Back

Back

Back Back |

Home > Tamarac Trading > Rebalances and Trades > Rebalance Review > Reading the Classic Rebalance Summary

|

Reading the Classic Rebalance Summary

|

Rebalance Summary as a PDF Report Customize the Rebalance Summary Report View Rebalance Status Messages Section Trade Actions on the Rebalance Summary Edit Trades/Create a Custom Strategy |

The following topic discusses the classic version of the Rebalance Summary report which is accessible on the classic Rebalance page.

![]()

For more information on the current Rebalance Summary, see Reading the Rebalance Summary.

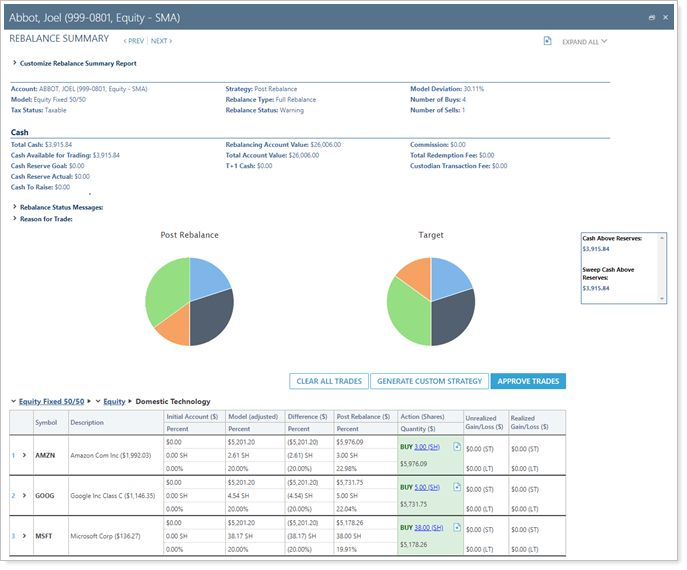

The Rebalance Summary report is the most frequently used report in Tamarac Trading. This report is a visual representation of trade recommendations in the context of an account's models and available cash. You can use this report to see recommended trades, cash information, and important warnings for individual accounts or groups.

You can also take trading action on the Rebalance Summary including editing recommended trades, adding new trades, and putting trades on hold.

To view similar information across all accounts, use the Rebalance Review.

If you're trying out the updated Rebalance Summary report and would like details, see Reading the Rebalance Summary.

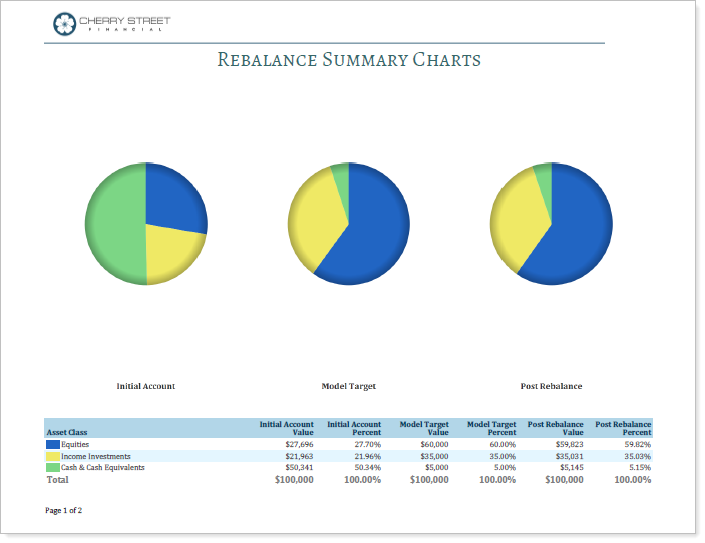

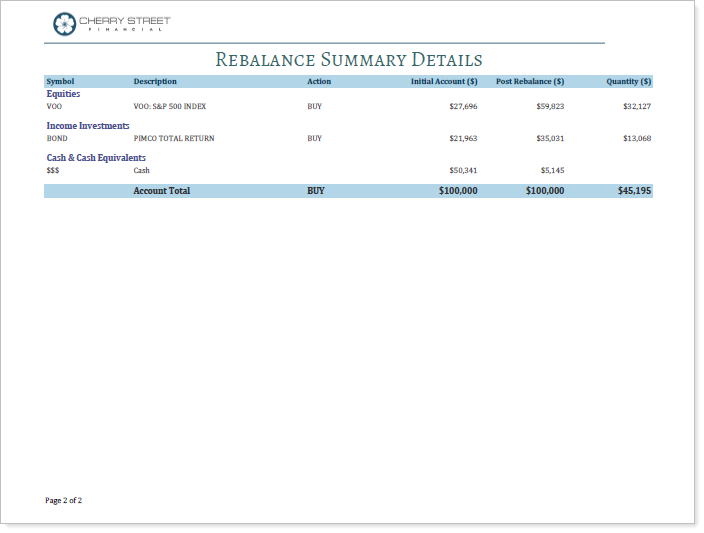

Rebalance Summary data can be used to generate PDF reports. These reports can help you share trade information with clients or can be used for internal review of trades.

There are two report section types available as a PDF:

This section shows side-by-side pie charts with a configurable legend. This allows you to compare rebalance information visually.

For more information on this PDF report section, see Rebalance Summary Charts Report.

This section shows rebalance details in a table that you can configure to include shares, model percentages, dollar differences, short term gains and losses, cash information, and more.

For more information on this PDF report section, see Rebalance Summary Details Report.

To open the Rebalance Summary, click ![]() next to the account or group you want to view on any of the following pages:

next to the account or group you want to view on any of the following pages:

If the account has not yet been rebalanced, ![]() will appear instead.

will appear instead.

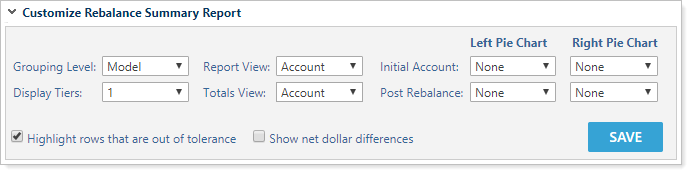

Expand the Customize Rebalance Summary Report section to change your view of the Rebalance Summary and customize its appearance.

The following options are available:

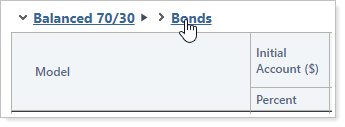

By default, the Rebalance Summary is grouped by Model; you can also group by categories you have set up. Example categories might include Asset Class, Sector, Security Type, and more.

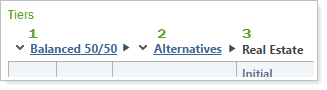

Choose the number of tiers you'd like to show on the report details of the Rebalance Summary. The more tiers you show, the more detailed information you'll see.

Even if showing only one tier, you can expand individual models or sections to see more detailed information. Choose All to display all tiers of a model.

Allows you to change which rows you see on the report, using these options:

Allows you to change how the totals at the bottom of the report are calculated, using these options:

If Report View is set to Account, this value will default to Account as well.

If Report View is set to Buys and Sells Only, you can choose to see totals as Buys and Sells Only, Account, or Both.

Select the Highlight rows that are out of tolerance option to indicate rows where securities are out of tolerance with respect to their models. To save this as your default view, click Save Settings as Default.

Select to change how the Difference ($) column of the is calculated:

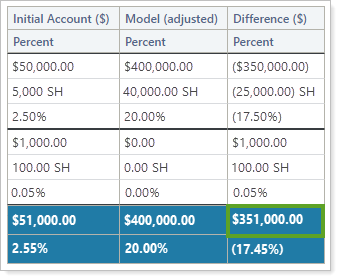

A client's rebalance summary shows the following when viewing in absolute dollars, the default setting. In this case, the amount shown is the absolute sum of the two Difference column amounts, regardless of negative or positive value: $350,000 + $1,000 = $351,000.

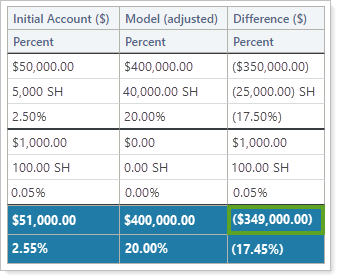

By checking the Show net dollar differences check box, the Rebalance Summary shows a calculation of the net dollar difference and considers the negative amount: ($350,000) + $1,000 = ($349,000).

Optional pie charts allow you to show data in two side-by-side pie charts, using these criteria:

Click Save to apply any changes you've made to your view of the Rebalance Summary page. These changes remain every time you visit any Rebalance Summary.

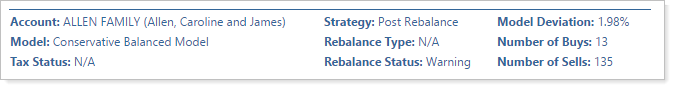

The summary section at the top gives you high-level information about your rebalance and the account settings for the account or group you're viewing. It tells you the number of recommended trades and how close the model is to target after a rebalance.

The following information is available in the summary section:

Shows the name associated with the account or group you're viewing.

Shows the model associated with the account or group.

For more information on establishing the model for an individual account, see Model Setting. For information on establishing the model for a group, see Rebalancing Group Settings.

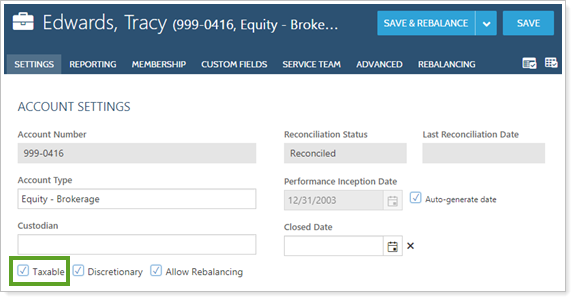

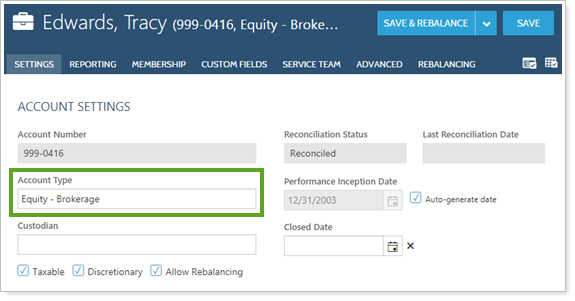

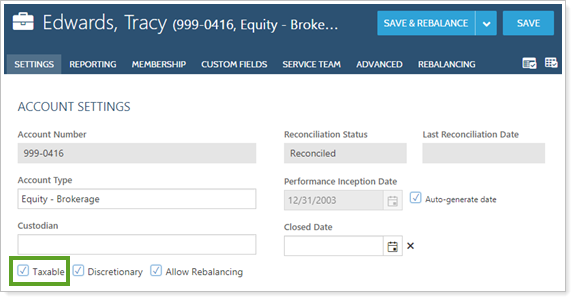

Shows the taxable status of the account. This is set on the Account Settings panel.

If you're viewing the Rebalance Summary for a group, the tax status will say N/A because the various accounts can have different tax statuses.

Shows the status of the account in the information being shown on the Rebalance Summary:

Initial Account.Information shown reflects the account where no rebalance has been run and no custom strategies have been created.

Post Rebalance.Information shown reflects the account where a rebalance or directed trade has been run on the account.

Custom Strategy.Information shown reflects the account where a custom strategy—including quick trades or edited trades—has been added to the account.

Shows the current rebalance setting for the account you're viewing. See Default Rebalance Setting for more information on this account-level setting.

If you're viewing the Rebalance Summary for a group, the rebalance type will say N/A because the various accounts can have different rebalance types.

Shows the overall status of the rebalance. One of the following statuses will appear in this field:

Success.The rebalance was successful.

Warning.The rebalance issued warnings. Warnings do not prevent the account from rebalancing successfully.

Unable to Rebalance.The previous rebalance issued errors that must be corrected. Errors prevent the account from rebalancing successfully.

No Trades Recommended.The account was not rebalanced because there were no trades recommended.

Custom Rebalance.Custom rebalance strategy was used to rebalance this account.

N/A.A rebalance has not been performed on the account.

Shows the percentage the account is deviated from the model prior to rebalancing, in absolute terms.

Shows the total number of buy recommendations.

Shows the total number of sell recommendations.

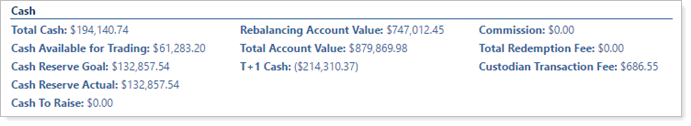

The Cash section gives you high-level information about the cash and account values for the account or group you're viewing. Information about commissions and fees in the Cash section can also help you make decisions about the cost of trading.

These are the fields shown in this section:

The total value of cash in the account, including any cash reserves.

The amount of cash that exceeds the cash reserve goal, in addition to any cash above the total cash reserve upper threshold. This amount will be negative if the account needs to raise cash to meet its cash goals and is below the total cash reserve lower threshold.

The target amount of cash reserves. This amount reflects the total cash reserves amount set at the account level.

The amount of cash held in reserves. This can be different from Cash Reserve Goal because of upper and lower thresholds set on any cash reserves.

The amount of cash the account needs to raise for cash reserves. This amount doesn't consider model cash, if any. This total can also be seen in Cash Management within the account's settings.

The value of the account, excluding any cash reserves.

The total value of the account, including all positions in the account and any cash reserves.

The T+1 cash available after a rebalance. This value is calculated as (Initial Cash + Value of Sells settling T+1) – Value of Buys, excluding fees.

The total amount which will be paid to the broker for trades in equities and ETFs. These commissions are set at the account level using Equity Per Trade Commission Setting and Equity Per Share Commission Setting.

The total amount that will be charged upon the sale of funds. This is set up on the Fee Schedules page.

The total amount of fees which will be charged by the custodian. This is set up on the Fee Schedules page.

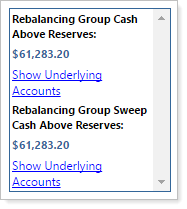

The floating box on the right side of the Rebalance Summary shows you basic cash information as you scroll down the page. If you're viewing a group, click the available links to either show or hide the cash details for individual accounts in the group.

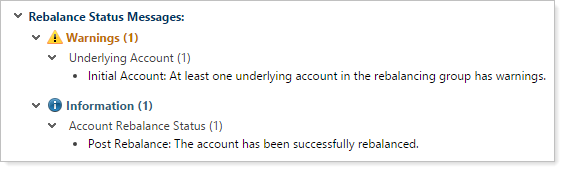

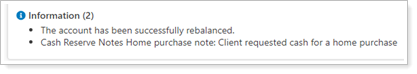

The Rebalance Status Messages section shows basic information, warnings, and errors associated with the rebalance. If your model deviation is off and you aren't producing expected trades, information in the Rebalance Status Messages section can tell you why.

The Expand All link at the top right allows you to expand all collapsed messages with a single click, including any messages at the group level.

This section contains three types of messages:

InformationProvides information about the results of the rebalance, as well as other account-specific details, like cash reserve notes and security restriction notes.

WarningsInforms you about a situation that may require action, such as warnings about securities with restrictions and messaging if a portfolio isn't able to trade to its min/max range. Warning messages will not prevent Tamarac Trading from rebalancing the account.

ErrorInforms you about a situation that requires action before the rebalance can continue, such as "The account has a negative total value. Please check the cash reserve amounts on the account." Error messages prevent Tamarac Trading from rebalancing the account.

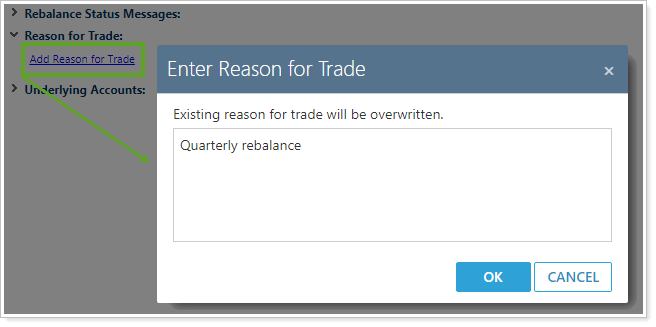

Expand this section to add a reason for trade by clicking the Add Reason for Trade link. This opens a dialog box where you can enter notes. Reason for trade notes can be seen in reconciliation bulk reports.

For more information on reason for trade notes, see Overview of Notes in Tamarac Trading.

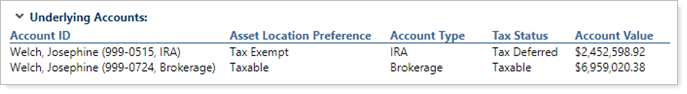

Expand this section to view information about the various accounts within the group. If you are viewing a single account rather than a group, this section will not be shown.

This section shows the following fields:

Shows the name and account number for each of the accounts within the group you are viewing.

Shows any Asset Location Preference setting you've assigned to the account.

This setting allows you to customize asset location for your various account types within a group. For more information, see Learn More About Asset Location and Priorities.

Shows the account-level account type you've set. This is set on the Account Settings panel.

Shows the taxable status of the account. This is set on the Account Settings panel.

Shows the total value of the individual account, including all positions in the account and any cash reserves.

The Rebalance Summary report information is where you'll find trades, informational messages, values, and allocations information, all grouped in the context of models within the account or group you're viewing.

You can collapse your view to see a high-level view of your models and the results of any recommended trades. You can also expand to see more model-level detail, down to the security level. If you're viewing the Rebalance Summary for a group, you can expand your view to show trades on a per-account basis.

Submodels are listed in alphabetical order by default. However, if you set a custom sort order, the Rebalance Summary will respect the custom sort order you've set. For more information on setting a custom sort order, see Create, Edit, and Delete Allocation Models.

The Expand All button at the top right allows you to expand all collapsed messages with a single click, including any messages at the group level as well as at the individual account level.

You can also click the names of individual models or sleeves to expand and collapse the details of that model.

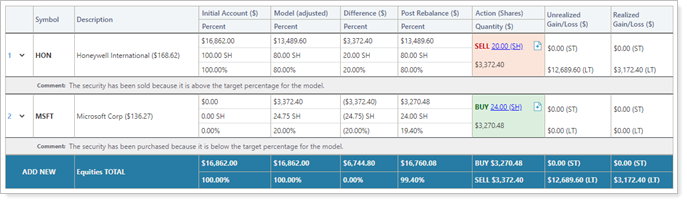

The following is a summary of the information and calculations used on the Rebalance Summary:

Displays the long name for the security. Description also shows the price used to generate the rebalance strategy shows in parentheses after the description.

If the price is a custom price, it is marked with an asterisk (*).

Shows the initial dollar value and percent of account for the row listed.

If expanded, this column can show values at the individual security level. If collapsed, this column can show values at the model level.

Shows adjusted model allocation based off the current holdings in the account if using rank-based models.

Shows the dollar amount of how underweight or overweight the security or model is to the adjusted model goal.

This is calculated as Initial Account ($) – Model (adjusted).

Shows the dollar amount held in a security or model after the rebalance/custom strategy.

This is calculated as Initial Account ($) + Buy ($) for a buy or Initial Account ($) – Sell ($) for a sell.

Shows the proposed dollar amount of the buy or sell.

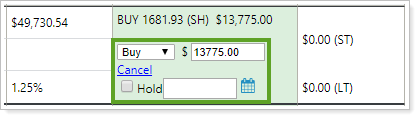

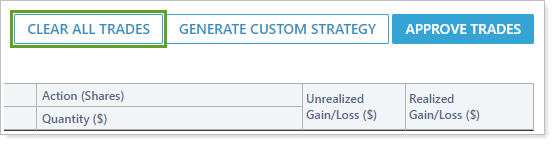

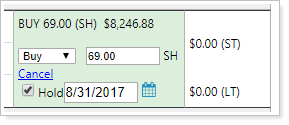

When expanded, shows the recommended trade in dollars or number of shares, if any, and allows you to edit the trade, place it on hold, or add an order note.

Shows any resulting unrealized gains or losses from the trades.

If the account is tax-exempt, this column will show N/A for that trade.

Shows any resulting realized gains or losses from the trades.

If the account is not in a rebalanced state, this column will show $0. If the account is tax-exempt, this column will show N/A for that trade.

When expanded, this row shows the reasoning behind the results of the rebalance for that security, as well as any restrictions or comments about that security.

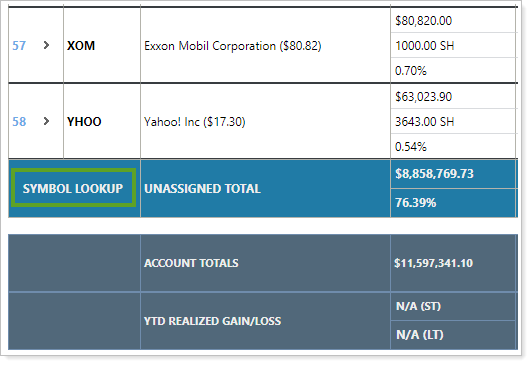

Unassigned securities, those securities not assigned to any client models, appear at the end of the Rebalance Summary under the heading UNASSIGNED. Allocations in these securities won't contribute to the Rebalancing Account Value amount. For more information, see Legacy Positions.

In addition to seeing recommended trades and cash information for the account or group, the Rebalance Summary also allows you to take some actions related to trading.

After a rebalance, the Rebalance Summary lists the ideal recommended trades for the account or group. However, there are cases where you'll want to change the recommended trades.

On the Rebalance Summary, you can edit details about a trade:

You can also use Symbol Lookup to add one-off trades for any securities not in the account.

For more information, see Manual Trades.

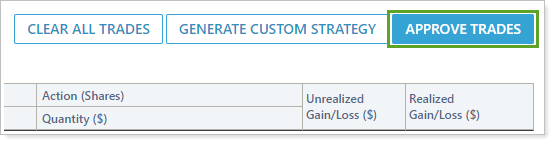

The Clear All Trades option allows you to remove all recommended trades from the account or group.

The Approve Trades option allows you to approve all trades on the Rebalance Summary.

For more information, see Approve Trades.

You can select individual trades and place them on hold for future execution.

For more information, see Trades on Hold.

Trading notes and account notes allow you to add useful information about a trade, and you can add a note to the account or group you're viewing by choosing the notes icon.

| Icon | Meaning |

|---|---|

|

|

This account has account notes |

|

|

This account has no notes |

|

|

This account has trading notes |

For more information, see Add, Edit, and Delete Notes.

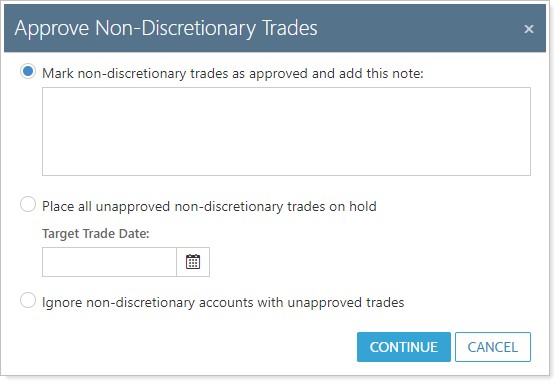

When you approve trades for non-discretionary accounts, you may see a warning message appear. This will require you to add a note before approving the non-discretionary trade and sending it to the Trade List.

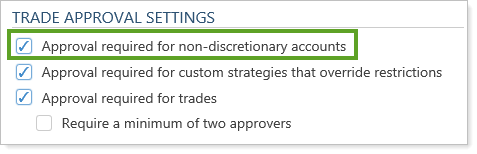

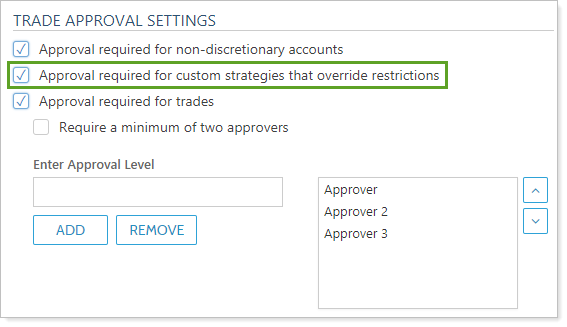

To require approval for trades in non-discretionary accounts, select Approval required for non-discretionary accounts on the Rebalancing System Settings page.

For more information, see Approve Trades.

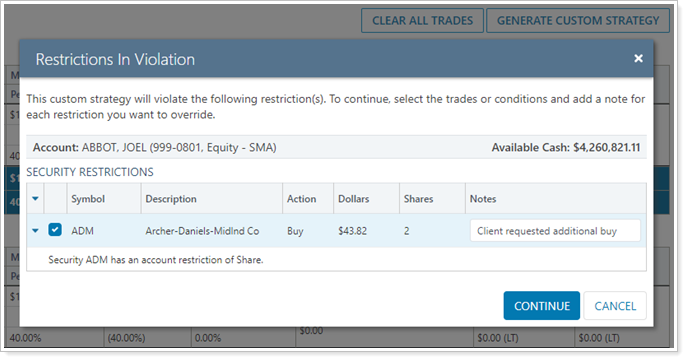

The Approval required for custom strategies that override restrictions option in Rebalancing System Settings adds restriction override features to the trading workflow.

When enabled, a trader or trade approver will be required to provide a note when approving a trade that overrides a restriction.

For more information, see Security Restriction Overrides.