Contents

Reporting

Sleeve-Level Reporting Coming Soon to Tamarac

Sleeve-Level Reporting Coming Soon to Tamarac

Important

Once enabled for your firm, sleeve-level reporting cannot be disabled.

When you have accounts where holdings are sorted into different sleeves managed by different managers or according to different strategies, you need to track transactions, holdings, and performance for each sleeve independently to see how each component contributes. Typically, firms that manage these types of accounts spend a substantial amount of time manually maintaining sleeve account data. This type of manual maintenance can be not only costly, but potentially error-prone.

Tamarac is thrilled to introduce our new sleeve reporting offering, which creates and maintains sleeve accounts automatically, groups them for ready reporting, and even handles unclassified holdings effortlessly. Through a seamless integration with Tamarac Trading, you can designate specific Security Level models and accounts as the basis for creating and updating sleeve-level groups and accounts with every sync.

> Example: Client Reporting

An account employs two different strategies: a conservative sleeve and an aggressive sleeve. The advisor wants to reassure the client of the account's diversification, as well as report on performance for each sleeve individually.

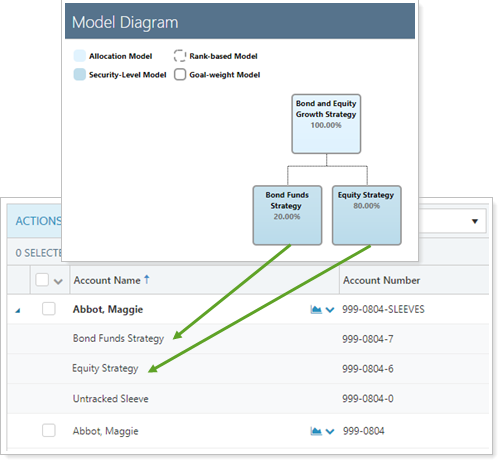

The advisor has already created Security Level models to reflect each strategy. By enabling sleeve reporting for those models and the account, Tamarac automatically generates:

-

A sleeve group identical to the original parent account for performance, transactions, and holdings reporting.

-

Two sleeve accounts within the group identical to the Security Level model allocations for the conservative and aggressive sleeves.

-

One additional sleeve account that aggregates any of the holdings not included in those Security Level models.

Now the advisor can generate PDF reports on the sleeve group to reflect results for the overall parent account, and on sleeve accounts to reflect results for each strategy. This allows the advisor to demonstrate the account's diversification and performance to the client.

> How Sleeve-Level Reporting Works

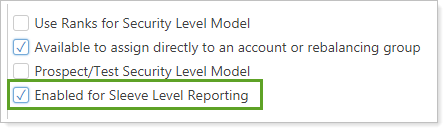

Once you've determined that sleeve-level reporting is right for you and your clients' circumstances, you'll set up your Security Level models—which serve as a record of your sleeves—and enable them for sleeve-level reporting.

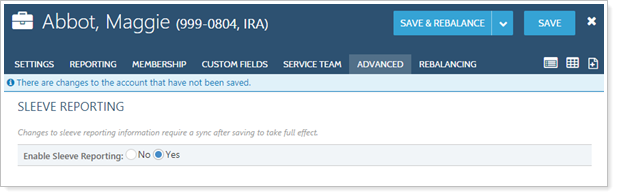

Next, you'll enable the individual accounts for sleeve-level reporting.

To complete the process, create trades in the account and run a sync.

You may also use the upload feature to create sleeve accounts and specify sleeve allocations.

> How Sleeve Groups and Accounts work

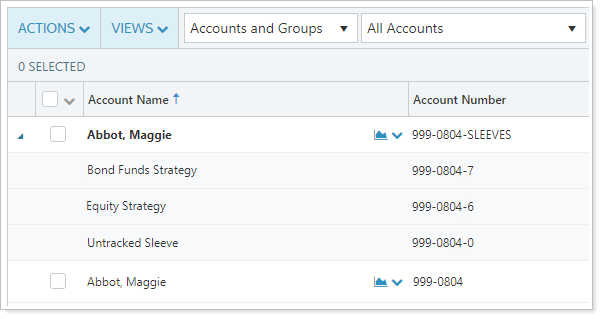

When enabled, Tamarac generates a sleeve group for each parent account and creates or reallocates one sleeve account to the group for each enabled Security Level model assigned to the parent account after each sync. One additional account is created that aggregates all the holdings not assigned to a model.

Sleeve groups and accounts act exactly like any other account for reporting purposes. You can:

-

Automatically create and maintain sleeve accounts based on Security Level models established within Tamarac Trading. For more information, see February 2019 - What's New in Tamarac Trading.

-

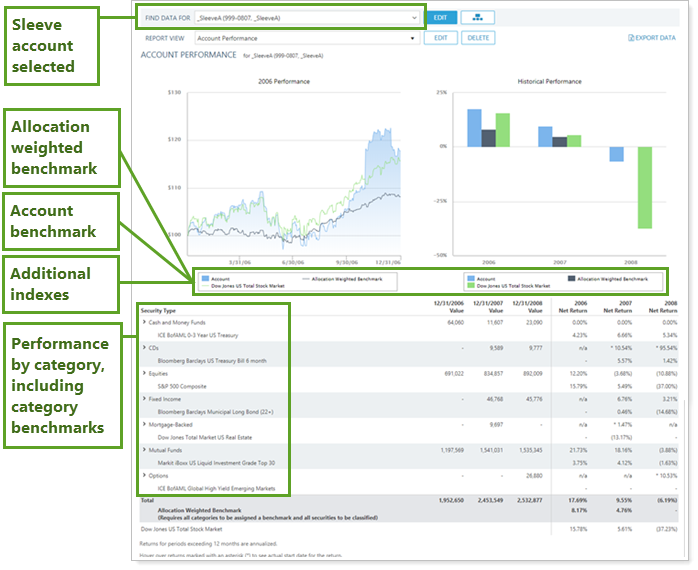

Analyze sleeve accounts in performance, holdings, and transaction reports.

-

Assign benchmarks, allocation weighted benchmarks, category benchmarks, target allocations, objectives, and more to sleeve accounts individually, or use multi-edit to apply settings across many sleeves at once.

-

Add sleeve groups or accounts to Households, groups, and account sets.

-

Upload and evaluate historical sleeve allocations.

> Example: Internal Reporting

An advisor oversees a large account that includes numerous sleeves, each managed by a different person. The account as a whole is not achieving the expected returns, and the advisor wants to know why.

The advisor decides to evaluate the performance of each sleeve to determine if one or more sleeves is underperforming, and if so, the cause.

In order to evaluate the performance of each sleeve, the advisor enables sleeve reporting for the account. Now the advisor can run performance reports such as the Account Performance report and the Interval Performance report on each sleeve account individually, as well as compare each sleeve with benchmarks and target allocations assigned to each sleeve account, as appropriate.

> Additional Features

Sleeve groups and accounts offer the following additional features:

-

Bulk Upload Data Sets.Add historical transactions data to a sleeve account using the Sleeve Account Allocations upload. For more information on uploading data, see Understanding Bulk Data Uploads.

-

Bulk Reports.Use a Sleeve Account Allocations bulk report to view your sleeve account data in a comma-delimited CSV format. For more information on creating bulk reports, see Understanding Bulk Data Exports.

-

Saved Search Filters.Filter the Accounts page with new sleeve-specific saved search filters that include or exclude sleeve groups, accounts, and parent accounts. For more information on saved searches, see Saved Searches.

-

Permissions.Restrict permissions to add or change sleeve accounts to certain users. For more information on user management, see Learn More About User Management.

-

Account and Group Naming. Rename sleeve groups and accounts and edit the account number, if the automatically generated name and number don't meet your naming standards.

Administrators get access to sleeve-level reporting by default. They can grant other users permission to access this feature under Roles > Accounts | Edit account sleeve level reporting and trading.

> Learn More - Watch the Video

Learn More About Sleeve Accounts and Groups >>

Enhanced Summary by Category Report Functionality

Last release we introduced the Summary by Category report as a powerful tool to evaluate performance at the category level. With this release, we expand the capabilities of this report by giving access to even more gain/loss data, aggregating values for assets not assigned to categories, and providing more fine-grained control of what data the report include and how they are displayed.

These changes include:

-

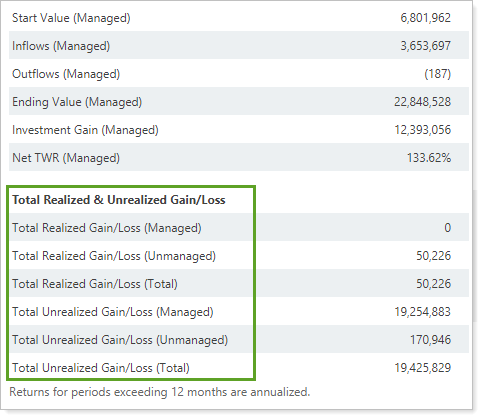

Realized and Unrealized Gain/Loss Rows. To make the report more useful, we've added short-term, long-term, and total realized and unrealized gain/loss rows as available data points. If you select Use the Account Custodian As the Source of Record for Realized Gains Losses, you'll see custodian data for realized gains and losses.

-

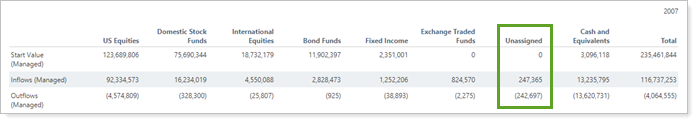

Unassigned column. We know that your firm may not have classified all your securities into every category. With this release, the report displays securities that aren't assigned to a category aggregated in the Unassigned column.

-

Manually Add Columns. To allow for greater consistency when you compare one account with another, you can now use Always include selected categories regardless of value to manually include columns for categories. For example, if you always want to see the Real Estate column, you can add that category to the report for all accounts, whether or not an individual account holds securities categorized as Real Estate.

We've also added the following settings to the Summary by Category report:

-

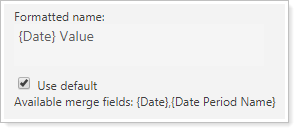

Use merge fields in custom naming for Start Value and End Value.

-

Dollar amount precision (dynamic report only)

-

Percentage amount precision (dynamic report only)

New Data Point: Yield to Worst

For firms that have callable bonds, we know that you make choices about suitability based in part on yield projections. To further facilitate analysis of fixed income securities, we've added another yield data point: Current Yield to Worst (Market).

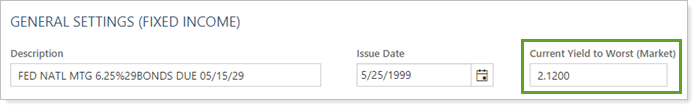

> Track Yield to Worst for a Fixed Income Security

In fixed income securities, you'll see Current Yield to Worst (Market) as an available field that automatically populates through the security detail sync. You can also manually edit the value in the General Settings of a fixed income security.

Note

To update Current Yield to Worst (Market) in bulk, use a Security Information upload.

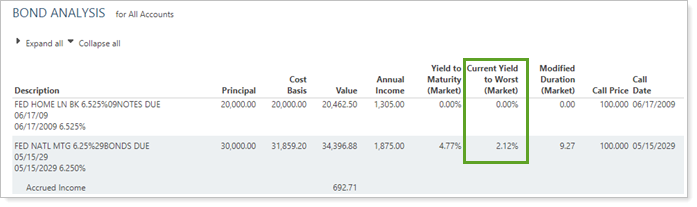

> Report on Yield to Worst

To report on Yield to Worst, you can add the new Current Yield to Worst (Market) column on the Bond Analysis dynamic and PDF report. You'll also find it in bulk reports within the Security - General section and on the client portal as a Client View data point.

Note that:

-

Tamarac reports on Current Yield to Worst (Market) based on the enterprise as-of date, regardless of report date settings.

-

You won't see Current Yield to Worst (Market) included in any total rows because it only applies to each individual security.

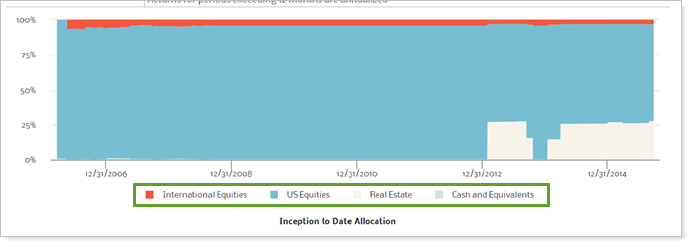

Control the Asset Allocation Over Time PDF Dashboard Report Category Sort Order

The Asset Allocation PDF dashboard report for allocation over time now joins the dynamic and full PDF report in automatically displaying categories sorted by your firm's category sort order. We've made this change based on your feedback to allow you to control the order in which the PDF dashboard displays categories.

Usability

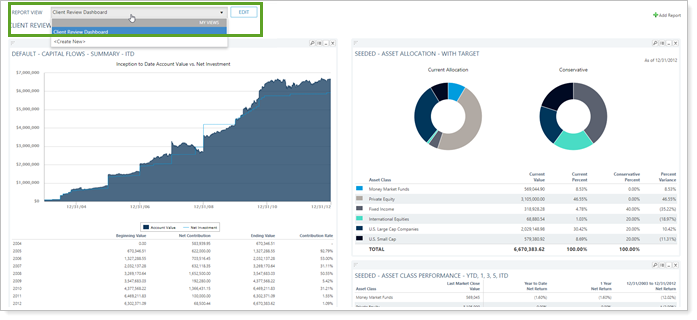

New Out-of-the-Box Default Configurations for Views, Bulk Reports, Searches, and More

New Out-of-the-Box Default Configurations for Views, Bulk Reports, Searches, and More

In the past, new users had to spend time setting up views, searches, custom fields, themes, and more before being able to use Tamarac. For example, before running a Transactions report, a new user had to create the specific view, and maybe even the date periods they want, before generating a really useful Transactions report. For a new user, wading through all the different setting configuration options could be daunting, or at least take substantial time.

Wouldn't it be nice for new users to open up Tamarac and, right out of the box, be able to use views on the Accounts page, run a dynamic report, produce a bulk report, or review the Reporting Dashboard without the setup time?

With this release, that dream becomes a reality.

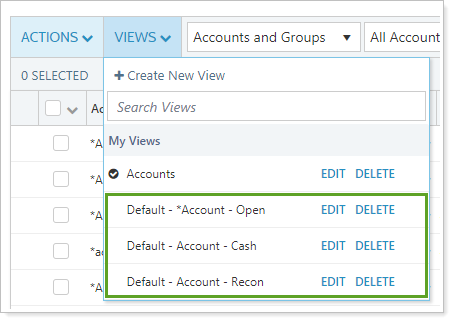

Our expert consultants have created default templates for standard, widely-adopted configurations for different areas across Tamarac, ranging from report views to user management roles. This means that all new users added after this release will open up a dynamic report, for example, and see a few default report views, marked with the prefix Default. Similarly, the Accounts page will include several Default views, as will bulk reports, saved searches, and more.

These default configurations will appear throughout Tamarac, including in:

> Report settings.

|

> Firm Settings.

-

Roles in User Management

These are private default configurations owned by each user. This means that the user can edit, delete, share, or copy any item marked Default.

> Permissions

-

Permissions apply to which default views users get. For example, if a new user doesn't have permission to handle billing, he won't see any billing-related default bulk reports, saved search filters, etc.

-

Existing users will not see these default configurations, but new users added to firms already using Tamarac will get them.

Standardized Data Labeling on Bulk Reports and Client Portal Dashboard Tiles

We've expanded our effort to make data labels more consistent across the board, this time including client portal dashboard tiles and the Account - Aggregate bulk report section. While results remain the same, you and your clients will find it easier to compare data across Tamarac with these standard naming conventions.

Changes include the following:

-

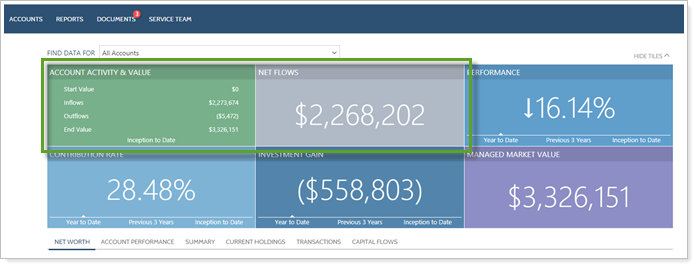

Client Portal Flow reporting. Client View dashboard tiles include Inflows and Outflows, as well as Net Flows.

-

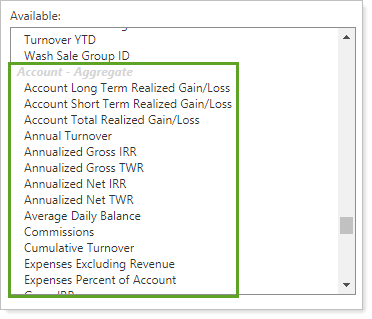

Bulk Report Returns. Returns reported in the Account - Aggregate bulk report section will be more consistent.

-

Renamed Data Points. We've renamed some of the existing data points in the available/selected list to make them match other reports. The renamed data points are:

Feature Old Name New Name Bulk Report Section: Account - Aggregate Account Net Contribution Net Flows Account Contributions Inflows Account Withdrawals Outflows Client Views: Summary Data Report Tile Net Contribution Net Flows Contributions Inflows Withdrawals Outflows Client portal tiles currently using one of these columns will continue to display the existing column name. For example, if you include Net Contributions now, after the release, it will still say Net Contributions, but it will report net flows. You will also have the option to include managed, unmanaged, and total inflows and outflows.

-

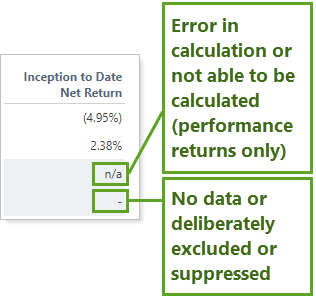

Standardized meanings for Missing Return indicators. On the Account - Aggregate bulk report section and on some client portal tiles, you may have noticed that some cells indicated $0, 0%, or N/A when there were no data to report. With this release, 0 means an actual value or percentage of 0, and Tamarac always marks missing data with the following indicators:

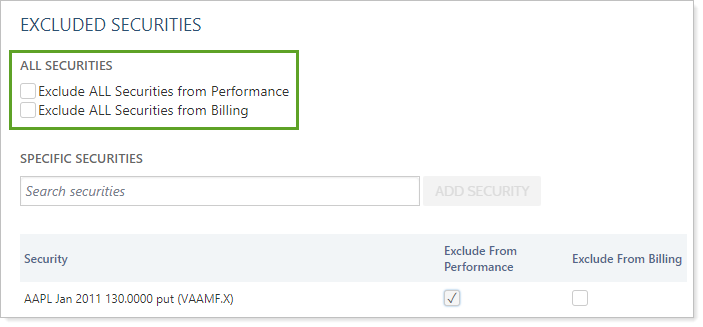

Clearer Labeling for Exclude All Securities Settings

We know that it's not always been easy to tell what happens when you select the check boxes next to Exclude From Performance and Exclude From Billing. To help make it clearer what these account settings do, we've moved and slightly renamed the check boxes to indicate that all securities within the account are excluded when you select either check box. The behavior of these check boxes hasn't changed.

Learn More - Watch the Release Video