Contents

Track an Annual Capital Gains Tax Budget

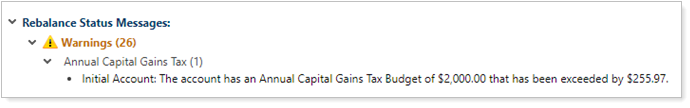

Clients rely on you to help minimize their tax burden. You do this in part by managing capital gains in taxable accounts. With this release, we provide you with powerful tools to compare incurred and anticipated capital gains to a budgeted annual capital gains amount, giving you the insights you need for tax-aware investing decisions. Now you can set annual maximum capital gains amounts for accounts or groups, proactively track the amount of gains an account or group has incurred year to date, and see a rebalance warning when a trade would incur capital gains that exceed the annual budgeted amount.

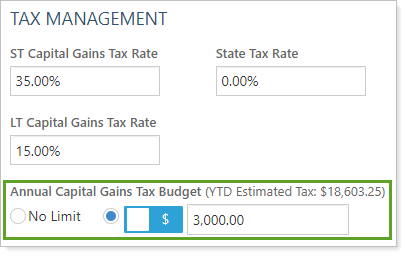

Set an annual maximum capital gain budget in dollars or percent of total rebalancing group or account value with the new Annual Capital Gains Tax Budget setting.

The annual capital gains tax budgeting tool uses the new Annual Capital Gains Tax Budget setting and the existing ST Capital Gains Tax Rate and LT Capital Gains Tax Rate fields to estimate the year-to-date taxes incurred by short-term and long-term gains and by the current rebalance. New tools allow you to compare the annual budgeted gains with the estimated gains and the year-to-date gains reported daily from Tamarac Reporting and track how much of the budget remains. Better still, you can use it to track long- and short-term gains together, individually, or as capital gains.

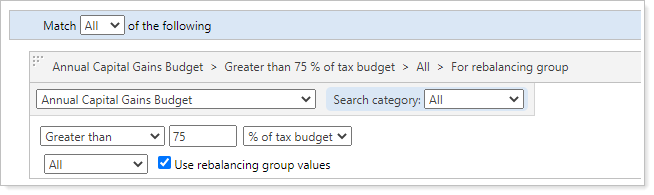

To track the budget status so you can optimize trades for capital gains, use the following new tools:

-

Saved Search Filter. Create a saved search with the Annual Capital Gains Budget filter to audit accounts or groups where a certain percentage of the capital gains budget that has been met.

-

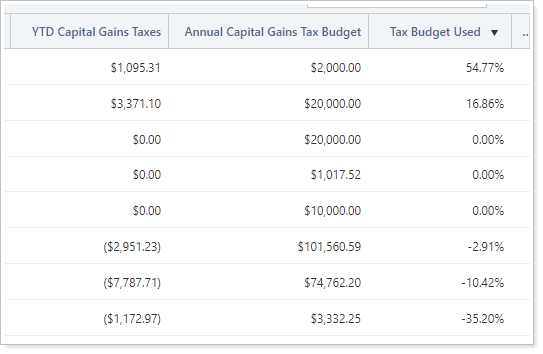

Rebalance Workflow Page Columns. Add the new Tax Budget Used, YTD Capital Gains Taxes, and Annual Capital Gains Tax Budget columns to the Rebalance, Trade List, and Rebalance Review pages to plan tax-appropriate trades for each client.

-

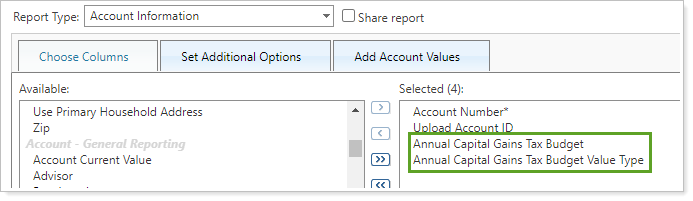

Bulk Report and Upload Columns. Use the new Annual Capital Gains Tax Budget or Annual Capital Gains Tax Budget Value Type columns in the Account Information bulk report and upload to view, add, or change capital gains budget amounts for many accounts or groups at once.

Note that this does not affect the current Max Gain Amount setting, which will still limit the amount of gains a rebalance can recommend.

For more information, see Using the Annual Capital Gains Tax Budget.

Apply Security Substitutes at the Account Level

With security substitutes, you designate securities to purchase or sell in place of the original parent security. Until now, you assigned security substitutes at the security level and the substitutes applied to all accounts globally. For example, if you set ORCL to substitute for MSFT, any client holding MSFT might have ORCL substituted when appropriate.

But we know that one size doesn't fit all. There may be cases where substituting ORCL for MSFT might not be suitable for a client. You want to specify substitutes at the account level, for example in accounts holding legacy securities with goal-based models. With this release, we add account-level security substitutes that give you the flexibility to customize security substitutes for individual accounts as is suitable for each client.

When using account-level security substitutes, be aware that:

-

You can apply account-level security substitutes to financial accounts, sleeve accounts, and ownership accounts, but not to groups. Sleeve accounts and ownership accounts do not inherit account-level substitutes from parent accounts.

-

If a security has a substitute configured at the security level and at the account level, the account-level substitute overrides the security-level substitute.

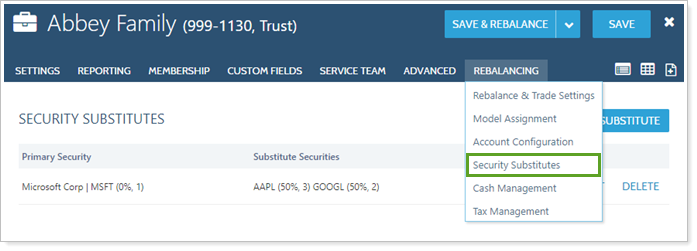

To access substitute securities for a single account, on the account's Rebalancing tab, click the new Security Substitutes option.

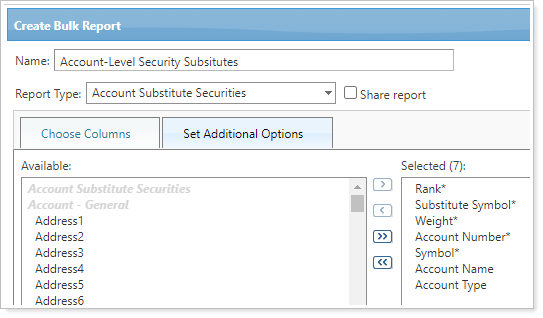

To export and edit substitute securities for many accounts at once, use the new Account Substitute Securities bulk report and upload.

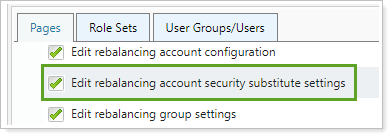

Administrators and users who can edit global substitutes can automatically use account-level security substitutes. To allow other users to add, edit, or delete account-level security substitutes, enable the new Role permission Accounts | Edit rebalancing account security substitute settings.

For more information, see Security Substitutes and Security Substitutes Panel.

Include Underlying Account Data in the Account Security Information Bulk Report

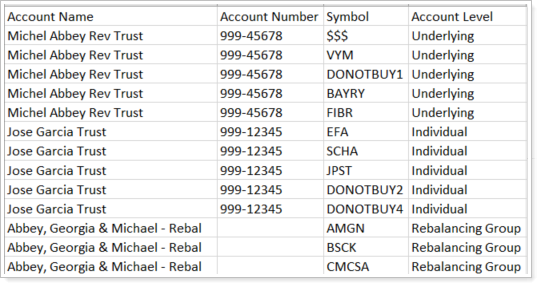

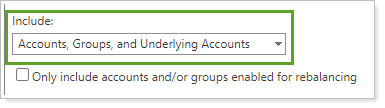

When you're auditing trades, the Account Security Information bulk report shows you critical information about what groups hold which securities, but in the past it didn't show the securities held in the group's underlying accounts. Now you can see securities held in underlying accounts when you run this bulk report on Rebalance workflow pages—even if you only select groups.

When creating an Account Security Information bulk report, under Set Additional Options, set Include: to designate where the data for the bulk report come from. You can include data from accounts, groups, and underlying accounts; only accounts and underlying accounts; or only groups.

To help keep the data set useful and targeted to your needs, select the Only include accounts and/or groups enabled for rebalancing check box to limit your export to only accounts or groups enabled for rebalancing.

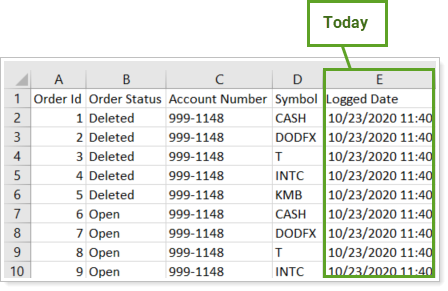

Audit Orders Created Today in Bulk

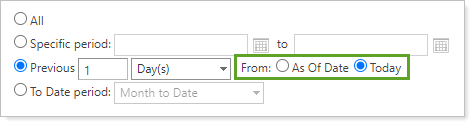

The Orders bulk report provides valuable insight into the status of orders in Tamarac, allowing you to audit and reconcile orders in bulk daily. Now you can limit the output of the Orders bulk report to the current trade date, giving you a clear view of what orders were created during the current business day.

To see orders created today, on the Orders bulk report on the Set Additional Options tab, set the date period to Previous 1 Day(s) and choose From: Today.

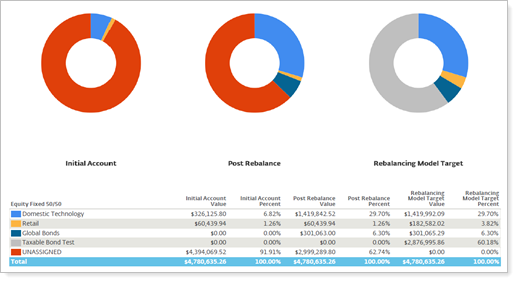

Group By Security Level Model on Rebalance Summary PDF Reports

When you rebalance, you want to compare the outcome of the recommended trades to the model allocations assigned to an account. Sometimes even employees who don't have access to Trading need to review the impact of rebalancing. Now we've added another way for any firm employee to audit accounts that may be out of tolerance: Grouping by security level model on the Rebalance Summary Charts Report and Rebalance Summary Details Report.

When you set Group by to security level model on either report, Tamarac generates PDF reports that display pre- and post-rebalance allocations grouped by security level model.

Firm users must have permission to access PDF reports to use this functionality. For more information about permissions, see Manage Permissions for Roles and Role Sets.

For more information on how to generate a PDF report, see Understanding PDF Reports.

Performance Enhancements

As part of our ongoing effort to improve speed and reliability on the Tamarac Platform, we are continuing to make enhancements under the hood. This table highlights improvements we made since our last release:

| Improvement Made | Type of Improvement |

|---|---|

|

To get you data earlier in the day, we:

|

Code/Database, IT/Infrastructure |

|

Recently we fine-tuned the code behind some of our reports to speed up report generation. You may notice, for example, that the Household Members bulk report generates up to 70% faster. |

Code/Database |

|

We've reduced calculation times by 40% for reports that include returns or average daily balance. Larger firms in particular may notice this improvement as reports generate more quickly. |

Code/Database |

Learn More - Watch the Release Video