistent daily syncs and earlier data delivery stem from:

|

Database/Code |

|

We increased overall platform performance with storage upgrades for higher Input/Output and availability. |

IT/Infrastructure |

|

We eliminated bottlenecks that caused site slowness and ensured more consistent uptime by doubling our processor capacity. |

IT/Infrastructure |

|

We improved performance for two saved search filters to reduce search times by between 80% and 90%. |

Database/Code |

|

Beginning with the June release and over the course of the next few months, we’re adjusting the daily sync of individual firms so Trading and Reporting data sync in parallel. This will shorten the full sync duration for some firms who use both Tamarac Trading and Reporting. This could mean some firms might be able to start trading sooner in the morning. |

Database/Code |

Learn More - Watch the Release Video