Contents

Reporting

Additional Group By Options and Category Columns on the Comparative Review Report

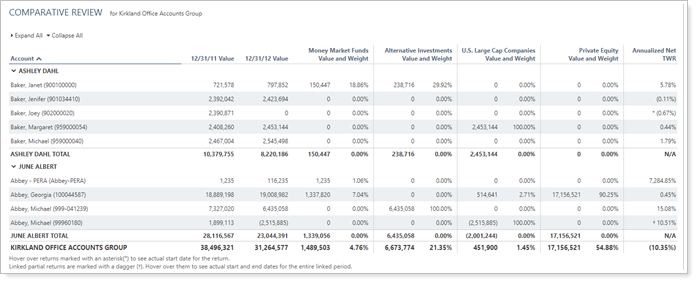

The Comparative Review report allows you to tell the story of how one account or category performed in comparison with an entire group or account set. We're rolling out some enhancements to give you expanded grouping and data accessibility on this report.

> Grouping Enhancements

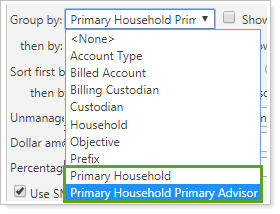

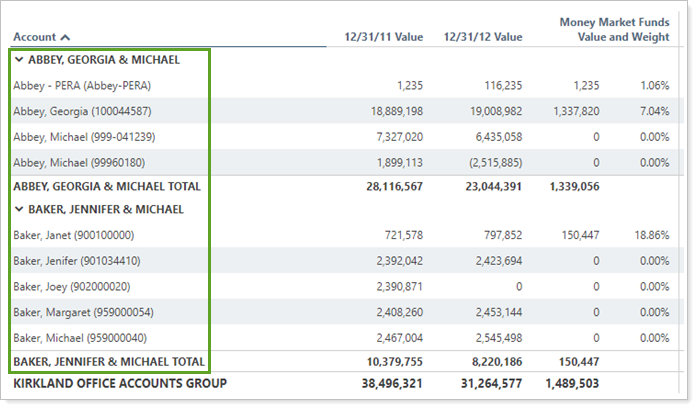

Group accounts by Primary Household Primary Advisor and Primary Household to turn the Comparative Review into a business intelligence-style report that compares performance results with relationships between advisors, Households, and accounts.

For example, you have an account set of the accounts managed by all the advisors in one office. To see all the accounts managed by each advisor, along with performance metrics like TWR and IRR, you run the Comparative Review report on that account set and group by Primary Household Primary Advisor.

-

Group by Primary Household Primary Advisor to compare returns and values for each account or group with which advisor manages the account. Also use this grouping to simply see a grid of which advisors manage which accounts.

This Group by option uses the primary advisor assigned to the Household's Service Team. For more information on assigning primary advisor, see Service Teams.

-

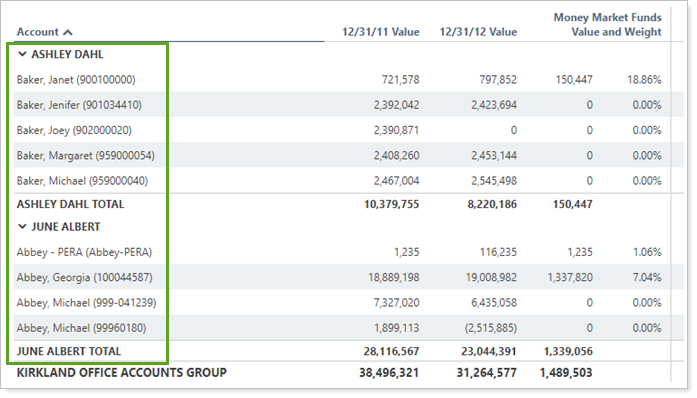

Group by Primary Household to display which Household each account in the group or account set belongs to.

Some grouping options may highlight values that are correct, but that don't add up in subtotal rows.

> Column Enhancements

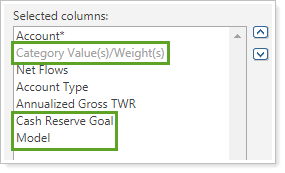

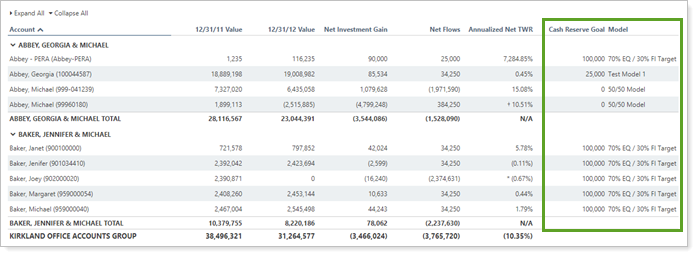

This release adds new data points you can include as columns on the Comparative Review report: Cash Reserve Goal, Model, and Category Value(s)/Weight(s). These columns allow you to compare how an account performs with additional factors like cash reserve goal or how much of one category an account holds.

-

Add Cash Reserve Goal and Model to compare these trading elements with the returns and values achieved by each account or group.

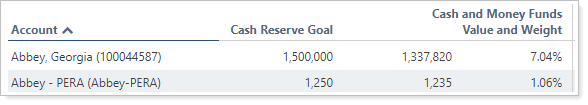

To help provide context about why an account holds a certain amount of cash, add Cash Reserve Goal next to the Category Value or Category Value(s)/Weight(s) column with a cash category type added. This makes it easy to compare how much cash an account actually holds with how much it's intended to be holding.

-

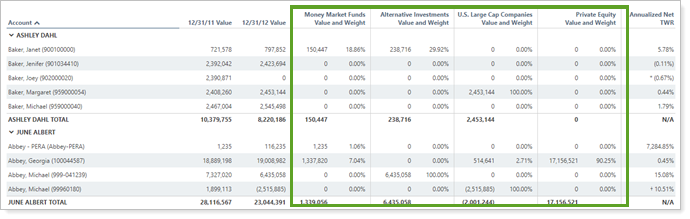

Previously, the Comparative Review report offered Category Value or Category Weight columns as individual choices. These worked well when viewing only category values or weights for each account, but you couldn't see value and weight side by side for each category on the same report.

That's why we've added an additional column, Category Value(s)/Weight(s), which brings together the value and weight data points into one column. This new column allows you to display the value and weight for one category side by side before showing value and weight for the next category for more meaningful and efficient viewing .

This new column behaves like Categories by Value and Categories by Weight: When you add the Category Value(s)/Weight(s) column, you designate which category type and categories you want to add as columns.

Be aware that the Category Value(s)/Weight(s) column allows you to add up to 15 categories to the Comparative Review PDF report section. However, with each category you add, you'll see two columns: one for value and one for weight. Adding many categories can cause PDF rendering errors.

You'll see these new options in the Comparative Review dynamic report, dynamic Reporting dashboard report, PDF report section, PDF dashboard section, and client view report.

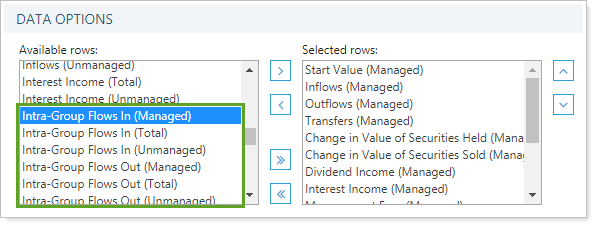

Track Intra-Group Flows With Additional Columns on the PDF Summary Report

In order to add greater granularity and clarity around flows, we've added four columns to the PDF and PDF Dashboard versions of the Summary report:

|

|

These columns allow you to track money movement between accounts and groups.

For example, you create a Summary PDF report section that shows the group and selected direct members. You clear the Include intra-group flows check box, but the subtotals and totals for the selected direct member accounts aren't summing up due to some intra-group flows that aren't displayed.

Add Intra-Group Flows In or Intra-Group Flows Out columns to track those intra-group flows and show how money moved between accounts.

These columns, which are already available in the dynamic Summary report, appear when you clear Include intra-group flows if your firm manages intra-group flows.

For more information about intra-group flows, see Intra-Group Flows.

Integrations

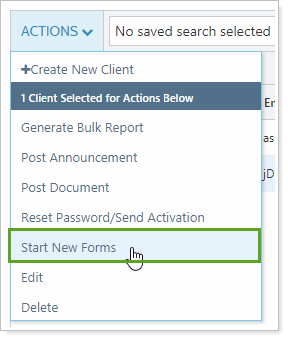

Digital Account Opening With Schwab OpenView Gateway™

When it comes to opening new accounts, filling out the paperwork is often time consuming. You have to look up and enter the account owner's personal details—and it can be easy to make a typo when completing custodial forms. That's why we've added the Start New Forms action for clients who use Schwab OpenView Gateway™.

Start New Forms allows you to securely export Tamarac client and Household data from the Clients/Client Portals page into new account applications for Schwab Advisor Center® instead of manually entering all that information. Digital account opening has never been easier.

Client information sent from Tamarac Reporting to Schwab includes:

-

Primary account owner informationFirst name, middle name, and last name from the client record.

-

Personal informationDate of birth from the client record.

-

Contact informationEmail address from the client record and street/mailing address from the associated Household.

Administrators automatically have access to Start New Forms if your firm has the Schwab OpenView Gateway integration enabled. Other users can be granted permission to access this feature under Roles, then Accounts | Clients/Client Portals.

Enable Digital Account Opening

To use this integration feature, the following must be enabled:

-

Start New Forms must be turned on at the firm level. Contact Tamarac Account Management at TamaracAM@envestnet.com to enable Allow Account Opening for your firm.

-

Your user must have the Start New Forms permission enabled under Accounts | Clients/Client Portals. Administrators automatically have access to Start New Forms.

Learn More about Schwab Digital Account Opening >>

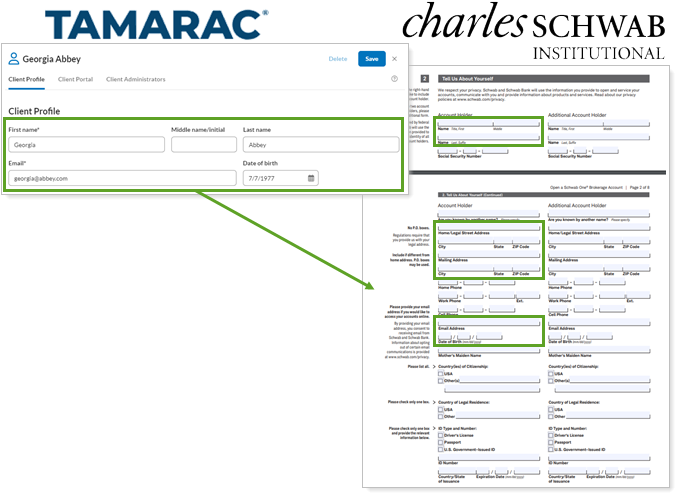

Now Available: Single Sign-On Into the BlackRock Advisor Center

In April 2019, we announced that soon you could use a single sign-on to open the BlackRock Advisor Center directly from Tamarac, with no additional login credentials required. This functionality is now available for all advisors enrolled in the BlackRock integration.

The BlackRock Advisor Center is a free tool for advisors that provides web portal access to practice management solutions such as scenario analysis and risk assessments. This single sign-on streamlines your workflows by reducing time spent logging in between systems.

> Enrollment

Before you can take advantage of the BlackRock SSO, you must have the BlackRock integration enabled. Please contact Account Management at TamaracAM@envestnet.com to enable this functionality for your firm.

For more information on using or enrolling in the BlackRock integration, see BlackRock Integration.

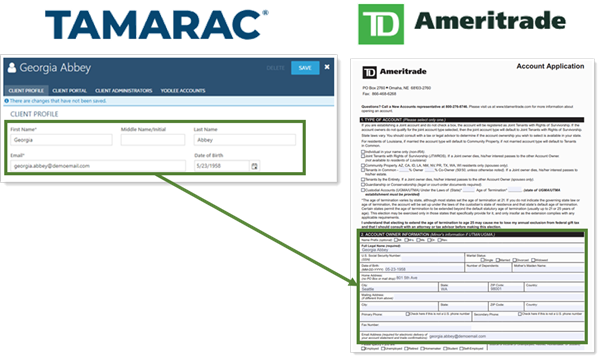

Now Available: Digital Account Opening With TD Ameritrade Veo®

In April 2019, we announced that soon you could kick off the digital account opening process through TD Ameritrade Veo® using Tamarac client data. This functionality is now available to all TD Ameritrade Veo integration users.

Enable Digital Account Opening

To use this integration feature, the following must be enabled:

-

Start New Forms must be turned on at the firm level. Contact Tamarac Account Management at TamaracAM@envestnet.com to enable Allow Account Opening for your firm.

-

Your user must have the Start New Forms permission enabled under Accounts | Clients/Client Portals. Administrators automatically have access to Start New Forms.

For more information on the digital account opening process or enrolling in the TD Ameritrade integration, see TD Ameritrade Veo Integration.

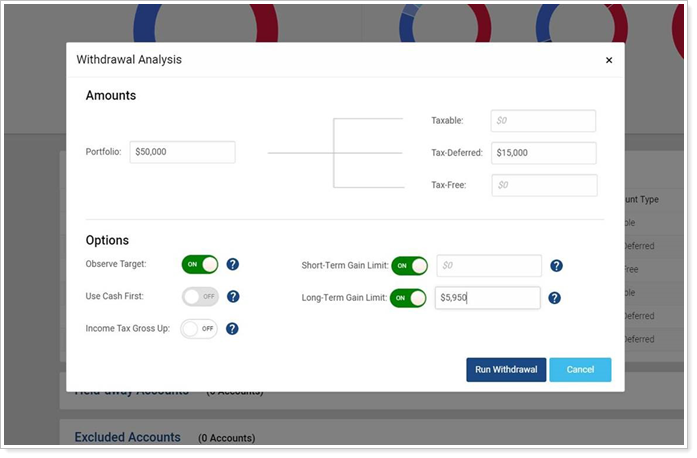

Manage Withdrawals More Accurately With the LifeYield Integration

LifeYield has recently introduced a feature called Income Advantage®. This feature helps advisors create a Tax-Smart Retirement Paycheck® by looking across all the accounts in a Household to suggest an optimal withdrawal strategy, including what to sell and how much to withdraw from each account.

With this release, if you use the LifeYield integration, LifeYield will receive purchase dates and lot-level cost basis data from your Tamarac accounts, allowing for a more accurate reflection of each account. This enhancement helps you coordinate a withdrawal across multiple accounts, allowing you to minimize drift, set gain limits, and improve the client's Taxficient Score by selling inefficiently located assets.

LifeYield’s Income Advantage integration increases your efficiency, allowing you to coordinate management of multiple accounts and Household portfolios across both Tamarac and LifeYield with seamless integration of analytics and tax optimization reports based on Household membership, holdings, and asset location.

To learn more about Tamarac's LifeYield integration, see LifeYield Integration.

Learn More - Watch the Release Video