Contents

Reporting

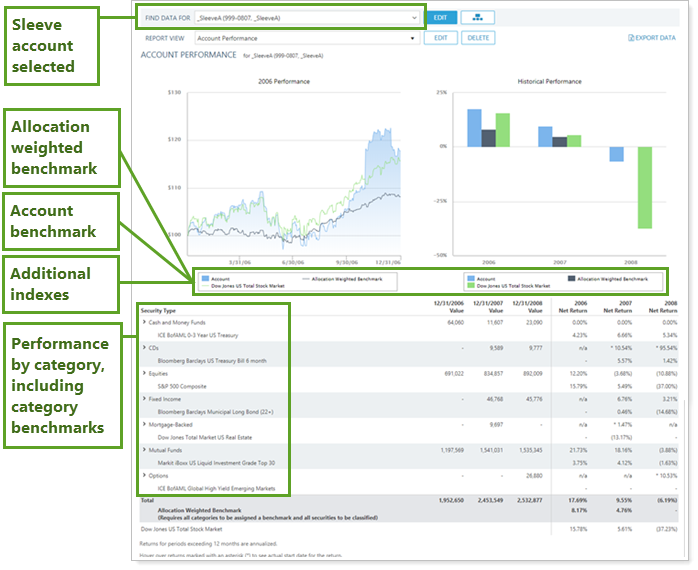

Introducing Sleeve-Level Reporting

Introducing Sleeve-Level Reporting

We first introduced sleeve-level reporting to you in February. Now, after beta testing and refinement, this feature is available widely to help you view performance in your sleeve accounts.

When you have accounts where holdings are sorted into different sleeves, such as when they are managed differently or are based on different strategies, you need to track transactions, holdings, and performance for each sleeve independently to see how each component contributes. Typically, firms that manage these types of accounts spend a substantial amount of time manually maintaining sleeve account data. This type of manual maintenance can be not only costly, but potentially error-prone.

Tamarac is thrilled to introduce our new sleeve reporting offering, which creates and maintains sleeve accounts automatically, groups them for ready reporting, and even handles unclassified holdings effortlessly. Through a seamless integration with Tamarac Trading, you can designate specific Security Level models and accounts as the basis for creating and updating sleeves with every sync.

Important

Once enabled for your firm, sleeve-level reporting cannot be disabled.

> How Sleeve-Level Reporting Works

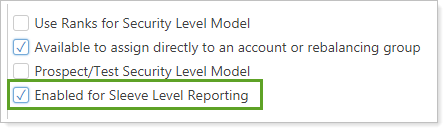

Once you've determined that sleeve-level reporting is right for you and your clients' circumstances, you'll set up your Security Level models—which serve as a record of your sleeves—and enable them for sleeve-level reporting.

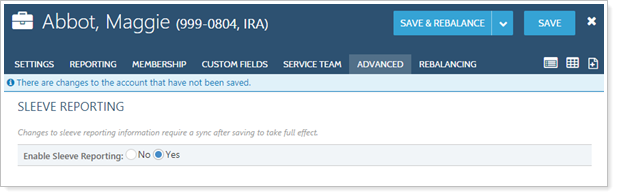

Next, you'll enable the individual accounts for sleeve-level reporting.

To complete the process, log trades in the account and run a sync. This creates your sleeve accounts, which you can then use for reporting.

You may also use the upload feature to create sleeve accounts and specify sleeve allocations.

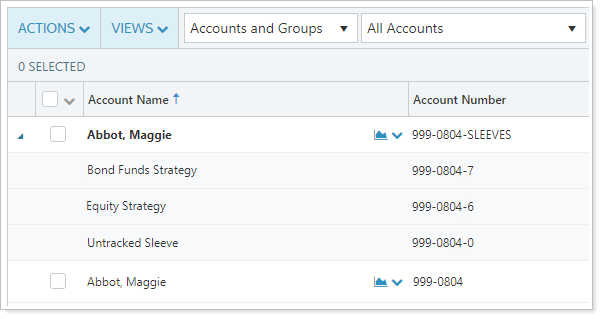

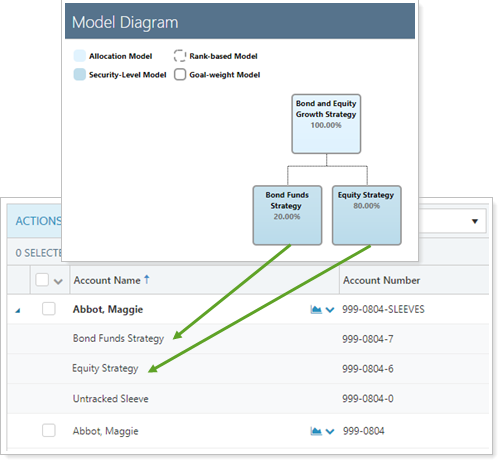

> How Sleeve Groups and Accounts work

When created, Tamarac generates a sleeve group for each parent account and creates one sleeve account within that group for each Security Level model assigned to that parent account. One additional account is also created that aggregates all holdings not assigned to enabled models, called Untracked.

Sleeve groups and accounts act exactly like any other account for reporting purposes. You can:

-

Automatically create and maintain sleeve accounts based on Security Level models established within Tamarac Trading. For more information, see April 2019 - What's New in Tamarac Trading.

-

Analyze sleeve accounts in performance, holdings, and transaction reports.

-

Assign benchmarks, allocation weighted benchmarks, category benchmarks, target allocations, objectives, and more to sleeve accounts individually, or use multi-edit to apply settings across many sleeves at once.

-

Add sleeve groups or accounts to Households, groups, and account sets.

-

Upload and evaluate historical sleeve allocations.

> Example: Internal Reporting

An advisor oversees a large account that includes numerous sleeves. The account as a whole is not achieving the expected returns, and the advisor wants to know why.

The advisor decides to evaluate the performance of each sleeve to determine if one or more sleeves is underperforming, and if so, the cause.

In order to evaluate the performance of each sleeve, the advisor enables sleeve reporting for the account. Now the advisor can run performance reports such as the Account Performance report and the Interval Performance report on each sleeve account individually, as well as compare each sleeve with benchmarks and target allocations assigned to each sleeve account, as appropriate.

> Additional Features

Sleeve groups and accounts offer the following additional features:

-

Bulk Upload Data Sets.Add historical transactions data to a sleeve account using the Sleeve Account Allocations upload. For more information on uploading data, see Understanding Bulk Data Uploads.

-

Bulk Reports.Use a Sleeve Account Allocations bulk report to view your sleeve account data in a comma-delimited CSV format. For more information on creating bulk reports, see Understanding Bulk Data Exports.

-

Saved Search Filters.Filter the Accounts page with new sleeve-specific saved search filters that include or exclude sleeve groups, accounts, and parent accounts. For more information on saved searches, see Saved Searches.

-

Permissions.Restrict permissions to add or change sleeve accounts to certain users. For more information on user management, see Learn More About User Management.

-

Account and Group Naming. Rename sleeve groups and accounts and edit the account number, if the automatically generated name and number don't meet your naming standards.

Administrators get access to sleeve-level reporting by default. They can grant other users permission to access this feature under Roles > Accounts | Edit account sleeve level reporting and trading.

> Learn More - Watch the Video

Learn More About Sleeve Accounts and Groups >>

Billing: New Option to Easily Prorate New Accounts Added Between Billing Periods

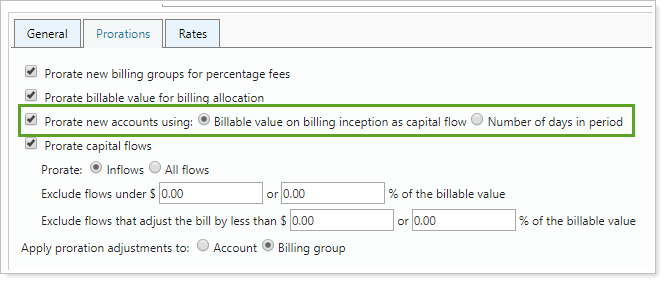

Prorate new accounts using number of days in period is only available when billing in arrears. It is not available when billing in advance or when using average daily or monthly balance.

When new accounts come in partway through a period, you don't want to bill as if you managed their assets for the whole time. Until now, Tamarac has offered the option to prorate new accounts based on initial flow, but the process to ensure that new accounts were prorated correctly could be cumbersome. Prorating new accounts based on initial flow meant that you had to make sure to set a billing inception date to a day the new account has value.

This release introduces another option for prorating new accounts when billing in arrears. Instead of prorating new accounts using billable value on billing inception as capital flow, you can choose to prorate new accounts based on the number of days in the period.

Prorating new accounts using number of days in period:

-

Eliminates the need to set a billing inception date for every new account.

-

Enhances flexibility by allowing you to prorate new accounts independent of capital flows.

-

Improves transparency on the billing statement by adding a section for new account adjustments.

By default, Tamarac sets Prorate new accounts based on to Billing inception as capital flow, which calculates new account prorations as it did before. This ensures that:

- All existing billing definitions will continue to function exactly as they always have.

- None of your existing billing definitions or billing history will be changed with this update.

- When you run billing in the future, Tamarac will still continue to calculate prorations as it always has.

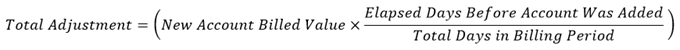

> How the Calculation Works

When you prorate new accounts using only the number of days to prorate the fee, Tamarac calculates the total adjustment (excluding any additional fees or adjustments) as:

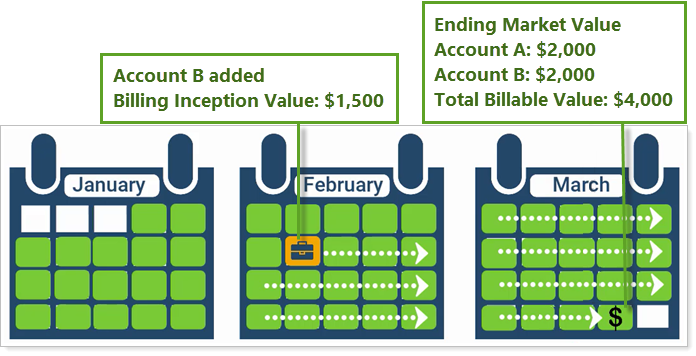

Example: Calculate by Prorating Fee based on Number of Days

A billing group contains two accounts: Account A and Account B. Account B is a new account that was opened 23 days into the period with a $1,500 value. At the end of the billing period, each account has an ending market value of $2,000, giving the billing group a total billable value of $4,000.

Calculating the fee using a simple number of days proration produces a total fee of $8.75, as detailed below:

Billing Group Values at the End of the Period:

- Account A: $2,000

- Account B: $2,000

- Total Billable Value: $4,000

- Allocation: 50% to each account

New Account Details:

- Billing inception value: $1,500

- Billing inception date: 23 days into the billing period

To calculate the total fee:

- Calculate the gross fee

- Calculate the adjustment amount

- Apply the adjustment to the gross fee

| Calculate the Gross Fee | |

|---|---|

| Billable value: | $4,000 |

| Annual rate: | 1% or 0.25%/quarter |

| Gross quarterly fee: | $4,000 × 0.25% = $10.00 |

| Billed value for each account: | $10.00 × ($2,000/$4,000) = $5.00 |

| Calculate the Adjustment Amount | |

| Billed value: | $5.00 |

| Elapsed number of days in period: | 23 |

| Total number of days in period: | 92 |

| Calculate adjustment amount: | $5.00 × (23/92) = $1.25 |

| Apply New Account Adjustment to Gross Fee | |

| Total fee: | $10.00 - $1.25 = $8.75 |

This new calculation will not impact any other proration options applied to the billing definition. You can use the new account proration option on its own or in conjunction with other prorations.

> See New Account Prorations in Billing History

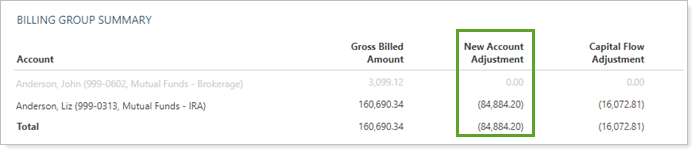

Billing history reflects new account prorations in the New Account Adjustment column. This column displays the proration discount amount applied to any applicable accounts.

You can also add new account proration amount to the Account Billing History bulk report by adding the New Account Adjustment Amount column.

> Include the Adjustment on the Billing Statement

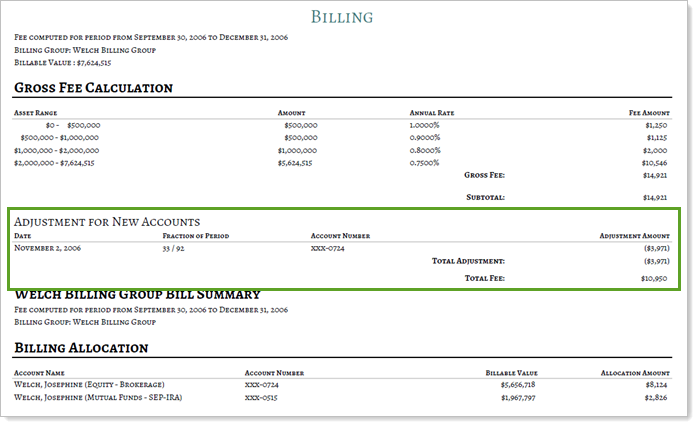

In the past, Tamarac swept new account adjustments into capital flows adjustments on the billing statement. While the calculation was correct, this didn't always clearly reflect to clients why the adjustment was applied.

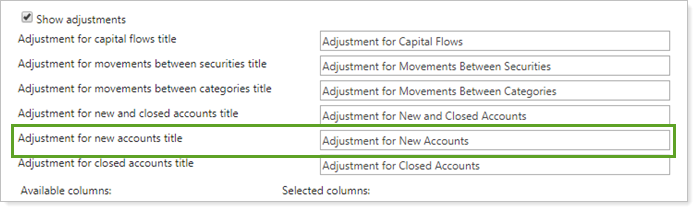

When you use the new account proration option, billing statements with applicable new accounts display a line item that details the adjustment amount for new accounts. This provides greater transparency to clients by clearly showing which adjustments went into the total fee.

To include adjustments on the billing statement template, select Show adjustments or Show adjustment details.

New Security Capital Call Dates Upload Data Set

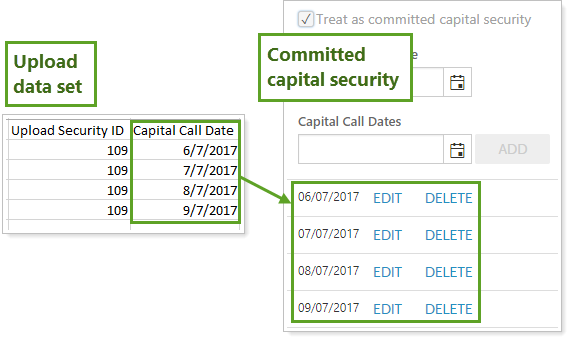

As you already know, Tamarac allows you to increase efficiency in your daily workflows. One of these efficiencies is the ability to upload data in bulk. After this release, you'll have the additional option to upload capital call dates in bulk.

When you have many clients with committed capital securities, the new Capital Call Dates upload data set allows you to add call dates to one or more committed capital securities more efficiently.

You cannot edit or delete existing call dates using the Capital Call Dates upload.

To successfully upload, include either the Symbol or Upload Security ID column in addition to Capital Call Date.

For more information on using capital call dates, see:

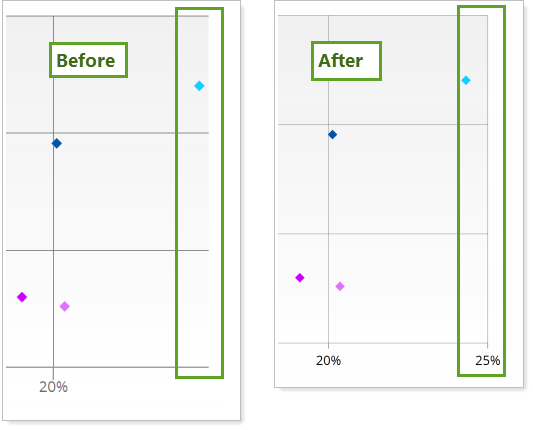

Clarified Account Analytics X-Axis Tick Marks

We've updated the Account Analytics Risk vs. Return chart to make it easier to interpret results that land on the right side of the chart. Previously, the right side of the chart appeared cut off, making results that fell into that section ambiguous. Now the chart includes a clear final x-axis value, tick mark, and closing line, ensuring that you can readily interpret all data.

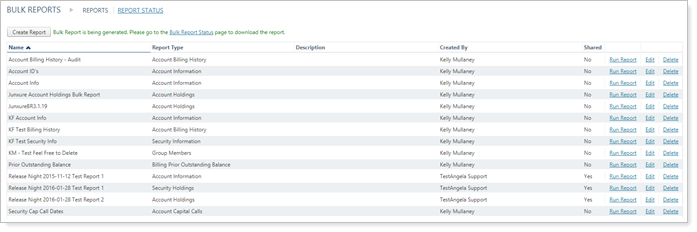

Alternating Row Colors on the Bulk Report and Bulk Report Status Pages

We heard you when you told us that it's sometimes difficult to track columns and rows across bulk report pages when you have many items listed. That's why, with this release, we've made it much easier to scan the Bulk Reports and Bulk Reports status pages by adding alternating colors to rows.

Tip: To sort by columns by ascending or descending value, click the column header.

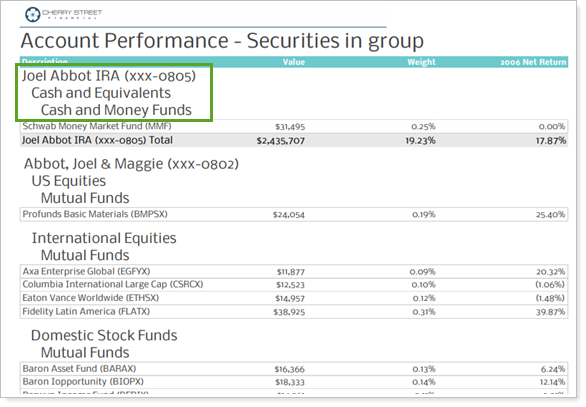

Additional Options When Grouping By Account on the Account Performance Report

As part of our commitment to enhancing your reporting experience, we've enhanced the grouping options on the Account Performance report. Before, if you wanted to Group by account, you couldn't group by the second and third grouping levels. Now you can group by account and also group up to two additional grouping levels.

This allows you to avoid having to create separate pages for each account on the Account Performance report. Instead, you can group accounts in-line with additional grouping options added below.

Integrations

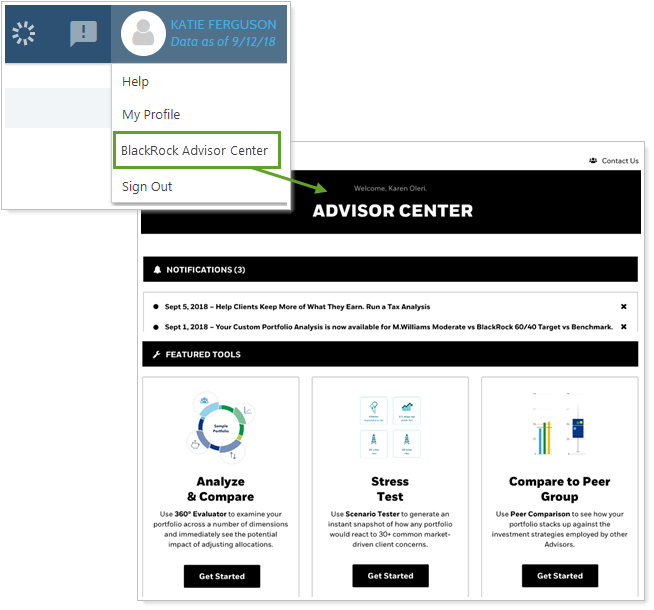

Coming Soon: Single Sign-On From Tamarac to BlackRock Advisor Center

Coming Soon: Single Sign-On From Tamarac to BlackRock Advisor Center

Coming soon, Tamarac will introduce single sign-on from Tamarac into the BlackRock Advisor Center as the first step in our integration partnership. This partnership, which will integrate BlackRock Aladdin Wealth Tech’s technologies into the Tamarac platform, enhances the investment technology solutions available you and your investor clients.

The BlackRock Advisor Center is a free tool for advisors that provides web portal access to practice management solutions such as scenario analysis and risk assessments. This single sign-on streamlines your workflows by reducing time spent logging in between systems.

To access the BlackRock Advisor Center from Tamarac, hover your mouse over your name at the top of the page and click BlackRock Advisor Center.

> Enrollment

You must have an authorization on file with Tamarac in order to add the integration. If you have not signed an authorization, contact Tamarac Account Management at TamaracAM@envestnet.com.

Open New TD Account Accounts Through Tamarac

Open New TD Account Accounts Through Tamarac

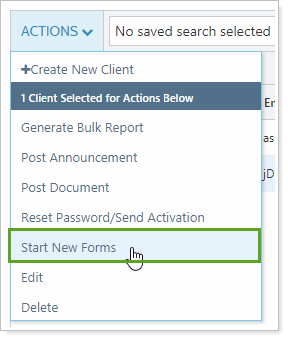

When it comes to opening new accounts, filling out the paperwork is often time consuming. You have to look up and enter the account owner's personal details—and it can be easy to make a typo when completing custodial forms. That's why we've added the Start New Forms feature.

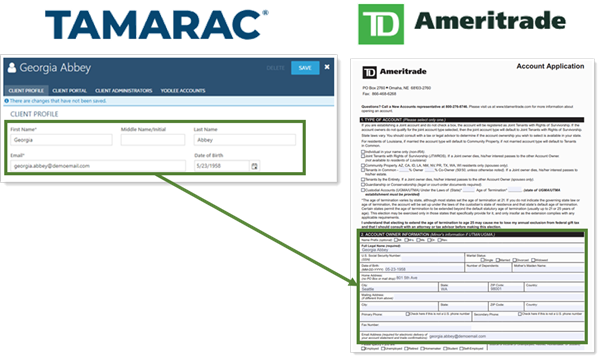

With Start New Forms, opening new accounts has never been easier. Instead of manually entering client information, you can securely import Tamarac client and Household data directly into TD Ameritrade Institutional's Veo One® forms directly from the Clients/Client Portals page.

Client information sent from Tamarac Reporting to TD Ameritrade Institutional's Veo One® platform includes:

-

Primary account owner informationFirst name, middle name, and last name from the client record.

-

Personal informationDate of birth from the client record.

-

Contact informationEmail address from the client record and street/mailing address from the associated Household.

Administrators automatically receive access to Start New Forms if your firm has TD Ameritrade Institutional's Veo One® integration enabled. Other users can be granted permission to access this feature under Roles, then Accounts | Clients/Client Portals.

> Enrollment

This feature must be turned on for your firm. If you're interested in having Start New Forms enabled, contact your Support Team.

Before you can take advantage of Start New Forms, you must have TD Ameritrade Institutional's Veo One® integration enabled. For more information about enrolling, see TD Ameritrade Veo Integration.

Easier Login to Tamarac From Single Sign-On Services

For those of you who use single sign-on (SSO) services to manage logins, including the Tamarac login, we've made it a little easier to access Tamarac. Previously, Tamarac requires users—you and your clients—to enter credentials the first time users log in to Tamarac through an SSO—credentials that you and your clients may not know.

To make it easier to use SSO services to log in to Tamarac, Tamarac now recognizes users by email address on first login, skipping the request for credentials. If this fails, you and your clients will still have the option to enter credentials to complete the first login.

> Enrollment

To use this integration, contact Tamarac Account Management at TamaracAM@envestnet.com.

Services and Support & Training Center

Smart Help Tool Now Available for On-Demand Information About Settings and Fields

Smart Help Tool Now Available for On-Demand Information About Settings and Fields

We're always looking for ways to put the information you need to succeed within easy reach, whether it's the latest performance numbers, a breakdown of firm revenue, or client relationship mapping.

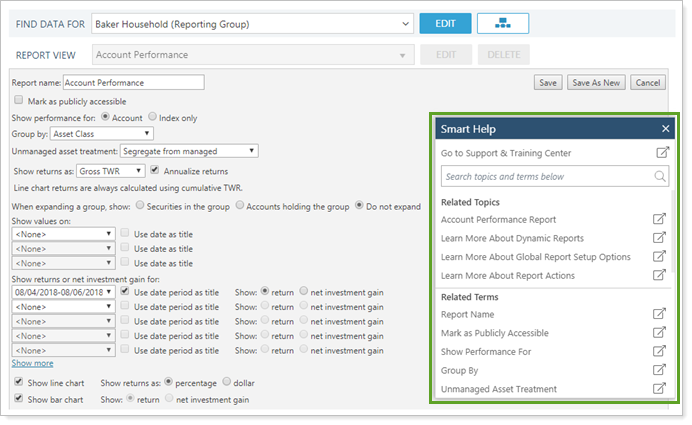

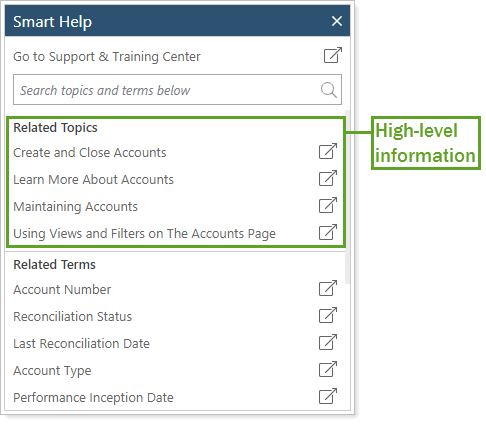

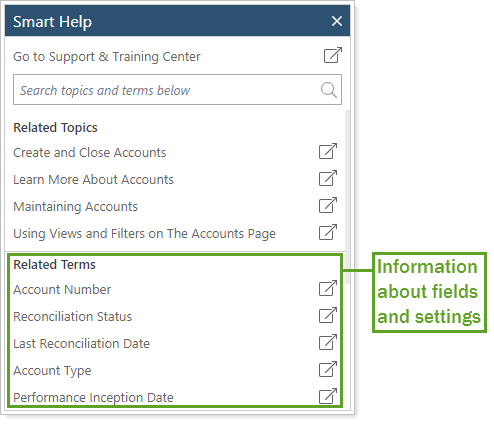

In keeping with our commitment to giving you the right information at the right time, we are pleased to introduce smart help. Smart help appears throughout Tamarac and provides direct links to the Support & Training Center and e-learning content that's relevant to the page you're working on.

Smart help answers questions like "What's the difference between showing return versus net investment gain on an Account Performance report?" and "What happens when you combine group positions on a holdings report?" This tool allows you to:

-

Search the available list of topics to quickly find a topic, setting, or field.

-

Access on-demand guidance for important workflows and tasks, such as the quarterly billing process or creating a group on the Accounts page. Each link takes you directly to a related page in the Support & Training Center.

-

Dive into field-level help to show you what a setting does and how you can use that setting to get the results you want. These links take you to our Data Dictionary for more granular information.

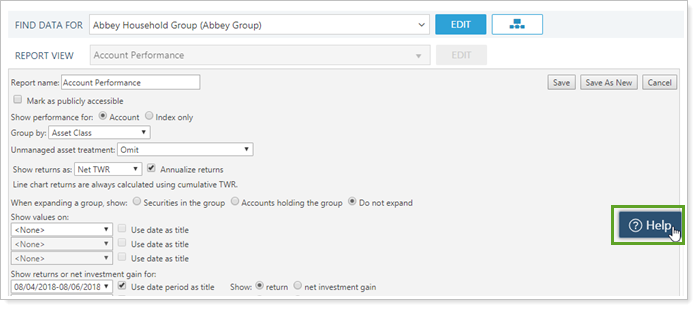

To access the smart help tool, hover your mouse over the tab on the edge of the page. Click Help to open the full smart help tool.

We'll be continuously updating this feature throughout Tamarac on an ongoing basis to keep the topics and information fresh. If you notice a page without smart help yet, don't worry—it's coming soon.

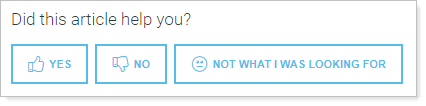

We're here to help! If you don't find the answers your looking for, try using the tools at the bottom of each page in the Support & Training Center to provide feedback. We review each submission and use this feedback to improve.

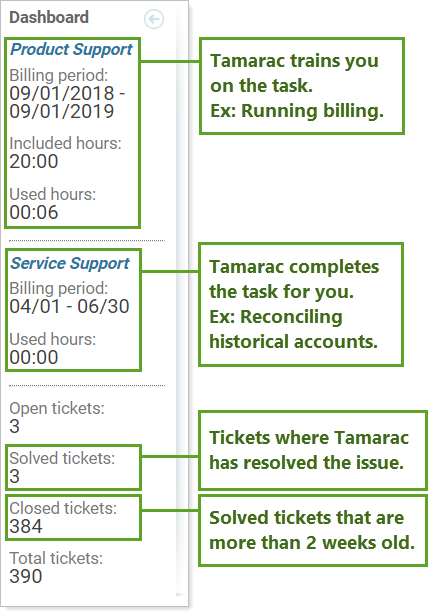

More Granular Support Hour Data Available on the Updated Support Management Dashboard

One reason you love Tamarac is our exceptional support. You can call us to get a solid answer for anything Tamarac-related, ranging from running a report to dealing with underlying data issues. Now it's easier for you to tell how much of your support time goes to product-related issues and how much goes to service-related issues. This helps you identify where additional training might help reduce support calls.

For example, if you notice a substantial number of product-related call hours, that might indicate firm users could benefit from additional training. On the other hand, if all your support calls go to service-related issues, that could indicate that your team is contacting support to handle tasks that could be more efficiently handled internally.

> What Qualifies as a Product Support Issue vs. a Service Support Issue?

| Product Support Issues | Service Support Issues | |

|---|---|---|

| What Qualifies | Tamarac Support trains you on how to complete a task. | Tamarac Support completes the task for you. |

| Examples |

|

|

Product Support is tracked for the total number of annual product support hours available to your firm.

Service Support is tracked for quarterly service support hours used. If you want to review total annual hours used, consult your Tamarac invoice for previous support service hours used, or contact your dedicated Tamarac Support.

You’ll notice we’ve updated the Support Management dashboard to reflect these updates. We've added:

-

Sections to split out Product Support time and Service Support time.

-

Sections to split out Solved Tickets and Closed Tickets, to more transparently communicate with you the status of all the tickets you’ve submitted.

You can access the Support Management dashboard through the Support & Training Center.

Learn More - Watch the Release Video