Contents

Integrations

Introducing Reconciled Linked Accounts and Streamlined Linked Account Management

If you're like most advisors, you manage investments for clients who have financial relationships outside of your firm, such as outside investment accounts, savings and checking accounts, loans, credit cards, and more. You may also have accounts with custodians that don't come into Tamarac through your regular data feed. Now you can see more detail about some types of accounts, view them alongside your standard Tamarac accounts, and see them in dynamic and PDF performance, holdings, and transactions reports.

Through Yodlee, Tamarac offers three types of linked accounts:

-

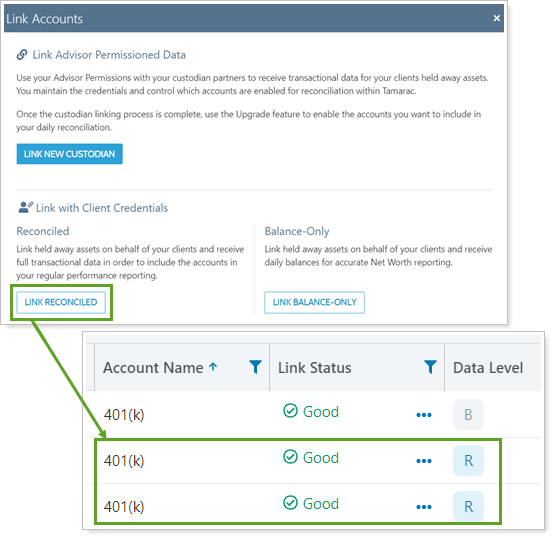

Reconciled Accounts.See these accounts on the Accounts page, add them to reporting groups and Households, and include them in dynamic and PDF performance, holdings, and transactions reports using client credentials.

-

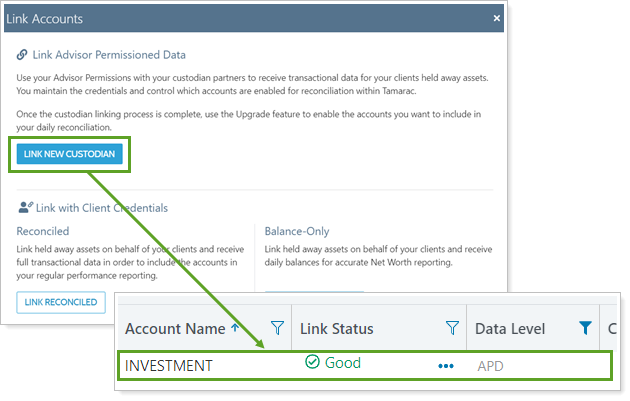

Advisor Permissioned Data Accounts (APD).Use your custodian credentials to bring in accounts that don't flow into your Tamarac data feed from any custodian. These accounts only appear on the Aggregated Accounts page. Convert them to reconciled accounts for full reporting. They cannot be added as balance-only accounts to Households.

-

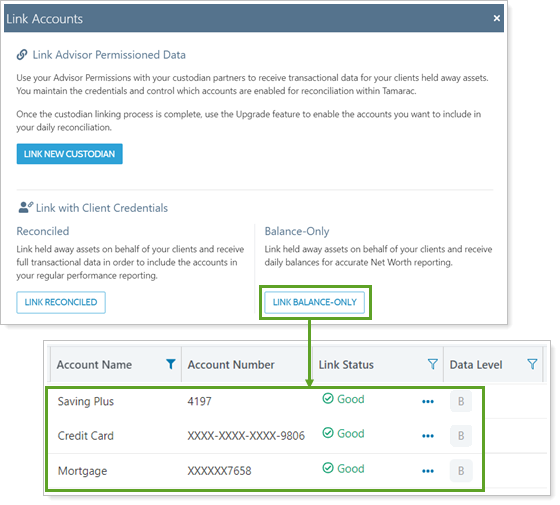

Balance-Only Accounts.Use client credentials to bring in financial data from checking accounts, student loans, mortgages, credit cards, and more, and view them as assets and liabilities. Some balance-only investment accounts can be converted to reconciled accounts for full reporting.

> The Updated Aggregated Accounts Page

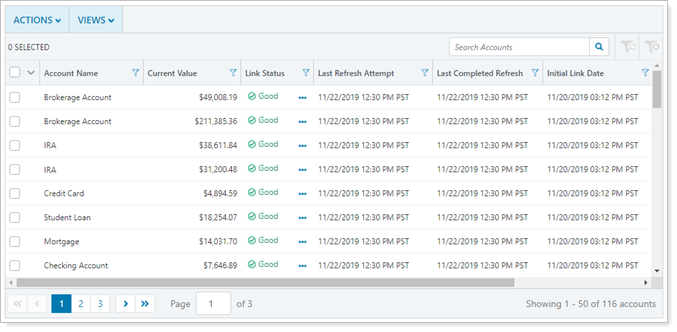

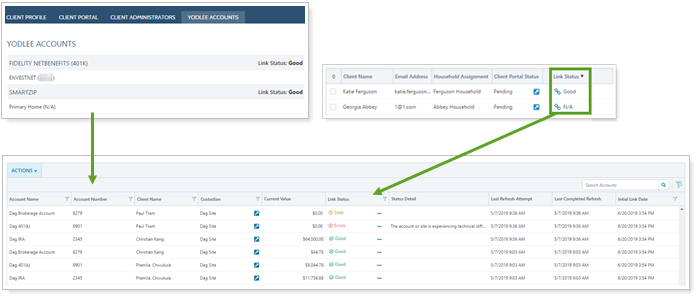

Use the new Aggregated Accounts page to see and manage all the types of linked accounts in one place.

On the Aggregated Accounts page, you can take these actions:

-

Link accounts using your advisor credentials.

Bring in accounts that you manage at an external financial institution using your advisor credentials. Convert the accounts to full reconciled accounts for complete reporting functionality.

-

Link reconciled accounts using client credentials.

Use client credentials to directly link investment accounts from external financial institutions for use on the Accounts page as reconciled accounts.

-

Link balance-only accounts using client credentials.

Use client credentials to add the daily value of assets and liabilities and investment accounts to the Net Worth report and the Household.

-

Upgrade accounts from balance-only to reconciled.

Convert accounts that are currently viewed as assets or liabilities to full reconciled accounts for complete reporting. -

Check link status, troubleshoot issues, and update credentials.

Monitor your linked accounts by checking their link status, fixing incorrect credentials, and troubleshooting issues with multiple linked accounts all in one place. -

Edit balance-only and reconciled account details.Edit balance-only assets and liabilities directly. For reconciled accounts, click the account name to open the account's edit panel.

-

Delete accounts.

Delete balance-only accounts or unlink reconciled accounts.

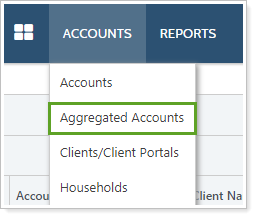

Find the Aggregated Accounts page under Accounts.

> Permissions

You can only use the Aggregated Accounts page to manage linked accounts if:

-

Your firm has the Yodlee integration enabled. For more information, see Yodlee Integration.

-

Your user role has permission to see the Accounts | Aggregated Accounts page and the Accounts | Households page. For more information, see Aggregated Account and Linking Permissions.

Administrators automatically get access to the Aggregated Accounts page.

> Changes to Existing Linking Workflows

The Aggregated Accounts page is intended to be the place where you do all linked account management. You can still add manual assets and liabilities and link balance-only accounts in the Household if you want to. But with this release, the linked account and Yodlee information that previously lived on the Clients page or in a client record moves to the Aggregated Accounts page.

Note

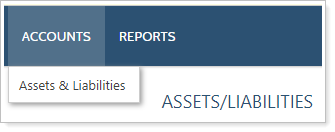

Your clients still add and manage linked accounts and assets and liabilities through Assets & Liabilities in the profile menu of the client portal.

> Learn More

For more information about linked accounts, see Understanding Linked Accounts.

For more information about the new page, see Using Views and Filters on The Aggregated Accounts Page.

For more information on linking accounts with Yodlee, see Yodlee Integration.

Enable eMoney Single Sign-On With a Bulk Report and Upload

The existing eMoney single sign-on (SSO) lets clients navigate smoothly between their Tamarac portal and eMoney, demonstrating your value in keeping their financial plan on track.

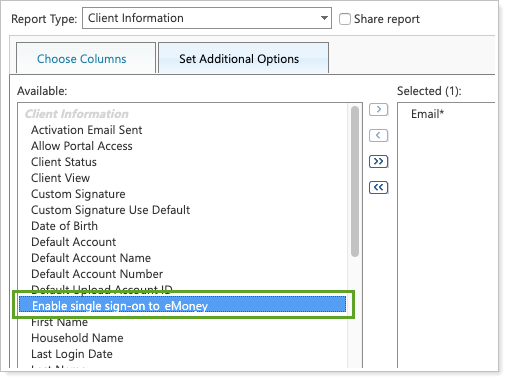

We've made it easier to set up multiple clients at once with the eMoney SSO using the new Enable single sign-on to eMoney column in the Client Information bulk report and upload. Set the column to Yes in the upload to enable the eMoney SSO for clients.

For more information, see eMoney Integration.

Reporting

Clarified Comparative Review Report Subtotals

With this release, we made subtotaling on the Comparative Review report more comprehensive. Now, all data points will display subtotals.

Performance History Report Settings Changes

As part of our continuing commitment to enhancing your reporting experience, we improved the Performance History PDF template with the following changes:

-

New and Renamed Columns.To maintain consistency with other reports, we renamed some existing columns:

Old Name New Name Contributions Inflows Withdrawals Outflows Net Contribution Net Flows When you add these columns and then set Show Return As to Gross TWR or Gross IRR, the report automatically updates the columns to Gross Inflows, Gross Outflows, and Gross Flows.

-

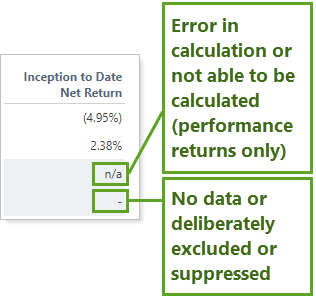

Standardized meanings for Missing Return indicators.Tamarac always marks missing data with the following indicators:

You'll now use Override all missing returns to display to manually set how the report displays missing returns. Learn More >>

-

Clarified Annualized/Cumulative Returns Options.It's much easier to tell whether you're displaying annualized returns, cumulative returns, or both at the same time. Learn More >>

-

Streamlined Category Picker. We made a few adjustments to the category picker to make it easier to find and add categories. To learn more about adding category returns, see Category Returns.

To learn more about the Performance History report, see Performance History Report.

Improved Performance While Running Bulk Reports

We've made some under-the-hood improvements that will keep Tamarac working smoothly while you're running large bulk reports. We think you'll be pleased with way these adjustments improve site performance.

Learn More - Watch the Release Video