Contents

New Client Portal

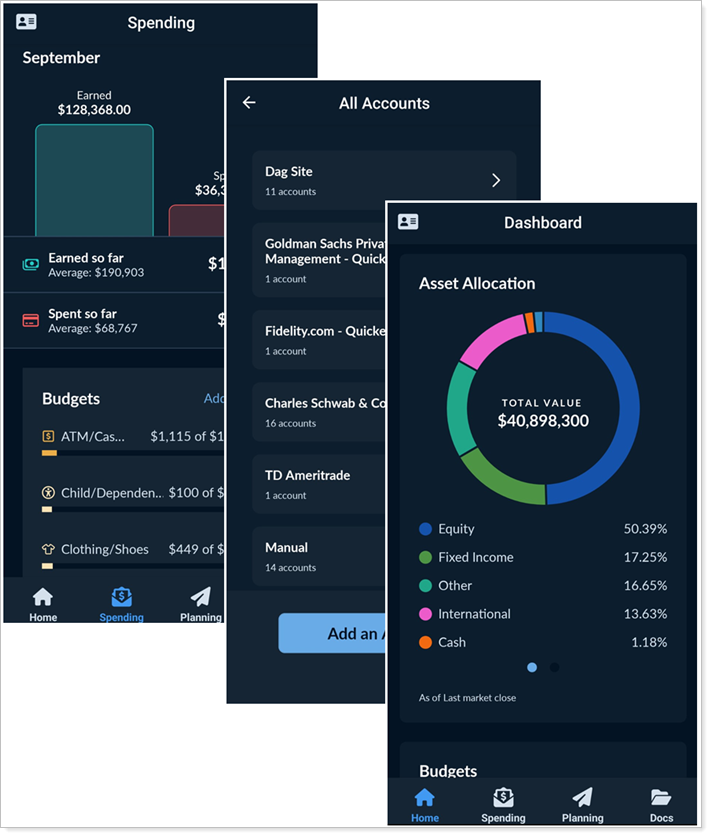

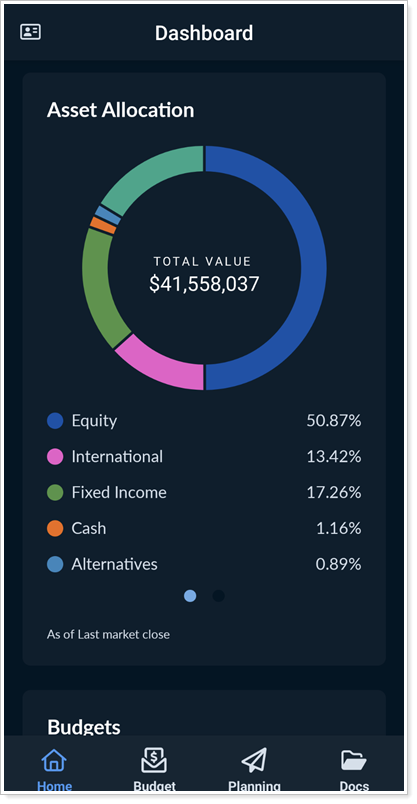

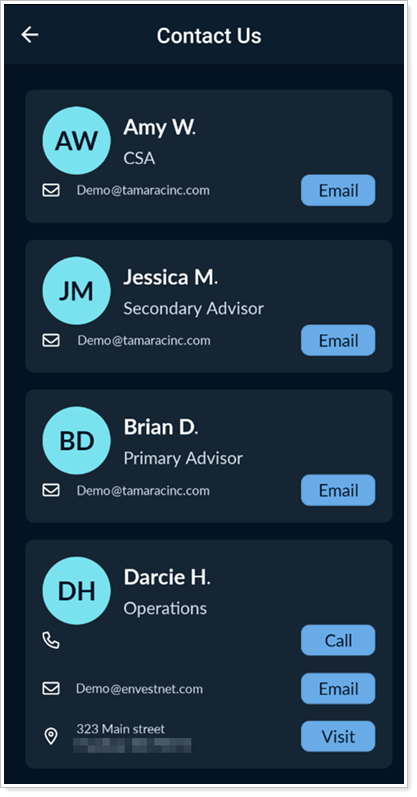

Wow Clients With the New Client Portal Mobile App

In our constantly connected digital world, clients expect to access their financial information anywhere, any time. The new mobile app provides instant access to the client portal, strengthening your client relationships by enabling you to connect and communicate with them wherever they are.

Depending on the specific client portal configuration, the mobile app makes it easier than ever to:

-

See dashboard tiles, based on desktop dashboard widgets.

-

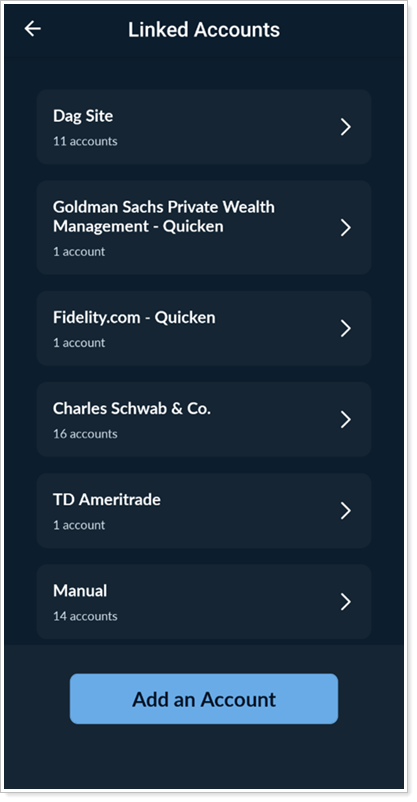

Add, edit, and view accounts, assets, and liabilities.

-

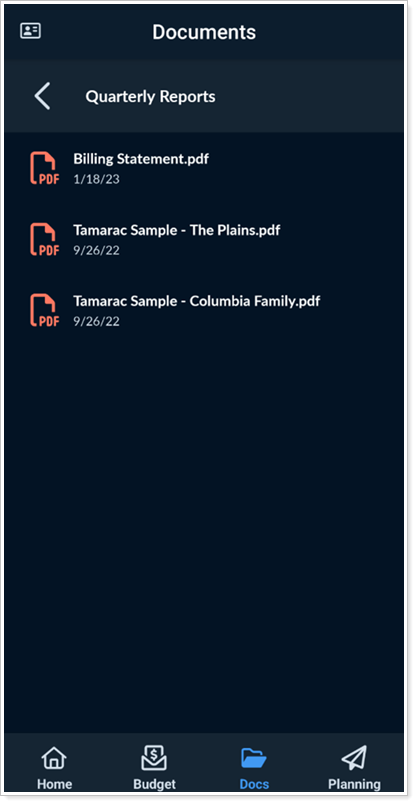

Access and preview files in Documents.

-

Contact your service team members directly.

Offering a great mobile app can give you a real competitive advantage. Clients expect an exceptional mobile experience, and this new app delivers. The mobile app provides financial resources, right in your clients’ pocket. It facilitates seamless communication, builds trust, and reminds clients of your value every time they use it. By providing this high-quality app, you’ll exceed clients’ expectations and launch your clients towards their Intelligent Financial Life.

To get started with the mobile app, see Introduction to the New Client Portal Mobile App.

Smarter, Smoother Client Portal Configurations

Creating the client portal experience, you know what clients should see. It’s not always obvious how to get from the configuration tool to the actual finished client portal. This release, we’ve updated the configuration tool in the following ways to make it easier and more intuitive to create the client portal experience you want.

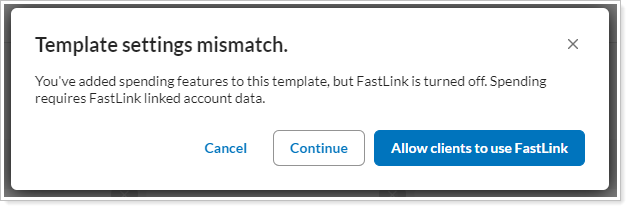

Helpful reminder when including a Spending page

The Spending page uses transaction data from linked accounts to power its features. That means that when you’re building a Reports template, you need to turn on Allow clients to use FastLink when you include the Spending page. Now, if a template includes the Spending page, we'll check if FastLink is turned on. If it's not, we'll allow you to enable it before saving the template.

This guidance helps ensure the template is correctly configured when you first include the Spending page. This sets you and your clients up for success from the start and saves you from the hassle of troubleshooting why the page isn’t working right. Everyone wins!

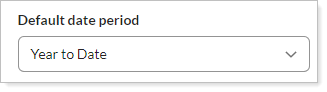

More default date periods

Setting the default date period allows you to align the date periods with your firm’s standards. Default date periods show clients the date range you think is most useful from the moment the page loads.

With this release, you can customize the default date periods for the following pages and widgets:

-

Realized Gains and Losses. The system default date period is inception to date.

-

Activity. The system default date period is quarter to date.

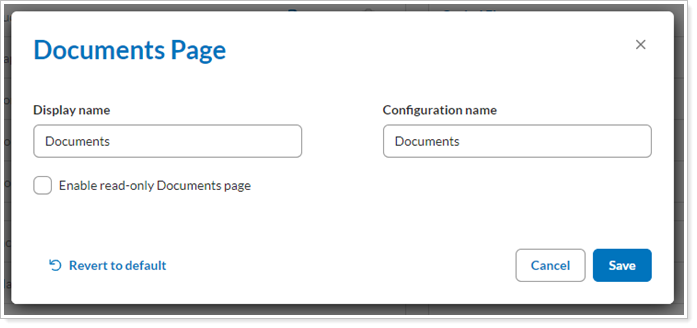

Simpler Documents page settings

We’ve made the system smarter. It doesn’t need the Enable Envestnet Reports section setting anymore, so we’ve removed it. You and your clients will continue to see the appropriate Documents page sections by default.

These changes all add up to more client portal customization with less effort. Not only do you save time, but configuration tasks are a little more helpful and intuitive, making creating a template smoother and more effective.

Update Client Portal Template Assignments in Bulk

The new client portal offers clean, intuitive user interface and powerful tools that you know will help your clients live an Intelligent Financial Life. When you’re ready to turn it on for your entire customer base, we’ve got you covered—one quick bulk update and you’re done. Save yourself time and start your clients on the new portal faster with bulk editing.

Bulk Edit and Upload

Use the following new columns in the Client Information bulk report and upload to export and edit template assignment:

-

Enable new client portal: Use this new column to turn on or off the new client portal for the given client. Set it to Yes to turn on the new client portal or No to use the legacy client portal.

-

Client portal type: This read-only column indicates whether a client uses the new or legacy client portal.

-

Branding template: Indicates which Branding template is assigned to the client. By default, this is the Starter Template.

-

Reports template: Indicates which Reports template is assigned to the client. By default, this is the Starter Template.

For details on bulk reports, see Create, Edit, or Delete a Bulk Report. For details on bulk uploads, see Upload Bulk Data.

Saved search

The Clients saved search now features the same new columns as the bulk report:

-

Client portal type

-

Branding template

-

Reports template

For details on using saved searches, see Create, Edit, or Delete Saved Searches.

For more information, see Assign New Client Portal Templates to a Client.

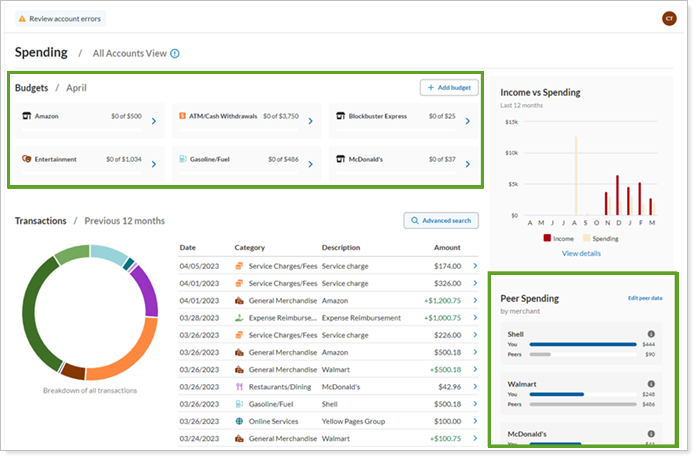

Customize Spending Page Sections

The Spending page offers clients income and expense tracking, budgeting tools, and a consolidated view of bank account and credit card transactions to give clients the information they need to make daily spending choices that support their financial goals. In the past, you couldn’t control what elements showed up on the Spending page. Now, you can further customize the page to only include the sections that would be most beneficial for your client for a customized, streamlined client experience that's best for your clients.

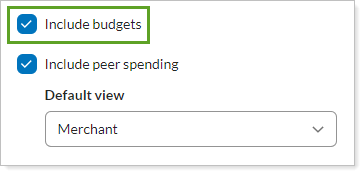

With this update, you can:

- Include or exclude the Budgets section.

Create templates that show the comprehensive budgeting module to clients who benefit from that—and hide it in templates for clients who don’t need to track monthly budgets.

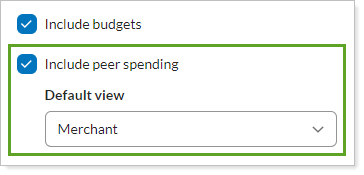

- Include or exclude the Peer Spending section.

Create templates that show a comparison of peer spending for clients who are motivated by seeing that comparison—and hide it in templates for clients who don’t care for those comparisons. Designate whether the comparison is for categories or merchants by default.

- Customize the page name that clients see.

Edit the Display name to name the page according to your firm’s standards.

Along with these enhancements, we’ve simplified the configuration for widgets that use Spending data—Budgets, Recent Transactions, Income vs. Spending, and Peer Spending. Now the widgets are independent of the Spending page, and you can include them in the dashboard as desired.

By default, the Spending page:

-

Includes Budgets and Peer Spending sections.

-

Always includes Transactions and Income vs. Spending sections. These sections aren’t customizable.

Add Benchmarks to the Summary Page

We’re excited to announce the addition of benchmarks to the Summary page and widget in the new client portal. Now, if your firm configures it, clients can see performance for benchmarks you set up in their Tamarac accounts.

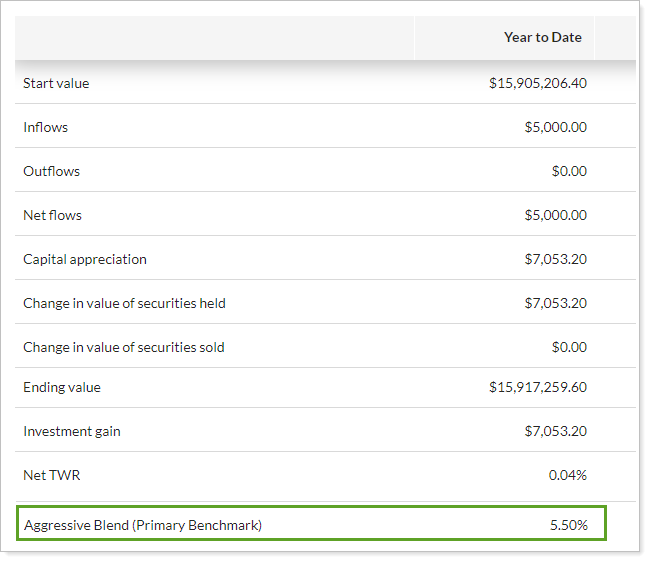

The Summary page shows one or more benchmarks as rows that you add to the table:

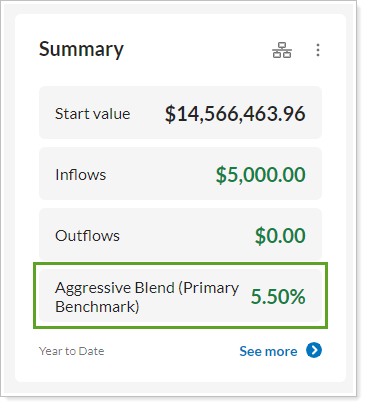

The Summary widget shows the benchmark as one of the four data points available for display:

This allows you to show clients a useful comparison on the foundational Summary page and widget in the client portal, enhancing the value your clients get when they visit the portal—and ultimately encouraging them to visit again.

For more information, see Include Benchmarks in the New Client Portal.

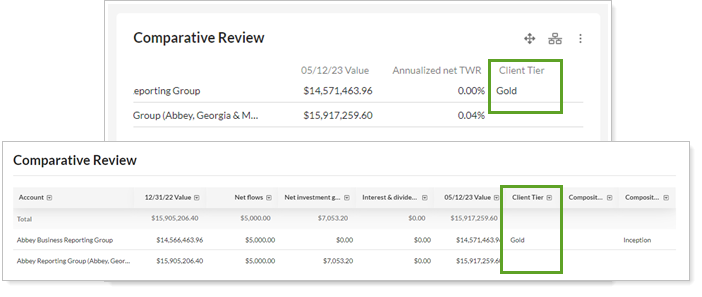

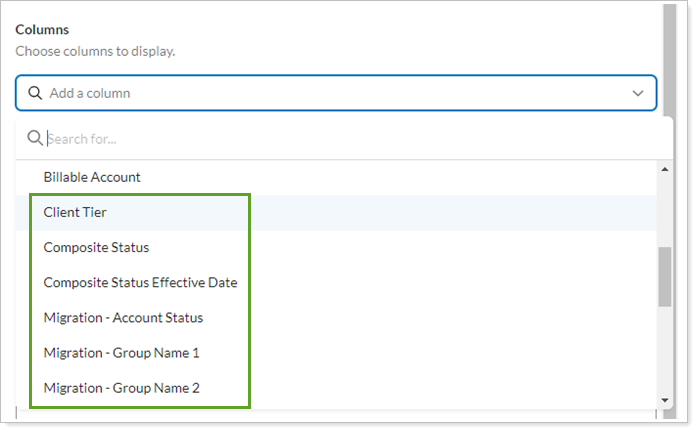

Include Custom Fields from Tamarac Reporting in New Client Portal Reports

You use custom fields to track everything from the dates you’ve met with your client to your firm’s unique securities classifications. Many of these fields can appear in reports, allowing you to further customize the financial data points you and your clients track.

With this release, you can add custom fields from Tamarac Reporting to the following new client portal reports:

-

Capital Flows - page only

-

Comparative Review - page and widget

-

Holdings - page only

-

Position Performance - page only

-

Projected Income - page only

-

Realized Gain/Loss - page only

Each report supports different custom field types.

Including these custom fields in your client portal reports brings further parity between the legacy and new client portal. It also allows you to communicate clearly with clients and to more easily compare results between the new client portal and Tamarac Reporting.

For more information, see Include Custom Fields in the New Client Portal.

Document Upload Can Trigger Email Notifications

Notes

This enhancement will be available shortly after the release.

With this release, we’ve expanded email notifications to the new client portal. Now you can each receive email notifications when you and your clients share files through the new client portal. This will enhance your clients' confidence in the portal, facilitate communication, and build trust.

Email notifications in the new client portal work the same as in the legacy client portal. You can trigger an email notification in all the places you used to send notifications to clients before.

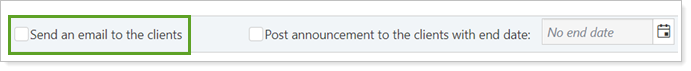

To send a client an email when you upload a file or post a PDF report to their portal, select Send an email to the client.

To receive emails when clients share files with you, see Customize the Automated E-mail Messages that Tamarac Reporting Sends.

View as Client to See Template Changes Immediately

When you’re creating a new client portal experience, you’re probably trying out lots of different options. Turn it on—view as a client to see what it looks like. Turn it off—view as a client again. This iterative process helps you create the exact portal you want. But it could take up to five minutes to see a change in the portal.

This release, we’ve removed any delay in seeing changes. Now, you’ll enjoy seeing all your changes immediately when you view as a client.

This enhancement reduces how long it takes to customize the client portal and removes the frustration of having to wait to see changes.

For more information about viewing as a client, see View a Client Portal Exactly As Your Client Sees It.

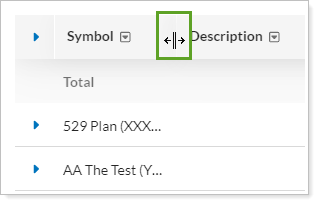

Resize columns

In the past, clients couldn’t resize column widths—they remained fixed. For columns with longer data, such as very long account names, this could make it difficult to see what was in each column. With this release, clients can resize columns to whatever width is appropriate for the data.

This helps organize information neatly in a table by making each column just the right width, so clients can see and compare data more easily. For example, when the column contains a very long account name, clients can expand the column to see as much of the name as they need.

To resize a column, click and drag the column divider to the desired width. Double-click to return it to the default minimum width.

Column resizing only lasts as long as you’re on the page. When you navigate away or sign out, it resets to the default minimum width.

Reporting

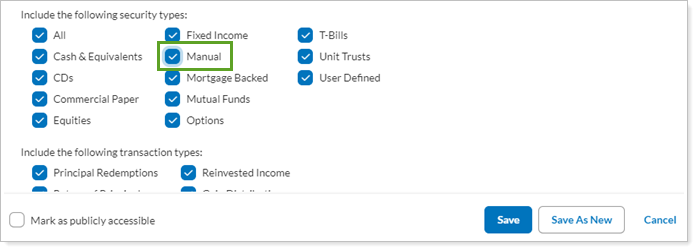

Include Manual Securities on the Projected Income Report

We know you rely on the Projected Income report, and we heard your feedback that you wanted to include Manual Securities in the report. With this release, you can include manual securities, thereby giving you a more accurate estimate of projected income that includes manual securities.

The following reports are impacted by this enhancement:

Dynamic

-

Full

-

Client View

-

CSV

-

Advisor Dashboard

-

Full

-

Dashboard

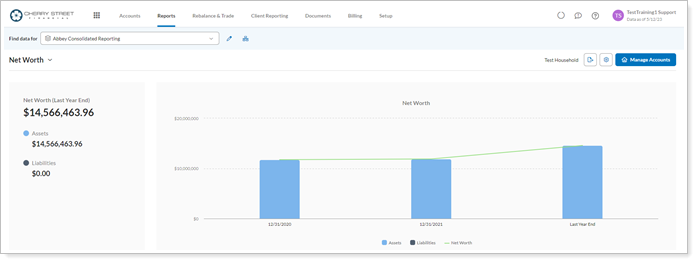

Updated Net Worth Report

As a part of our continued effort to improve your experience with the Tamarac platform, we’re excited to introduce the updated Net Worth report. This update brings you a more modern and intuitive experience, keeping with our ongoing effort to enhance your experience withe Tamarac platform. The updated navigation structure of this report will simplify how you access the details from the Net Worth report.

For more details, see Net Worth Report.

Learn More - Watch the Release Video