Contents

Integrations

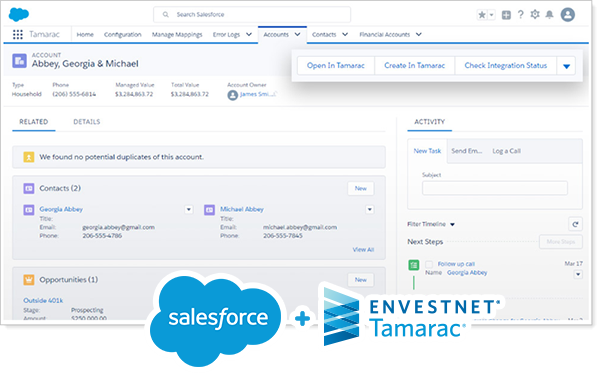

Introducing the Tamarac App for Salesforce

We know that some of you have invested significant time and resources into customizing Salesforce for your firm. That's why, in addition to our own integrated CRM, Advisor CRM, we now offer deep integration between Advisor View and Salesforce via the new Tamarac app.

While we continue to invest in our integrated CRM, Advisor CRM, with an all-new Dynamics 365 coming out in Q1 next year, we know that current Salesforce users will value this powerful new Advisor View and Salesforce integration. The new Tamarac app for Salesforce seamlessly integrates Salesforce with Advisor View to drive greater efficiency, improve accuracy, and give your firm the ultimate portfolio and client management platform. The integration combines the power of Advisor View with your daily Salesforce workflows, such as creating records, maintaining data, and monitoring account values with the click of a button.

With the new Salesforce integration, you can:

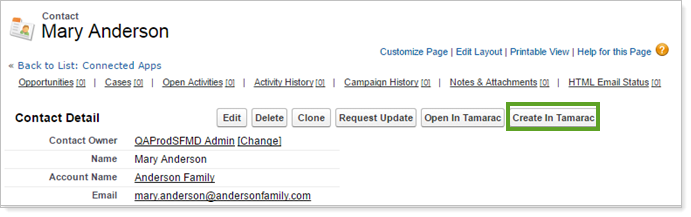

Create Clients and Households Directly from Salesforce

Until now, every time you brought new clients on board, you had to create duplicate records in Salesforce and Advisor View—using valuable time and introducing the opportunity for errors with every entry.

The new Tamarac app dramatically reduces errors and back office time with the Create in Tamarac button, which lets you create individual clients or an entire Household, complete with new clients, in Advisor View directly from Salesforce.

With this integration, you can:

-

Create Households and clients in Advisor View from Salesforce with one click.

-

Automatically populate new Advisor View Households with clients from Salesforce.

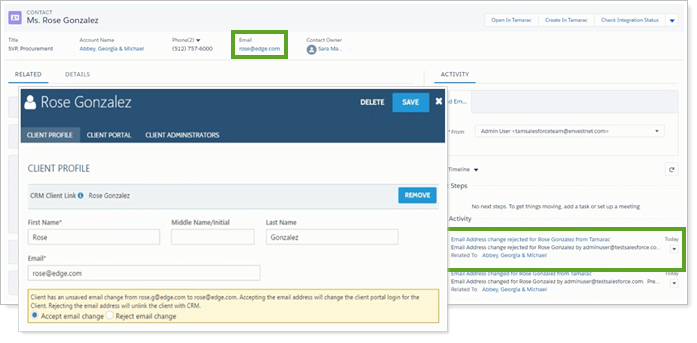

Sync and Document Changes Instantly

Keeping client information—email address, mailing address, and even name—up to date across many systems takes time. Cut that time dramatically with the Salesforce integration, which automatically syncs changes between Advisor View and Salesforce.

With this integration, you can:

-

Instantly sync changes to Household and client information between Salesforce and Advisor View.

-

Track changes made in Advisor View using automatically generated tasks in Salesforce.

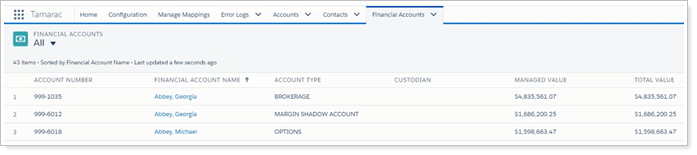

See Tamarac Financial Account Data in Salesforce

Instead of flipping back and forth between your Salesforce and Advisor View windows and having to navigate to corresponding records in each system, the Tamarac app puts detailed financial information from Advisor View within Salesforce. Smart contextual linking from Salesforce opens relevant records in Advisor View, no navigation or searching required.

With this integration, you can:

-

View detailed financial account information from Advisor View in Salesforce.

-

Use the context-sensitive Open in Tamarac button in Salesforce to open the corresponding Advisor View record.

Integration is available for the following Salesforce installations:

-

Classic Sales Cloud

-

Sales Cloud with Lightning Experience

-

Sales Cloud with Custom Financial Account Object

-

Financial Services Cloud

To get started with the Salesforce integration, see our website or contact Account Management at TamaracAM@envestnet.com.

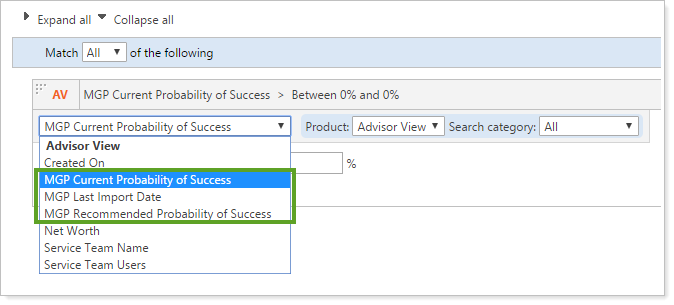

Enhanced MoneyGuidePro® Integration

When it's time to update MoneyGuidePro plans for clients, you're looking to keep accounts updated efficiently and control the data that is passed. With this release, we enhanced the MoneyGuidePro integration to include Household Saved Searches, so you can more efficiently review probability of success and last import date on the Households page.

New MoneyGuidePro-specific filters available in Saved Searches under the Household search type are:

-

MGP Current Probability of Success

-

MGP Recommended Probability of Success

-

MGP Last Import Date

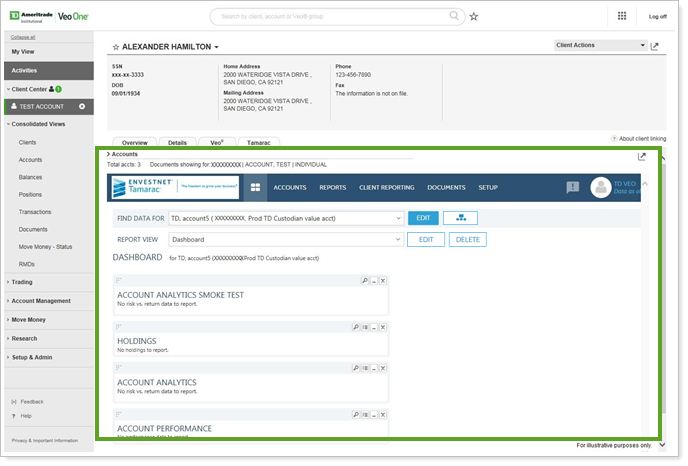

Log In to Advisor View Directly from TD Ameritrade Institutional's Veo One®

The TD Ameritrade Institutional's Veo One® platform brings your Veo integrated third-party technology applications onto one platform with one login, one view, and one unified experience. With this release, Veo One users can use single-sign on (SSO) to open Advisor View in a new tab with the click of a button.

Even better, when you open Advisor View through Veo One, contextual linking will automatically open the account you're already looking at open on the Advisor View Dashboard.

TD Ameritrade Institutional, Division of TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. All rights reserved used with permission.

Usability

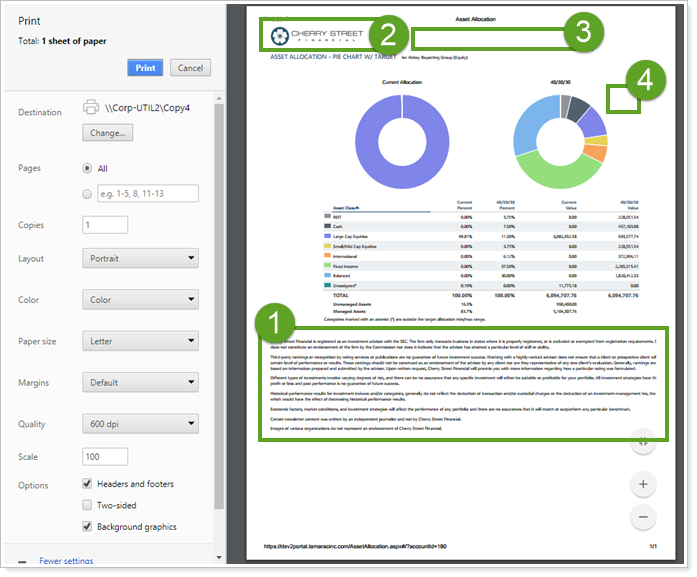

Expanded Dynamic Report Printing Features

When you're in a client meeting, dynamic reports let you flexibly create and display charts that directly address meeting topics. But when you want to print a hard copy of the dynamic report for the client to take home, you hit roadblocks: Compliance has concerns about the lack of a disclosure; Marketing prefers you only hand out documents that are firm branded. And when you print the report, it is not the most visually appealing.

While we have carefully designed PDF reports to provide the best quality printed reporting, we know that there may be unavoidable times, as in that client meeting, when you want to print a dynamic report. For those times, we have added several features to improve the look of printed dynamic reports:

Include custom disclosures Satisfy your Compliance department by providing printed dynamic reports that include fully formatted custom disclosures at the bottom. These disclosures appear on screen, on printed dynamic reports, and in CSV exports for all Holdings, Transaction, and Performance dynamic reports.

Include custom disclosures Satisfy your Compliance department by providing printed dynamic reports that include fully formatted custom disclosures at the bottom. These disclosures appear on screen, on printed dynamic reports, and in CSV exports for all Holdings, Transaction, and Performance dynamic reports.

Show Firm Branding The logo and background color you see on the menu bar in Advisor View are automatically printed in the upper-left corner of the page. To see background colors, enable background graphics when printing from your browser.

Show Firm Branding The logo and background color you see on the menu bar in Advisor View are automatically printed in the upper-left corner of the page. To see background colors, enable background graphics when printing from your browser.

Hidden Find Data For List To clean up the look of your printed report, the Find Data For list on the webpage is hidden when you print.

Hidden Find Data For List To clean up the look of your printed report, the Find Data For list on the webpage is hidden when you print.

Print icon removed To de-clutter the dynamic report on screen and when printed, the print icon has been removed. You can still print as usual through your web browser. When you print, what you see on the screen is what you get on the printed page. The page is not formatted for optimal printing. If you want to customize printed reports, consider using a PDF report.

Print icon removed To de-clutter the dynamic report on screen and when printed, the print icon has been removed. You can still print as usual through your web browser. When you print, what you see on the screen is what you get on the printed page. The page is not formatted for optimal printing. If you want to customize printed reports, consider using a PDF report.

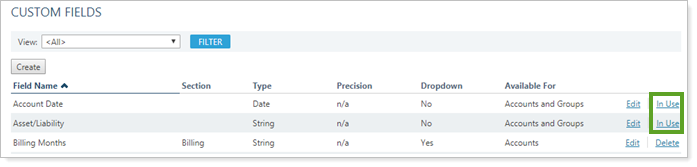

Find Where Custom Fields Are Used With The In Use Report

Have you ever had a time when you wanted to delete a custom field but were blocked because it was marked "In Use"? At the Advisor Summit this year, we heard great suggestions from many of you, including an award-winning suggestion to address this custom field issue. We're pleased to announce that we've incorporated the suggestion into this release of Advisor View.

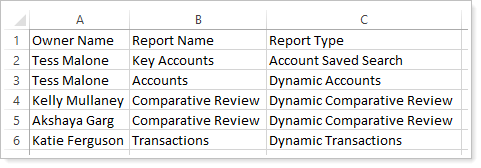

To help you track down where custom fields are used, we added the In Use report, available for all custom fields.

You can find the In Use report for any particular Custom Field by clicking the In Use hyperlink.

The In Use report shows you all the places the custom field is used, allowing you to track down and resolve those instances that are blocking the deletion of a field.

Identify Closed Accounts at a Glance

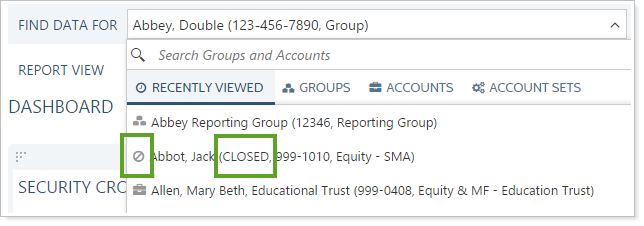

When you're scanning the list of accounts and groups in the Find Data For list, it's always been difficult knowing which accounts are closed and which are open. Now you'll be able to easily identify closed accounts by the new closed ![]() icon, and the account name reads (CLOSED, [your account display configuration]).

icon, and the account name reads (CLOSED, [your account display configuration]).

Slight Changes to Accounts and Groups Settings

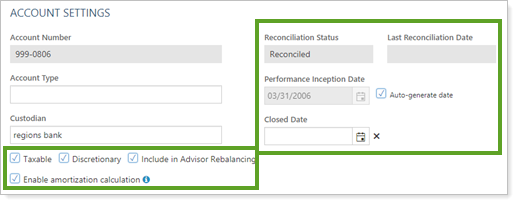

You may notice after the August release that in Account and Group settings panel, the location of some of the fields have changed, including the following:

-

More logical field locations.Some settings fields for Accounts and Groups moved. No functionality changed.

-

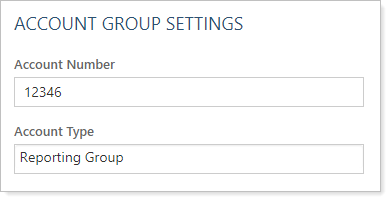

Clearer panel naming.The Group settings panel that was called Account Settings has been renamed Account Group Settings.

-

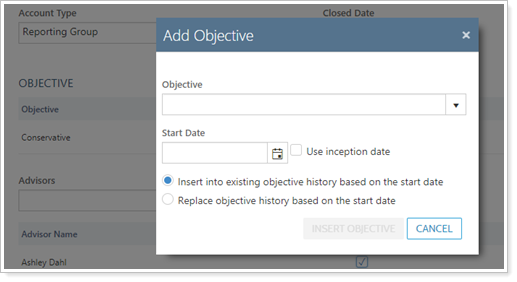

Cleaner Add Objective interface.When you add an objective to an individual account or group, you will notice that the associated settings appear in the Add Objective dialog box.

These changes are designed to improve your user experience by putting settings in the most logical place.

Product Security

Default Client Portal Session Timeout Reduced from 480 Minutes to 15 Minutes

As part of our effort to continually improve security, we reduced the default client portal timeout for your clients from 480 minutes (eight hours) to 15 minutes. This ensures that your data remains secure and protected even if a user walks away without logging out.

If you already have custom timeouts set, those will remain unchanged.

To set a custom session timeout duration, contact your Tamarac Service Team.

Reporting

Improved Allocation Weighted Benchmark Calculation

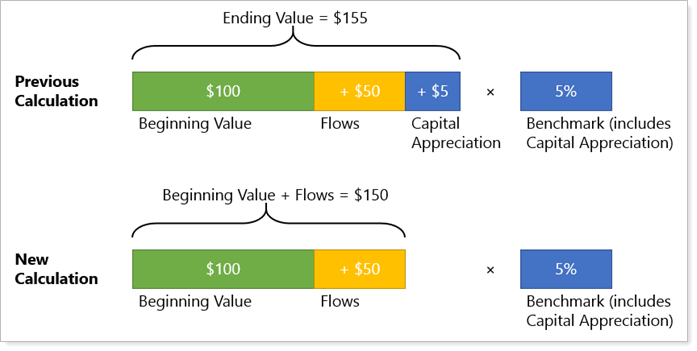

In order to improve the accuracy of allocation weighted benchmark performance reporting, we revised the calculation to better account for capital appreciation, inflows, and outflows.

Previously, the allocation weighted benchmark calculation overweighted gains and underweighted losses.

Now, the calculation has been updated to use the beginning account value. It accounts for any flows, then multiplies by the benchmark. With this change, only the benchmark accounts for performance, ensuring proper weighting of gains and losses.

This change impacts the following reports:

Column Clarification on Amortization and Accretion Report

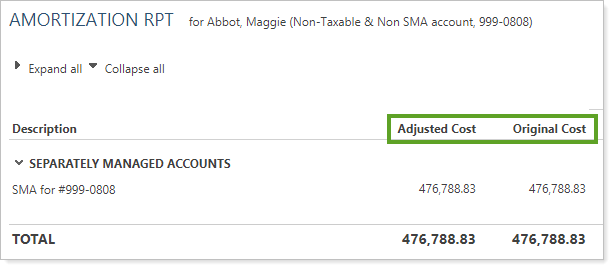

You may have noticed at times that, for fixed income or mortgage-backed securities, the original cost reported in Advisor View did not match the original cost listed with your custodian. This was caused by the way the Original Cost column on the Amortization and Accretion report was calculated. For positions that originated with a buy transaction, the Original Cost column reported the original purchase price. However, for securities receipted in to an account, the Original Cost column displayed not the original purchase price, but the amortized value of the security when it receipted in.

To address this issue, we renamed the old Original Cost column to Adjusted Cost to reflect the fact that it is a calculated amortized value, while a new Original Cost column always shows the original cost basis amount.

For existing reports that already include an Original Cost column, you will not see any change. If you want to see the new Original Cost calculation, remove the old column and replace it with the new Original Cost column.

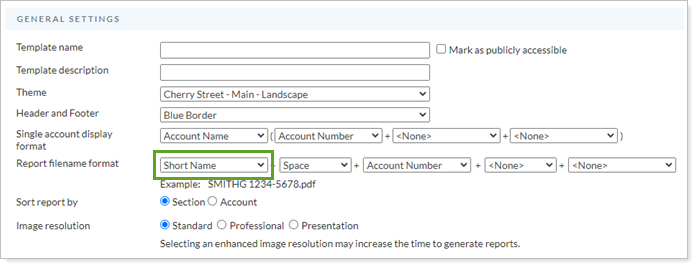

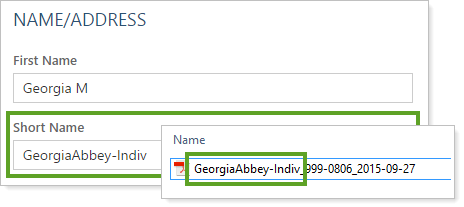

Customize PDF Report Names with the Short Names Field

You may have been frustrated by the limited file name format options if you have ever wanted to generate PDF reports with file names that matched your firm's naming conventions. This release widens your options for PDF naming by adding the Short Name field as a naming option.

The Short Name field is an flexible open field available under the Account and Reporting Group Name/Address panels.

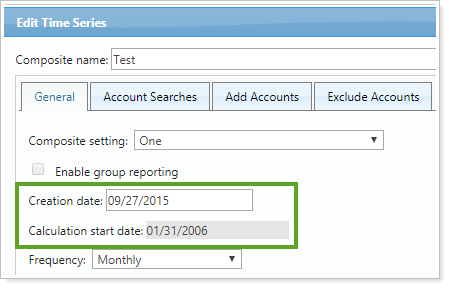

Definitions for GIPS-Related Dates Adjusted

When you use composites, you are setting your firm up for Global Investment Performance Standards (GIPS) compliance. In order to further facilitate that compliance, we have adjusted some composite settings to align more fully with GIPS standards.

-

The Inception Date field previously reported the inception date of the oldest account in the composite. Now the inception date is defined as the start date of the first attempted calculated time series for the composite.

-

The field previously called Creation Date has been more accurately renamed to Calculation Start Date, and is defined as the date as of which time series will be calculated. This field locks when a new composite is first saved.

-

A new Creation Date field has been added that defaults to match the Calculation Start Date, but it can be edited at any time to reflect the actual date that it was decided to use composites to make the accounts GIPS compliant.

Billing

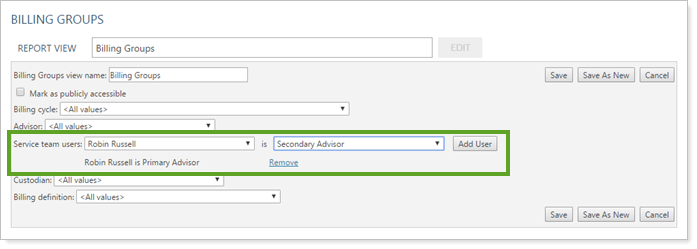

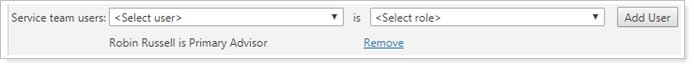

Filter Billing Groups by Service Team

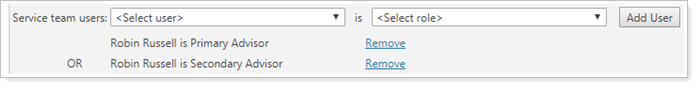

Service Teams allow employees at your firm to serve multiple roles within Advisor View—perhaps Primary Advisor for some Households and Secondary Advisor for others. With this release, you can now filter billing groups by any Service Team members and their specific roles at your firm, allowing you greater flexibility and control over which billing groups you see.

For example, Robin Russell serves as Primary Advisor for the Team Russell Service Team. He is also Secondary Advisor on the Team Anderson Service Team. With the new service team filtering, you can:

-

See only billing groups with Robin Russell as Primary Advisor by adding one service team user filter.

-

See all billing groups with Robin Russell as playing an advisory role—primary or secondary—by adding two service team user filters.

Advisor Services

Timing of the Cost Reconciliation Report Changed

Because custodian data for cost reconciliation is often received after the daily morning sync, the Cost Reconciliation report will now be run at 9:00 P.M. PST as an end-of-day report. This ensures that reconciliation status is fully up to date. The report will be sent to your FTP site. No change is required on your part.

Learn More - Watch the Release Video